Description

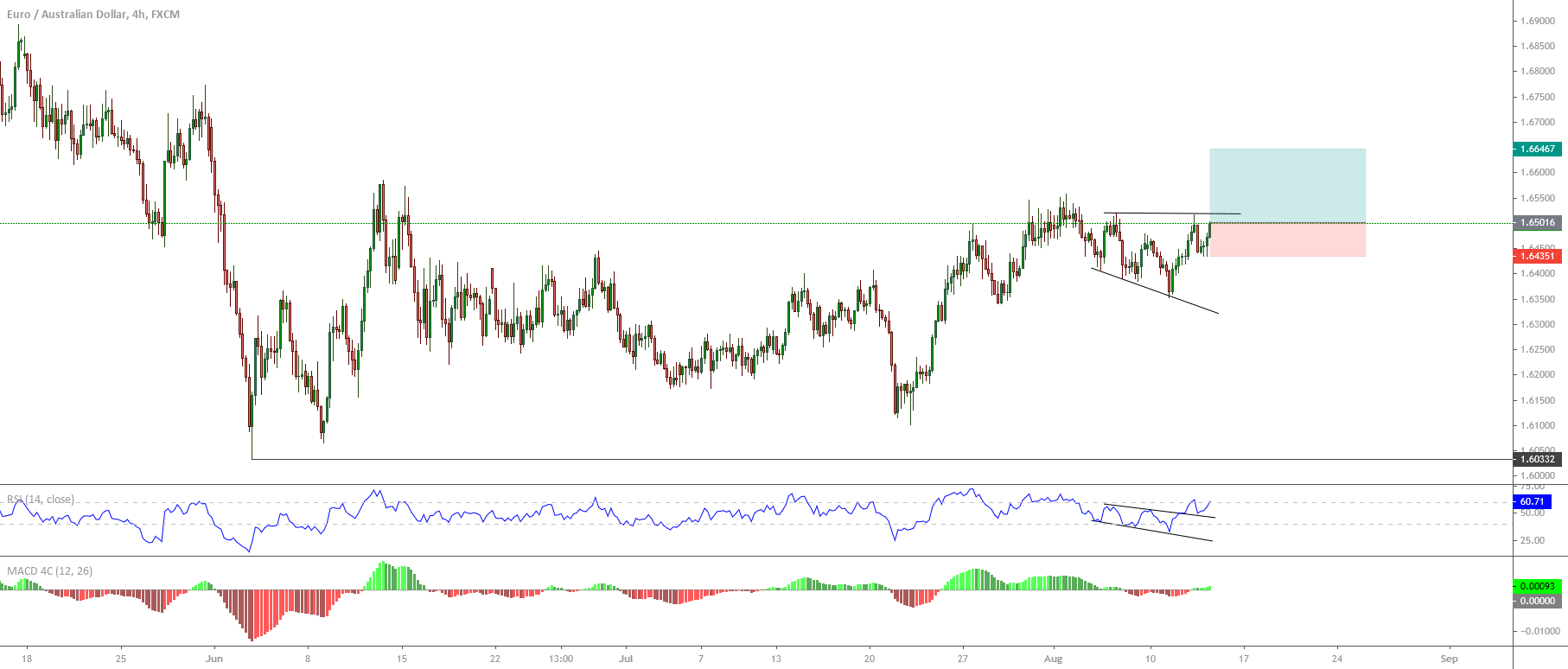

The EURAUD cross, in its 4-hour chart, shows sideways sequence, which found a bottom at 1.6033 on last early June from where the price started to bounce, finding resistance in the psychological barrier at 1.6500 level.

On July 22nd, once the price found fresh buyers at 1.6102, the cross started to advance in an upward sequence that looks like an impulsive structure that remains in progress. This bullish movement found resistance at 1.6558 in early August, where the price started to develop a consolidation formation as an expanding triangle pattern, which remains testing the psychological barrier of 1.65. This movement leads us to foresee more upsides in the following trading sessions.

On the other hand, the RSI oscillator moves above level 60. This context leads us to support the upward bias. A bullish position will trigger at 1.6503 with a potential profit target at 1.6638.

The invalidation level of the bullish scenario locates at 1.6438 that coincides with the recent August 12th low.

Chart

Trading Plan Summary

- Entry Level: 1.65032

- Protective Stop: 1.64382

- Profit Target: 1.66482

- Risk/Reward Ratio: 2.23

- Position Size: 0.01 lot per $1,000 in trading account.

Check out the latest trading signals on the Forex Academy App for your mobile phone from the Android and iOS App Store.