Where next for the EURUSD pair?

Thank you for joining this forex academy educational video.

In this session, we will be looking at the EURUSD pair.

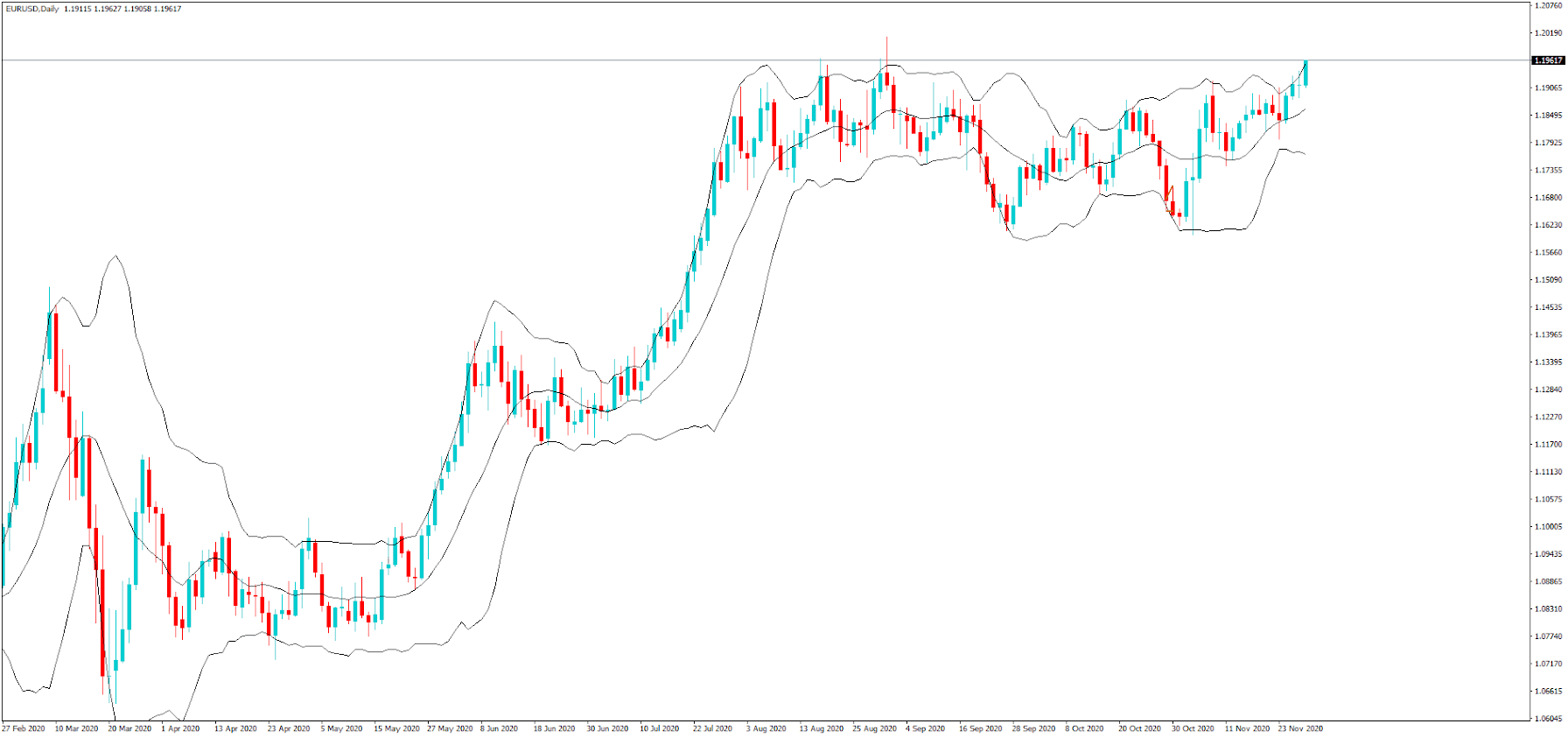

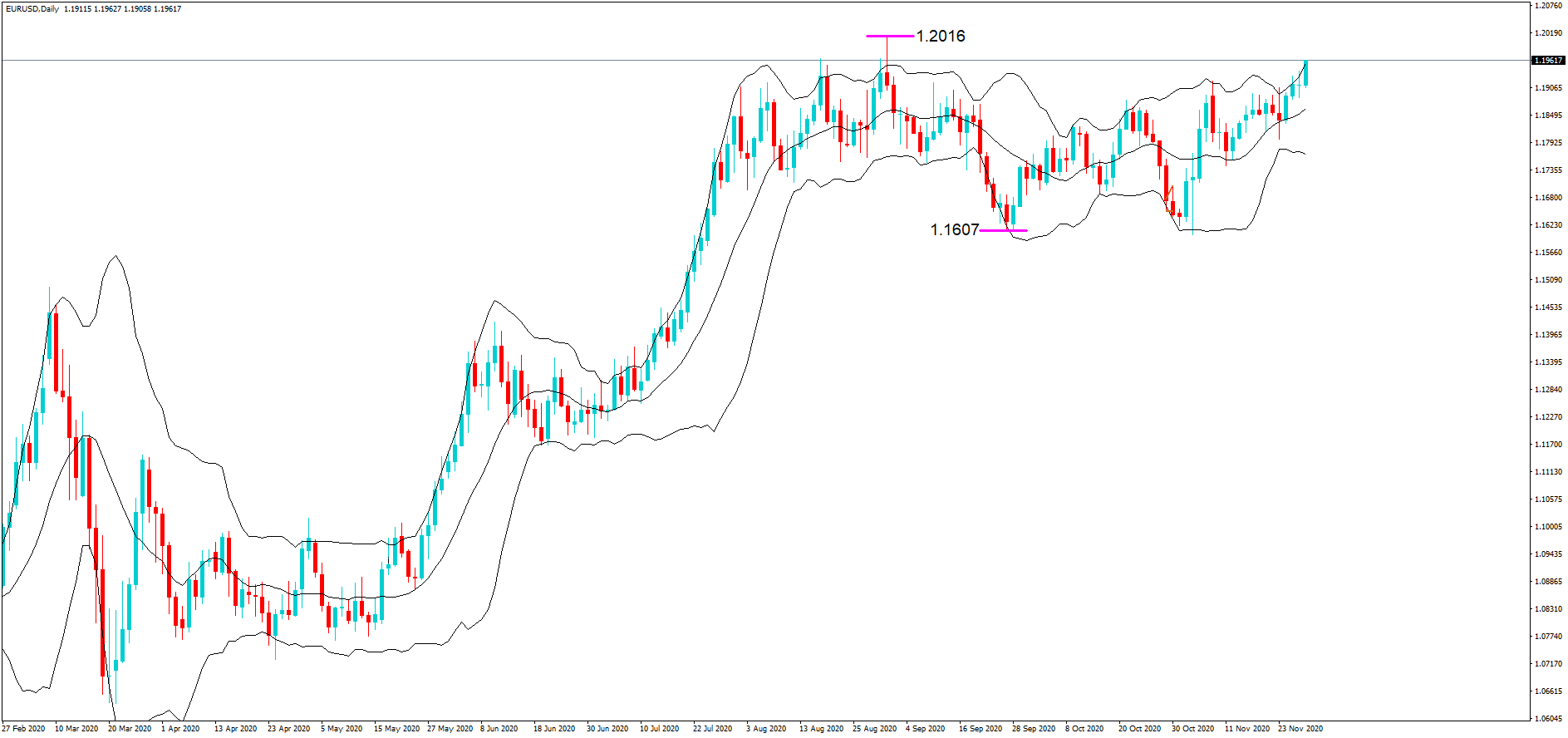

This is a daily chart for the pair, which shows that the bulls are in control and pushing the pair up to the key 1.20 level from the current 1.1961 at the time of writing.

This week’s broad dollar weakness has pushed the dollar index under the key 92.00 level, has certainly helped to give the euro a lift. However, while publicly declaring a neutral stance on the strength of the euro, the ECB will no doubt privately be hoping for or a decline, simply for export reasons while the Euro area is still in the grips of the pandemic, and where the recovery path is muted.

