Trading Bitcoin Futures Gaps – part 1/3

While there are many similarities in cryptocurrency trading and traditional asset trading, there are just as many differences. That’s why we are covering regular market strategies, but appropriately adjust them according to the specifics of the cryptocurrency market.

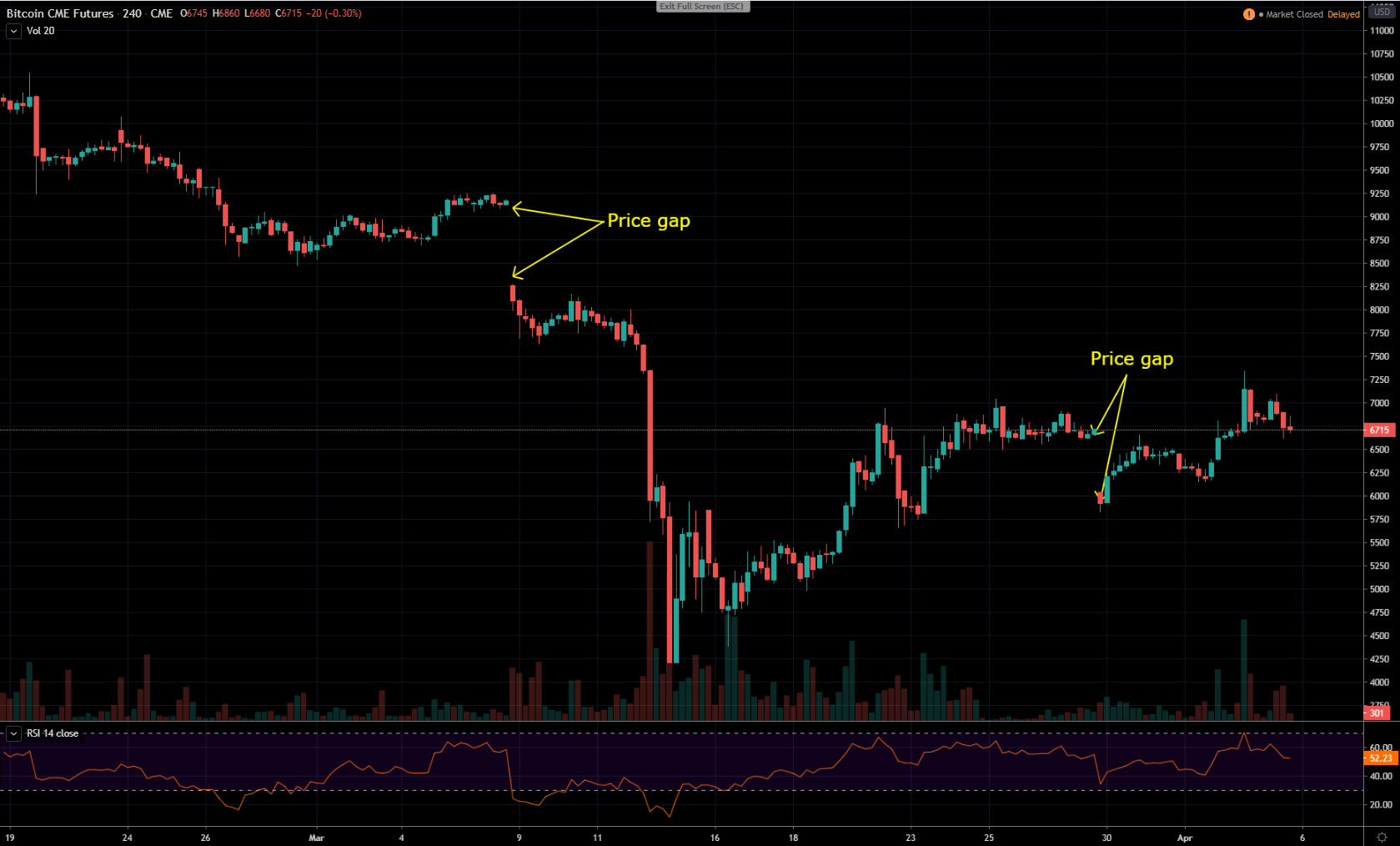

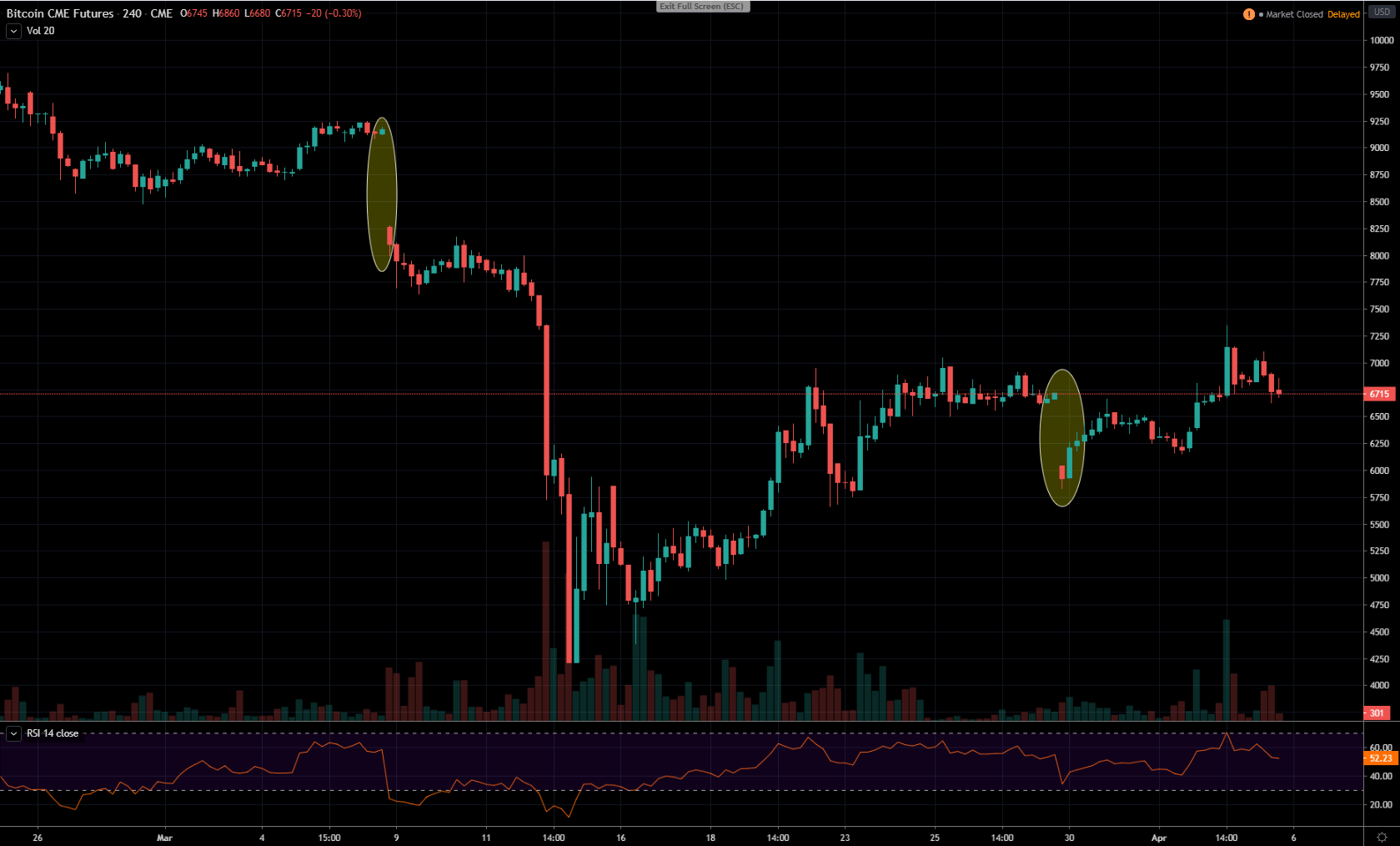

Price gaps are almost a regular occurrence within traditional markets. With the Bitcoin futures market, we can already see that they are becoming a factor in Bitcoin price analysis too.

What Are Price Gaps?

A gap is a part of the chart where an asset’s price rises or falls from the previous day’s closing price without any trading occurring in between.

While this cannot happen in crypto markets since they don’t stop trading on Friday and run 24/7, we can see these gaps in the crypto Futures markets.

Gaps in Bitcoin’s charts

Bitcoin reached nearly $20,000 in a major rally in 2017, which caught the attention of almost everyone in the world. This extended to major institutional players as well.

With such rising interest, two Chicago-based brokers launched Bitcoin futures trading, which allowed contracts to be cash-settled against the US Dollar. The first one was Chicago Mercantile Exchange (or CME), while the second one was the Chicago Board Options Exchange (or CBOE).

As CME and CBOE are regulated establishments, they have to operate and trade only between certain hours within the weekdays. While CBOE no longer offers Bitcoin futures, CME still does.

