People coming to the Forex markets usually learned new vocabulary. The first special words they learn maybe are, margin, profit, risk-reward, and candlestick. Perhaps, afterward, they learn new concepts such as Volatility. Also, along with other technical indicators, they get to know one study called Average True Range. However, later, they forget about it since they usually consider it unimportant.

The Average True Range (ATR) is one way to measure Volatility. Volatility is, as we know, a measure of risk. Therefore, ATR can be used as an estimate of our risk. This measurement is essential for us as traders, especially if we are trading on margin. And I’ll explain why.

What tells the Range?

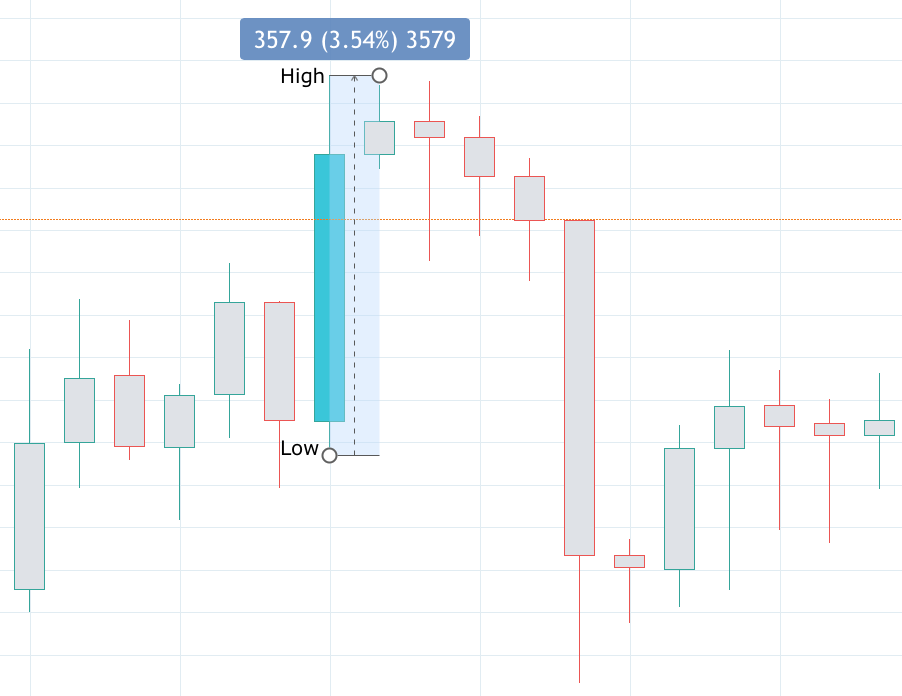

A range is a measure of the price variation over a period of time. It is measured between the High and the Low of a bar or candlestick. For instance, the range of figure 1 below (a 4H chart) is 357.9 points. If each point/lot were worth $1, a short position started at the Low of the bar would have lost $357.9 in four hours on every lot traded. Conversely, a long position would get this amount of profit.