Some analysts believe that the current level of ECB monetary easing policy is discounted in the pair’s exchange rate and believe that leveraged investors are reluctant to continue long positions from these highs……

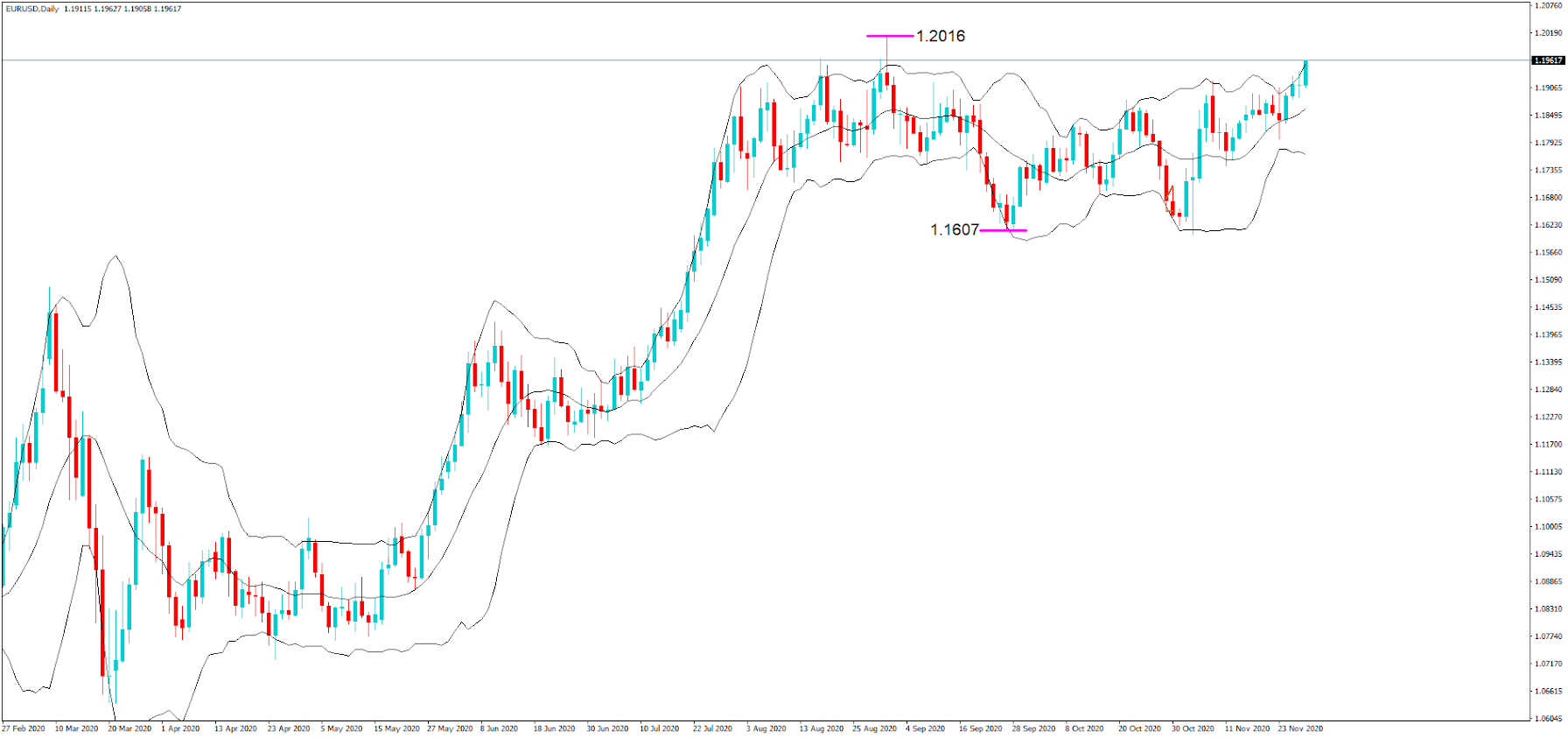

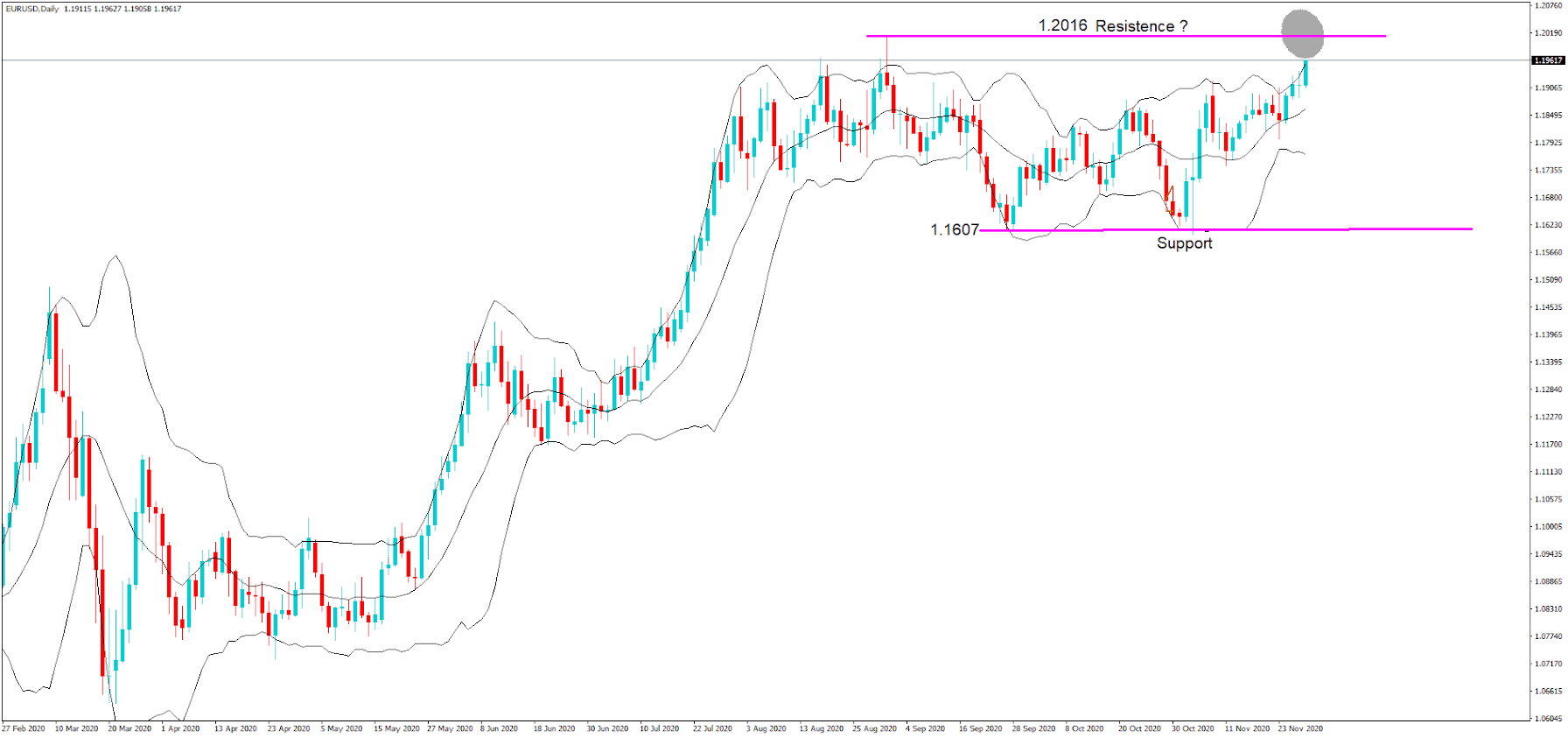

….and where the market saw a distinct pullback from the 1.2016 level to 1.1607 at the beginning of August 2020. Certainly, If the big guns stop buying because of these reasons, price action will stall at the key 1.2000 level for a second time, and a reversal would follow

Other fundamental risks include a new US president in the waiting and whereby President Biden’s post-inauguration monetary policies will directly affect the markets and especially US stock markets and the value of the dollar, whose decline has helped lift the Euro in recent months and where the Covid relief financial stimulus package has been a long time in coming.

Also is the conundrum of the ongoing Brexit free trade agreement negotiations between the EU and UK. A failure to reach an agreement in what is seen as the eleventh-hour talks, before the end of the transition period on the 31st of December, would mean increased tariffs between the EU and UK where the EU exports than it imports, and which would be potentially harmful for the ailing EU economy. This would affect the value of the euro negatively.

