DK Trade is an FSA regulated broker that describes themselves as a boutique brokerage company focused on client satisfaction. The company is located in Saint Vincent & the Grenadines and offers multiple account types, along with several other advantages, so there’s a lot to take into consideration if you think this broker may be a good fit for you. Stay with us to find out more about what sets DK Trade from the crowd, and where they fall short of their competition.

Account Types

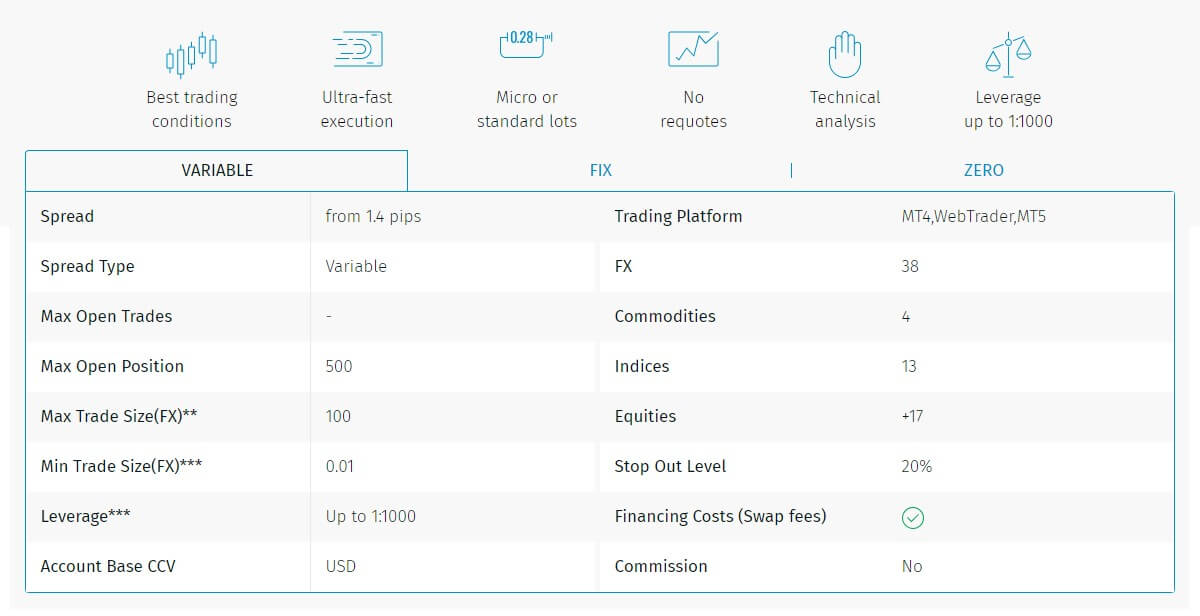

DK Trade offers three different account types, with each being designed to tailor to a different type of trader. The choices are the Variable, Fix, and Zero account types. The Variable and Fix accounts are very similar, with the main difference being that the spread is variable on the Variable account and fixed on the Fix account, as you may have guessed. The Zero account differs from the other account types because it offers extremely low spreads, but charges commission fees where the other accounts do not. All of the accounts share the same leverage, assets, trading platforms, minimum, and maximum trade sizes, and stop out levels. Take a quick look at the specifics for each account type below.

Variable Account

Spread: Variable. From 1.4 pips.

Commission: None

Leverage: up to 1:1000

Fix Account

Spread: Fixed. From 1.5 pips.

Commission: None

Leverage: Up to 1:1000

Zero Account

Spread: Zero. From 0.4 pips.

Commission: $10 FX/$15 Metals per round lot

Leverage: Up to 1:1000

Platform

One of the main advantages of choosing DK Trade would be the fact that they offer the classic MetaTrader4 platform in addition to its successor MetaTrader 5. Both are excellent programs, but many traders have their own preferences on which platform is better. Most brokers offer one or the other, with MT5 being offered less often. So, which platform should you choose? In order to make the decision, you’ll need to know some of the key differences. MetaTrader 4 was designed with currency pairs in mind and is often preferred for its customizable and user-friendly interface, while MT5’s interface comes with a similar layout, but includes advanced trading features. Mt5 offers more time frames, pending order types, and the programming is easier to use. Still, while it may seem that MetaTrader5 is offering more advantages, MetaTrader4 remains the world’s favorite platform. The decision on which platform is better falling upon the trader’s personal preference. Luckily, DK Trade will allow you to make the choice.