True Range

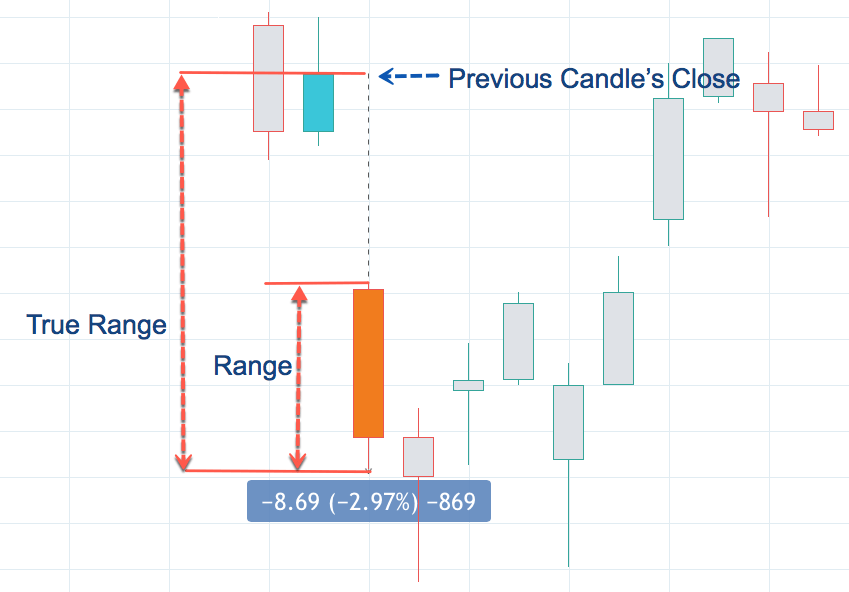

True range is similar to a normal Range, but it takes into consideration possible gaps between bars. That happens a lot in assets that do not trade all day. Not always the close of a session matches the open of the next one. A gap may form. A True range accounts for that by considering gaps as part of the range of the bar if the gap is not engulfed by the range.

Average True Range

As we can see, in the figure above, every bar’s range varies depending on the particular price action on the bar. Some bars are impulsive and move considerably. Other bars are corrective, and their range is short.

