Introduction

Moving Average is the most common indicator used by the traders in the industry. The Moving average is quite popular among the traders because the indicator itself serves the foundation for a couple of other indicators, such as MACD and Bollinger bands. Day Trading is a fast game; most of the intraday traders and scalpers trade the markets couple of times a day. As a trader, you need to understand very clearly and precisely which way the indicator is moving. So here the moving average plays an important role for the traders, first of all, it is a simple indicator, if it is below the price, then the trend is up, and if the MA is above the price, then the trend is down. This thing makes it easier for traders to identify the market trend, and without any wasting time on additional analysis, traders can make quick decisions to trade the market. In intraday trading, having the ability to make quick decisions without performing any additional manual calculations can make a huge difference in your trading.

Moving Average Settings.

Choosing the right moving averages for day trading is the real key to trade the market effectively. The right average adds reliability to your analysis, whereas the wrong or any randomly chooses average can easily let you stay away from the profitable trading opportunities. The smaller averages work best for the intraday trading and. In contrast, for the bigger timeframe traders, smaller averages are useless; conversely, for the lower timeframe traders, the bigger averages are useless. To trade the market professionally, it is advisable to use the ten-period averages for the intraday trading. Most intraday traders use to trade the market breakouts to make some quick bucks, so the ten periods give enough room to the market to trend.

Example of using the ten period Average for trading the breakout.

So for intraday trading, always use this indicator on the 15 minutes and below charts. Below are the buy and sell example; you can use this same way to trade the markets.

FOR BUY.

- Find out the trending market.

- Look for a breakout above the most recent higher high.

- MA must be below the price action.

- Price action must hold above the breakout.

- Go long.

- Put the stop loss below the Moving Average.

- Go for brand new higher high.