Even though the CME Bitcoin futures market closes every week on Friday, regular Bitcoin trading doesn’t stop. This can, among other things, create a big disparity in prices.

As we can see in the example, when a sharp move happens during the CME downtime, we can usually expect a gap on the next trading day.

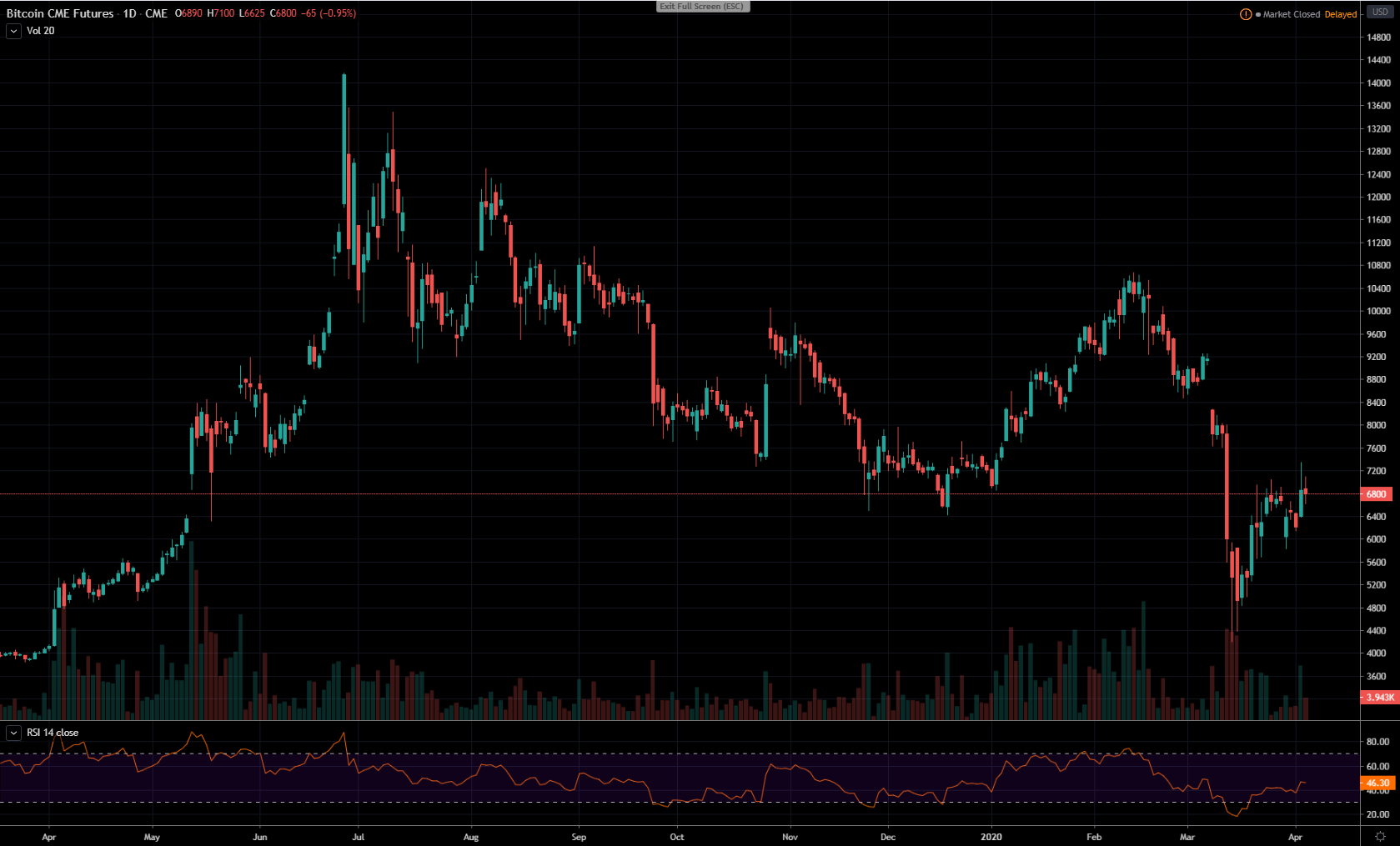

Bitcoin price gap filling

While there are a few cases with gaps not being filled, almost every gap gets closed in a very short time (up to a week). Recent data shows that out of 100-weekend gaps, 95 got filled or closed. We can expect somewhere around 50% of the gaps to be closed on an opening day, while an additional 30% or so will be closed within the same week. On the daily chart, we can see several examples of price closing the previous gap.

Check out part 2 of the Bitcoin futures gap trading to learn more about how to trade these gaps and make a profit.