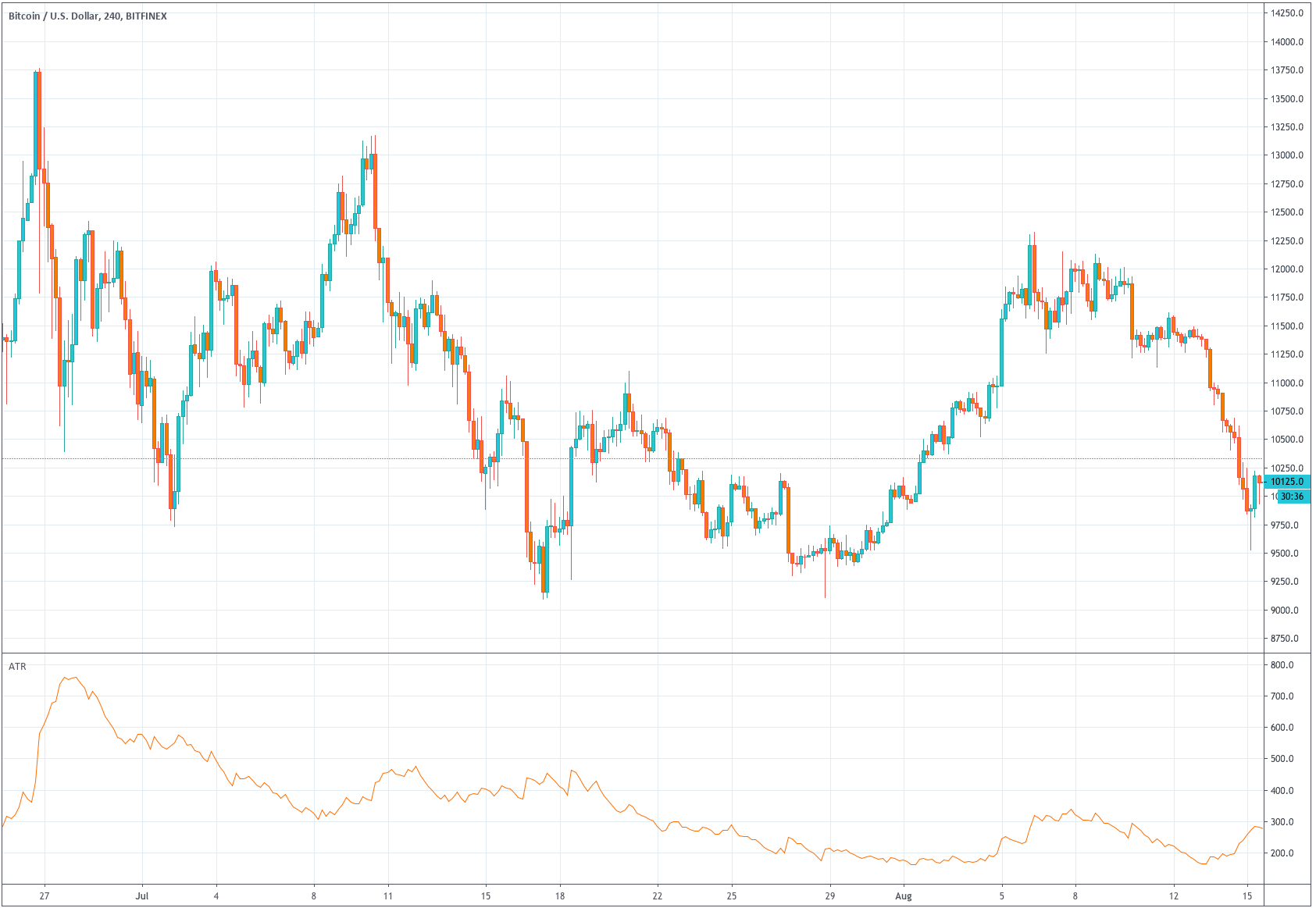

Therefore, to measure the average price range an average is taken, usually, the 14-period, although traders can change it. Below we show the 10-bar ATR of the Bitcoin.

On this figure, we see that the ATR gets quite high at some point on the left of the figure, and it slowly decreases in waves. That is normal. Assets move in a series of increasing and decreasing volatility waves, which describes the interests and power of buyers and sellers.

Average True Range and Risk.

Retail traders usually have small pockets. The first measure a retail trader should know is how much his account would endure in the event of an adverse excursion.