Leverage

DK Trade advertises maximum leverage of 1:1000. This amount is certainly one of the highest leverage options we’ve ever seen available. However, the advertised leverage is only available for currency pairs and you’ll find that the options are much more limited for the other types of assets. Still, offering maximum leverage of 1:1000 on currency pairs is noteworthy and much higher than what the majority of their competitors are offering. Leverage on indices and commodities goes as high as 1:100, while equities offer a better leverage option up to 1:200. All account types share the same leverage options.

Trade Sizes

DK Trade does allow for the trading of micro lots on all account types, so many will find satisfaction with their minimum trade size. The maximum allowed trade size is set at a satisfactory 100 lots, which is much better than the 20 lot minimums we’ve often seen. Stop out levels are set at 20% for all three account types.

Trading Costs

DK Trade profits through spreads, commission fees, and swap fees. As their client, your personal trading costs will depend on which account type you’ve opened. Spreads start at 0.4 pips on the Zero account but climb to more of an average level on the other account types. You’ll also be able to avoid commission charges altogether on the Variable and Fix accounts, but the Zero account charges $10 on FX and $15 on Metals per round turn. Swap fees are charged when positions are held overnight and those charges are applicable for all of the account types. In our opinion, the charges with this broker aren’t too bad, and it’s nice to be able to select from different accounts that offer different types of charges. As long as one chooses the right account type, then they could save a lot of money in the long run.

Assets

DK Trade offers the same tradable assets for all of their account types. Their portfolio contains 38 forex pairs, 4 commodities, 20 indices, and 17 plus equities. Forex pairs include popular options like the EUR/USD and the UAD/USD. Commodities include coffee, sugar, cotton, and more. There are more than 20 indices available and include options like the NAS100. Crypto trading is also supported. Taking all of this into consideration, we could certainly say that DK Trade is offering a diverse and satisfactory product portfolio.

Spreads

Both the Variable and Fix accounts offer very similar spreads, with the option being from 1.4 pips on the Variable account and 1.5 pips on the Fix account. The spreads start around an average level, but it is possible that they could climb higher, which would result in higher than average spreads on those two account types. The takeaway would be that there are no commission fees for either account type.

One of the only differences between these two account types would be the fact that spreads on the Variable account are variable, while spreads on the Fix account are fixed. If you want access to the best spreads possible, you’ll want to choose the Zero account, which offers since it offers spreads starting as low as 0.4 pips. This is considerably lower than the other offers, but you will be paying commission fees if you choose this account type, so you’ll need to decide which account type offers the best advantages for your trading style.

Minimum Deposit

The minimum deposit requirement with this broker is set at just $10 for all of their account types. This amount is much lower than the industry average, so there is certainly an advantage here if you’re just getting started, or if you don’t have a lot of funds. We do recommend making a larger deposit if you have the means to do so since you won’t be able to do much with only $10 in your trading account. Still, it’s great to see this broker offering such a relaxed deposit requirement, especially when some of their competitors require amounts in the thousands or more. Having such a low requirement for all of their account types also ensures that all of their traders will actually have the ability to select the account they want with no funding barriers.

Deposit Methods & Costs

The DK Trade website advertises Visa, FasaPay, MasterCard, Maestro, WebMoney, UnionPay, American Express, Bank Wire, Neteller, and Skrill as available funding methods. The website doesn’t offer any further information, so we had to reach out to support to learn more. From what we could find out, there do not seem to be charged on deposits, however, bank wire would most likely incur fees from your bank’s side.

Withdrawal Methods & Costs

Sadly, we can’t give you much information about withdrawals. While we did reach out to support, they would only inform us that they offer a wide variety of withdrawal methods. That suggests that all of the e-wallets and Visa/MasterCard options are available for withdrawal, but it doesn’t give us any clue as to whether there are fees, or how high those fees may be. While DK Trade could have possibly scored highly in this category otherwise, the lack of information on their website and the lack of information given by their support team made us somewhat wary about the possible withdrawal costs. It’s common to see charges on withdrawals with other brokers, but it is important for one to be able to compare these fees in order to make an informed decision.