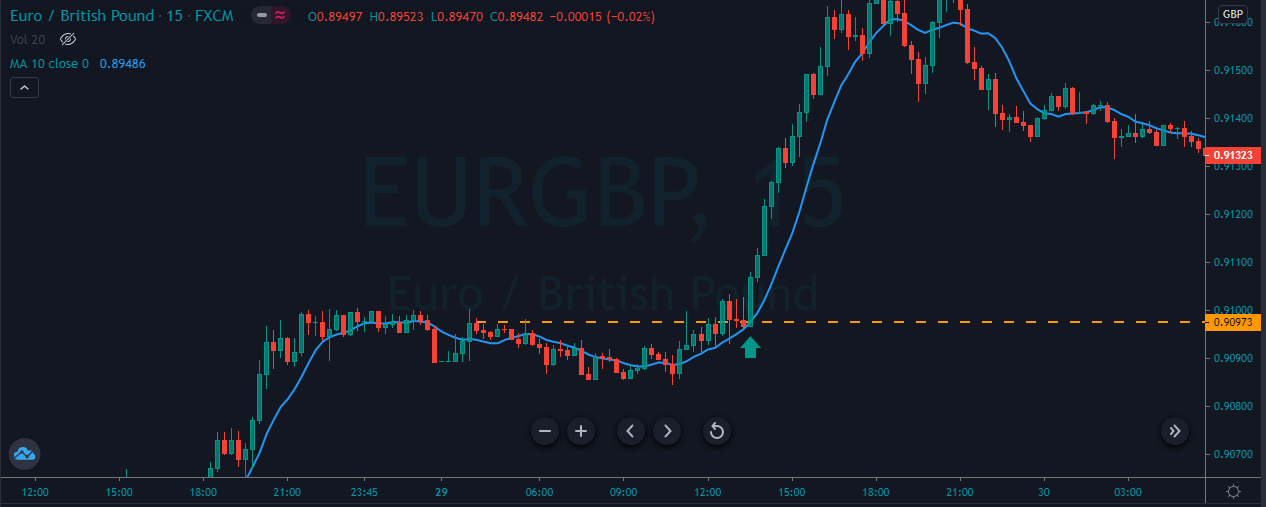

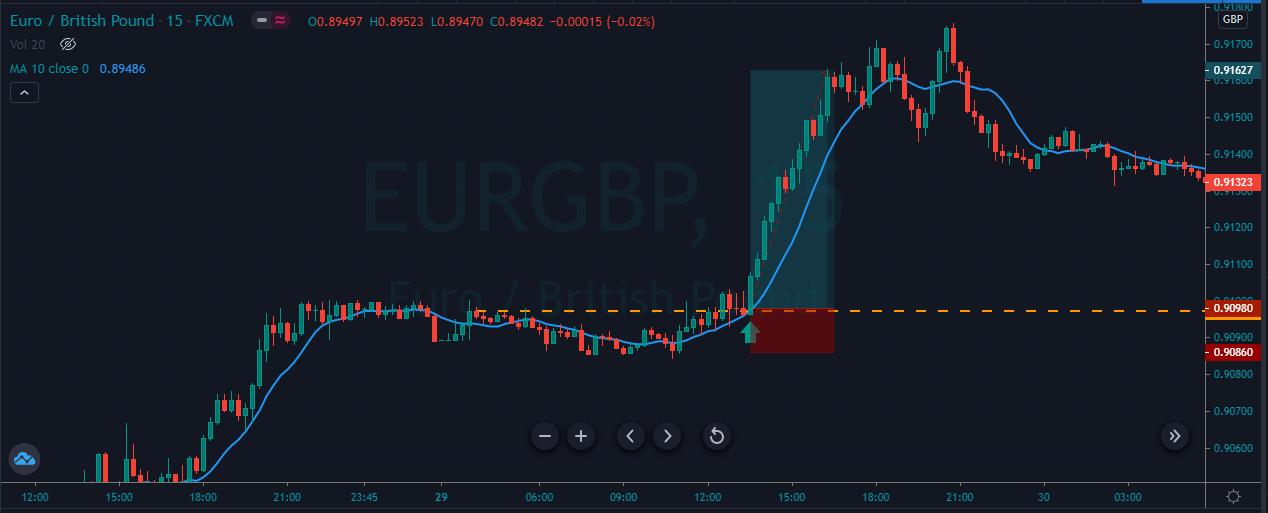

The image below represents the buying trend in the EURGBP forex pair.

The image below represents the entry, exit, and stop-loss in this forex pair. As you can see, the pair was in a strong buying trend, and it gives the small pullback and price action breaks above the most recent higher high. When it breaks the higher high, it holds there for a couple of candles, which confirms the breakout, and the MA below the price action indicates the buying momentum. So we took the entry above the breakout was good enough, and we choose to go for the brand new higher high.

FOR SELL.

- Find out the trending market.

- Look for a breakout below the most recent lower low.

- MA must be above the price action.

- Price action must hold below the breakout.

- Go short.

- Put the stop loss above the Moving Average.

- Go for a brand new lower low.