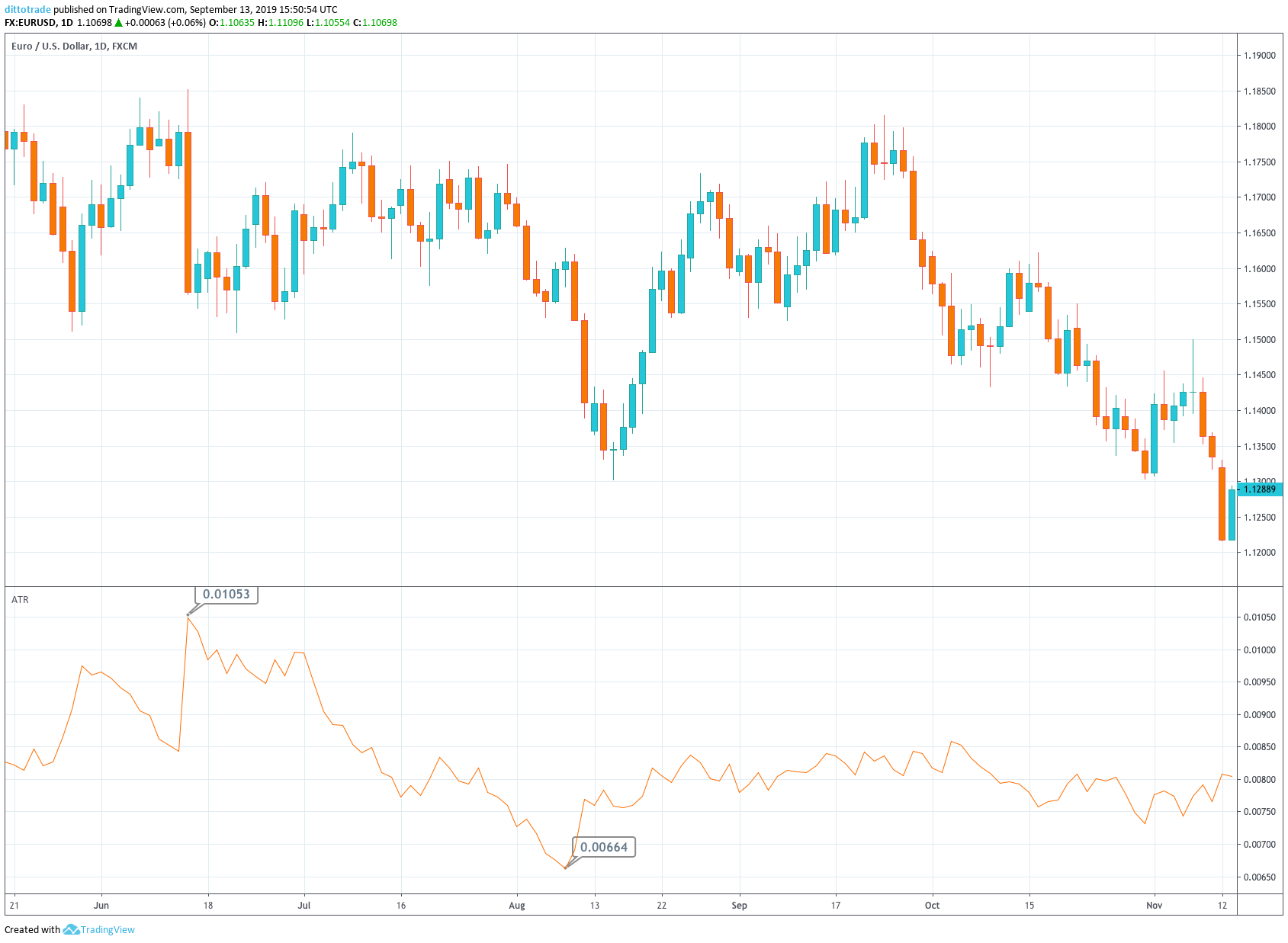

As an example, let’s examine the EURUSD daily chart. Observing the 10-ATR indicator in the chart below, we see that the maximum level on the chart is 0.01053 and the minimum value is 0.00664. Since we want to assess risk, we are only interested in the maximum value.

Let’s assume that we wanted to trade long one EURUSD contract at $1.1288 and that, on average, our trade takes one day to complete. How much can we assume the price would move in a single day?

If we take the 0.01053 as its daily range value and multiply it by the value of a lot ($100K) we see that the EURUSD price is expected to move about $1,053 per day. We don’t know if that will be in our favor or not, but from the risk perspective, we can see that to be on the safe side we would need at least $1,053 of available margin for every lot traded.

If the average trade, takes 4 or 8 hours instead, we should set the timframe to 4H or 8H and proceed as we did with the daily range.

For not standard durations, we could use the following rule: For each doubling in time, the average range grows by a factor of the square root of 2.

That is handy also to compute the right trade size. Maybe we do not have the required margin level, but just one fourth. Thus, if we still wanted to trade the asset, we should trim down our bet size to one-quarter of the lot.

How much time our stop-loss will endure?

Based on ATR figures, we could assess the validity of a stop-loss level. If the stop-loss size is too short compared to the ATR, it might be wrongly set.

What profits to expect?

We could assess that as well, on average, of course. If the dollar range of an asset is $1,000 in a 4-hour span, we can expect that amount on average in four hours, and $1.410 (√2 * $1,000) on an 8-hour lapse.

Deciding which asset to trade

We could use the True Range to assess which asset is best for trading. Let’s suppose, for instance, that you are undecided about trading Gold (XAU) and Platinum (XPT). So let’s examine them.

Gold:

Spread: 3.2

$Spread cost: $32

Digits: 2

contract size: 100

MAX Daily ATR: 16, $ATR: $1600

Spread cost as Percent of the daily range: 2%

Platinum:

Spread: 12.9

$Spread cost: $129

Digits:2

Contract Size: 100

Max Daily ATR: 22, $ATR $2,200

Spread cost as Percent of the daily range: 5.86%

After these calculations, we can see that it is much wiser to trade Gold, since the costs slice only 2% of the daily range, while Platinum takes almost 5% of the range as costs before break even.