Withdrawal Processing & Wait Time

According to support, it could take between one and two days to receive your withdrawal. Comparing this with the competition, one would find that this is a realistic waiting period. We base this observation on the fact that some brokers offer instant withdrawals and others can take upwards of 7 days to return funds, therefore, DK Trade falls in the middle of the spectrum.

Bonuses & Promotions

DK Trade is currently offering a 50% welcome bonus and a 25% re-deposit bonus. You must deposit a minimum of $500 in order to qualify for the welcome bonus and the bonus is only available on your first deposit. In order to qualify for the re-deposit bonus, you must make a deposit of at least $200. The bonus amount is tradable, but the amount is not available for withdrawal. Aside from the 50% welcome bonus, the account cannot have claimed any other bonuses in order to qualify for the re-deposit bonus. The amount cannot exceed $5,000 but it can be applied to multiple deposits. Note that if you withdraw funds during the two-month promotional period for either bonus, your account would be disqualified from the offers.

Educational & Trading Tools

The DK website offers an economic calendar that announces relevant news and information that could have an impact on the financial market. Keeping tabs on the calendar could certainly help one to make informed decisions. The website also offers a feature called the ‘AutoChartist’. The aforementioned web portal and plugin provides a wide range of user-friendly technical analysis tools. The program provides automatic intra-day alerts in real-time and can be downloaded as a plugin for the MT4 platform within 30 seconds. VPS is also available. In ways of education, the only offer from DK Trade would be the ability to open a demo account. Overall, the few trading tools that are offered are nice, but the company should definitely add more educational resources to their site in the future.

Demo Account

DK Trade offers advanced demo accounts that mimic their real-account counterparts. For example, one could actually open a demo version of the Fix account and practice using the same fixed spread that the real account offers. Since all three account types are available via the demo, one could test out one, two, or even all three of the available account types to help decide which account is most attractive. Demo accounts also give beginners or those that aren’t very experienced, a great chance to test the market. Since you’re trading with virtual funds and the accounts are free, there are no real risks. Virtual funds for the demo can be chosen from an amount between $5,000 and $50,000.

Customer Service

DK Trade’s multilingual customer support team is available 24/5 via LiveChat, contact form, or phone. LiveChat is an excellent contact option because of the fact that it is instant, but we must mention the fact that the first two times we attempted to contact support through this method there were no agents online. Our attempts were made later in the evening, but the lack of available support agents suggests that it may not be possible to get in touch with support 24 hours a day, as advertised. Phone numbers and email are not listed on the contact page, so the only way to get in touch with support through these methods would be to leave a message on the website’s contact form. Overall, the advertised support hours and methods make the customer support team with this broker seem nearly perfect, but it may more difficult to get in touch with them than it seems.

Countries Accepted

At this time, DK Trade is not accepting of clients located in the United States of America. We were a little surprised, considering that this broker is located in Saint Vincent & the Grenadines, which is usually openly accepting of US clients. There do not seem to be any further restrictions but feel free to contact support if you do not see your country on the sign-up page.

Conclusion

There are several advantages to choosing this broker, including the ability to choose between three different account types, leverage options up to 1:000 on currency pairs, $10 deposit minimums, spreads that start at 0.4 pips on their Zero account type, the ability to trade micro lots, the option to choose between MetaTrader 4 and MetaTrader 5, commission-free account types, a large asset portfolio, bonus opportunities, and advanced demo accounts. Some features are merely average, including the spreads on the Variable and Fix account types, withdrawal times, and the availability of their customer support team.

There are several advantages to choosing this broker, including the ability to choose between three different account types, leverage options up to 1:000 on currency pairs, $10 deposit minimums, spreads that start at 0.4 pips on their Zero account type, the ability to trade micro lots, the option to choose between MetaTrader 4 and MetaTrader 5, commission-free account types, a large asset portfolio, bonus opportunities, and advanced demo accounts. Some features are merely average, including the spreads on the Variable and Fix account types, withdrawal times, and the availability of their customer support team.

Lack of educational resources, the fact that the US is not accepted, and vague information about their withdrawal fees fall into the bad category. The good qualities seem to outweigh the bad with this broker, but some may prefer to keep looking for another option. If you do decide to open an account here, make sure you open the account type that best suits your trading style.