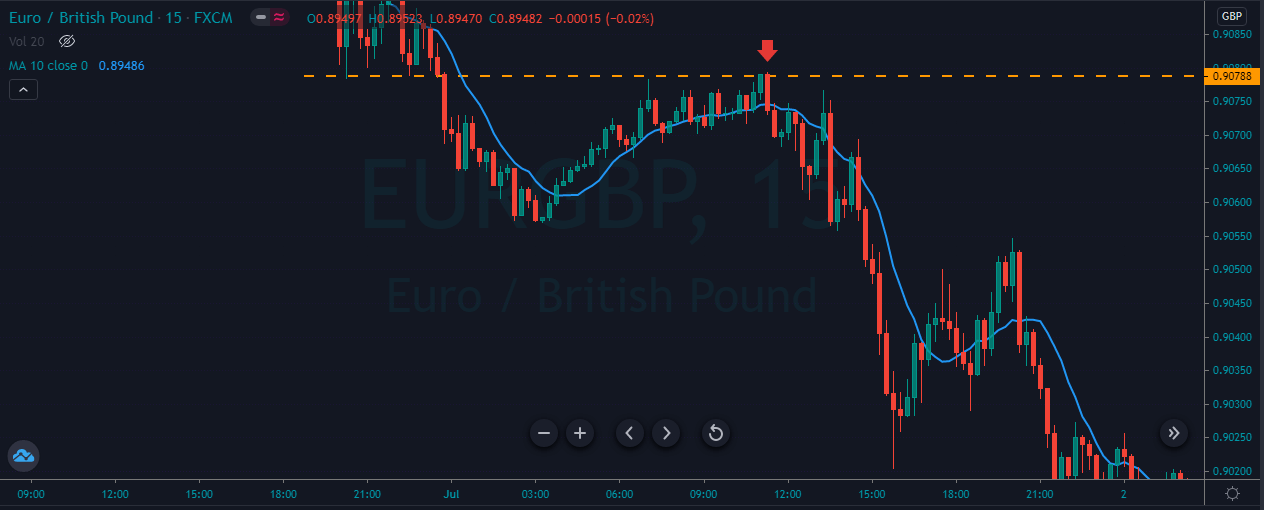

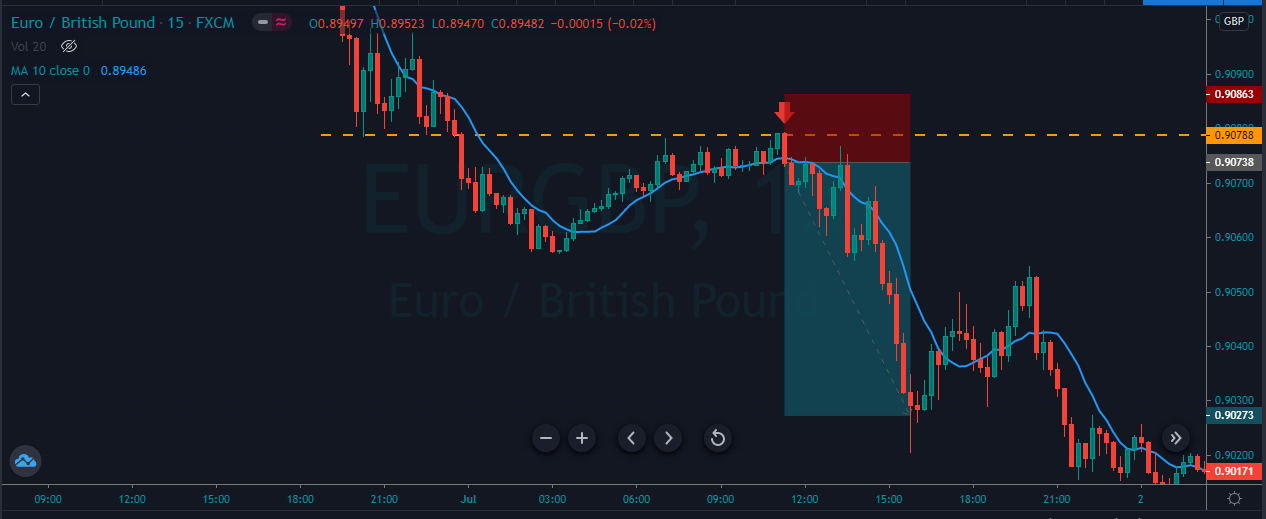

The image below represents the downtrend in the EURGBP forex pair.

The image below represents the entry, exit, and stop-loss in this forex pair. You can see when the price action breaks below the most recent lower low; after that, it gravitates towards the resistance line, and the hold below the resistance line confirms the selling entry. The price action dropped hard after our entry, and the smaller stop loss above the entry was kind enough to ride the move.

Trading the Five-period Moving Averages using the Support and Resistance levels.

So in this strategy, we are using the five-period averages for purely intraday trading. Do not use it on the higher time frame; only trade this average on five and 3-minute charts.

FOR BUY.

- Look for the trending market.

- Wait for the price action to pull back to the nearest support area.

- The moving average must be below the price.

- Let the price to test the support area.

- Hit buy.

- You can exit your trades on the most recent higher high, or you can go for the brand new higher high.

- Use five pip stop loss.

