During the Friday’s European trading hours, the EUR/USD currency pair succeeded to extend its previous session gaining streak and hit the intra-day high level around above 1.1800 level mainly due to the broad-based U.S. dollar selling bias, triggered by the market risk-on sentiment. However, the market risk tone was being supported by optimism over a possible vaccine and treatment for the highly infectious coronavirus.

Meanwhile, the increasing expectations of further U.S. stimulus packages also boosted the market trading sentiment, which keeps the U.S. dollar lower. Apart from this, the United States’ political uncertainty also weighs on the broad-based U.S. dollar, which provided an additional boost to the currency pair.

On the contrary, Europe’s quickly rising coronavirus (COVID-19) cases fueled the worries over the EUR economy recovery, which becomes the key factor that kept the lid on any additional gains in the currency pair. Meanwhile, the latest report that the Spanish Prime Minister (PM) Pedro Sánchez announced a state of emergency in Madrid also played a significant role in capping further currency pair gains.

However, the reason for the risk-on market sentiment could be associated with the renewed probabilities of the further stimulus package, triggered after the U.S. President Donald Trump stepped back from his earlier ‘NO’ to the coronavirus (COVID-19) aid package talks. This was witnessed after the discussions between House of Representative Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin over the U.S. stimulus package resumed overnight. Apart from this, the coronavirus (COVID-19) vaccine’s hopes also favored the market risk tone, which eventually underpinned the safe-haven U.S. dollar.

As per the latest report, China joins the World Health Organization’s virus vaccine program after returning from one week-long holiday, which initially fueled the hopes of a disease cure. Meanwhile, the market trading sentiment was further bolstered by the positive reports that Gilead and Regeneron’s vaccine research efforts will offer strong results to stop the virus.

As in result, the broad-based U.S. dollar failed to stop its previous session losing streak & remained depressed during the European session as the investors continue to sell U.S. dollars on the back of the U.S. fiscal stimulus hopes, which keeps the market sentiment bullish. Furthermore, the U.S. dollar losses could also be associated with political uncertainty in the U.S. ahead of U.S. elections. Thus, the losses in the U.S. dollar kept the currency pair higher.

On the contrary, the Spanish Prime Minister (PM) Pedro Sánchez announced a state of emergency in Madrid as the COVID-19 cases in the U.K. and Germany are also worrisome. At the coronavirus front, the coronavirus cases grew to 314,660, with a total of 9,589 deaths toll, according to the German disease and epidemic control center, Robert Koch Institute (RKI) report. In the meantime, the cases rose by 4,516 on the day while the death toll rose by 11. The daily rise in new cases topped 4,000 for the second day in a row, the highest numbers since April 10. These virus fears could be considered one of the key factors that kept the lid on any additional currency pair gains.

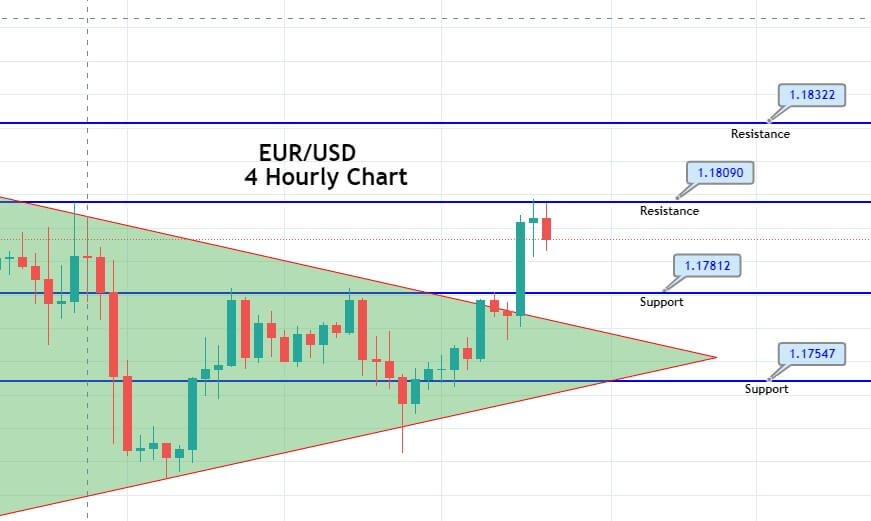

Daily Support and Resistance

S1 1.1626

S2 1.1672

S3 1.1694

Pivot Point 1.1718

R1 1.174

R2 1.1764

R3 1.181

The EUR/USD pair is consolidating below 1.1780 level, and the closing of candles below the triple top resistance level of 1.1780 level may drive the selling trend in the EUR/USD pair until the support level of 1.1758 and 1.1740 level. Conversely, the bullish breakout of the 1.1780 level can trigger a sharp buying trend until today’s 1.1807 mark. Checkout a trading signal below..

Entry Price – Sell 1.17755

Stop Loss – 1.18155

Take Profit – 1.17355

Risk to Reward – 1:1

Profit & Loss Per Standard Lot = -$400/ +$400

Profit & Loss Per Micro Lot = -$40/ +$40

Fellas, now you can check out forex trading signals via Forex Academy mobile app. Follow the links below.

iPhone Users: https://apps.apple.com/es/app/fasignals/id1521281368

Andriod Users: https://play.google.com/store/apps/details?id=academy.forex.thesignal&hl=en_US