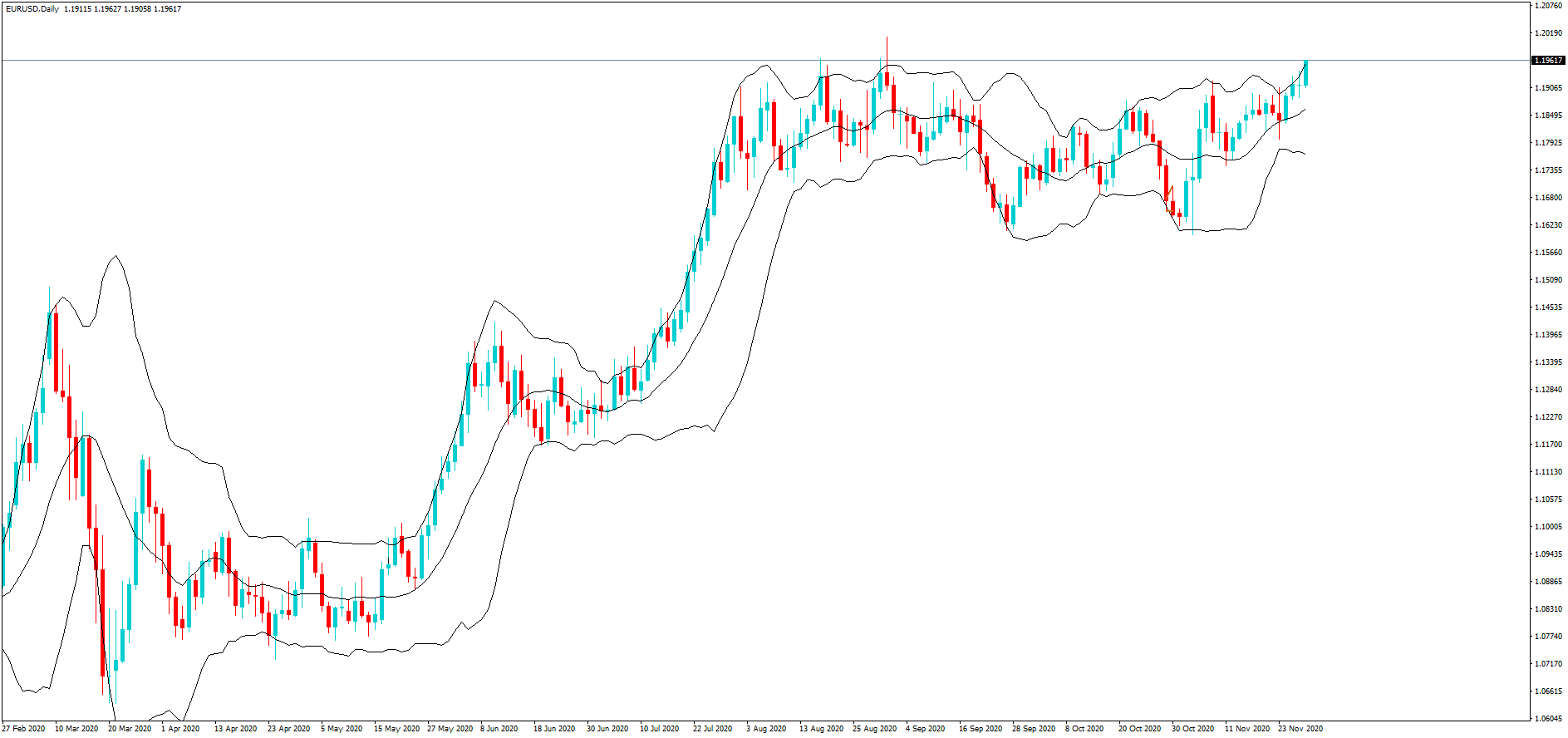

Now let’s look at the technical risks.

The daily chart clearly shows a support line at the key 1.1600 area, and we are very close two a retest of the key 1.200 line to the upside. Should that happen, we will have had two attempts at a support line and two attempts at a resistance line, which will give us a confirmed sideways range for the pair. The risk for bulls is a potential double top formation, with its danger of a reversal. The previous 300 pip, reversal as shown, must be a warning sign for buyers.

The next test would be price action moving above the 1.20 line, pulling back to it, and finding support there, potentially leading to a higher continuation.

Traders should look to use the 1 and 4-hour charts to gain an intraday perspective of what is happening around this key 1.2000 level, to ascertain if it will become an area of support or resistance while factoring in the very risky fundamental reasons as previously alluded to.