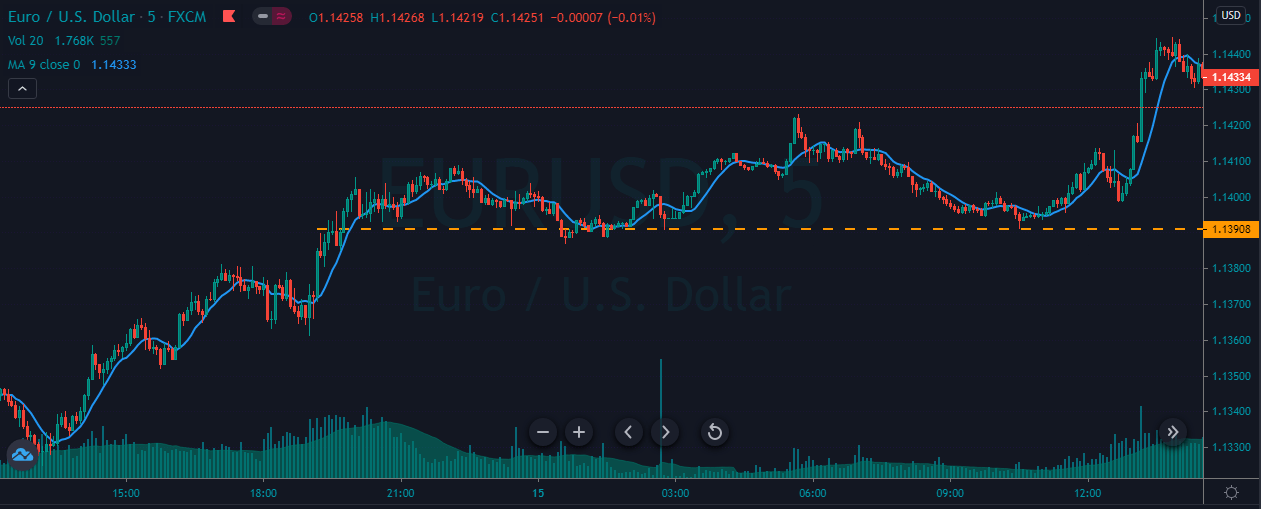

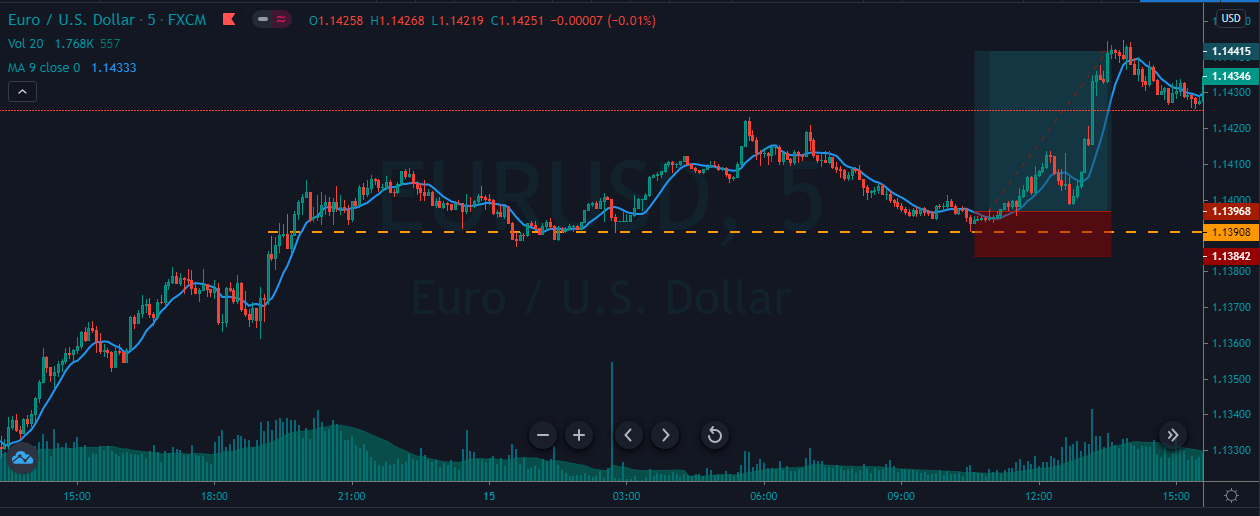

The image below represents the buying trend in the EURUSD forex pair.

As you can see, the image below represents the entry, exit, and stop-loss in the EURUSD forex pair. The pair was in a strong uptrend, and during the pullback, it holds above the support area. Whenever the prices tried to go below the support area, it failed to do it, which shows the buyers are maintaining the ground, and sooner, we will witness the brand new higher high.

FOR SELL.

- Look for the trending market.

- Wait for the price action to pull back to the nearest resistance area.

- The moving average must be above the price.

- Let the price to test the resistance area.

- Hit sell.

- You can exit your trades on the most recent lower low, or you can go for the brand new lower low.

- Use five pip stop loss.

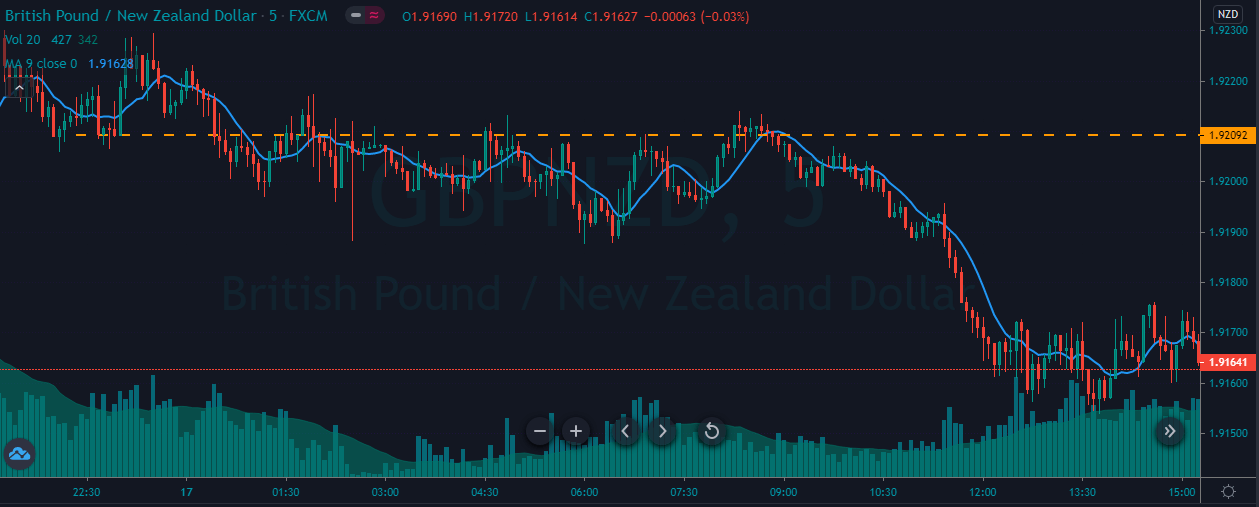

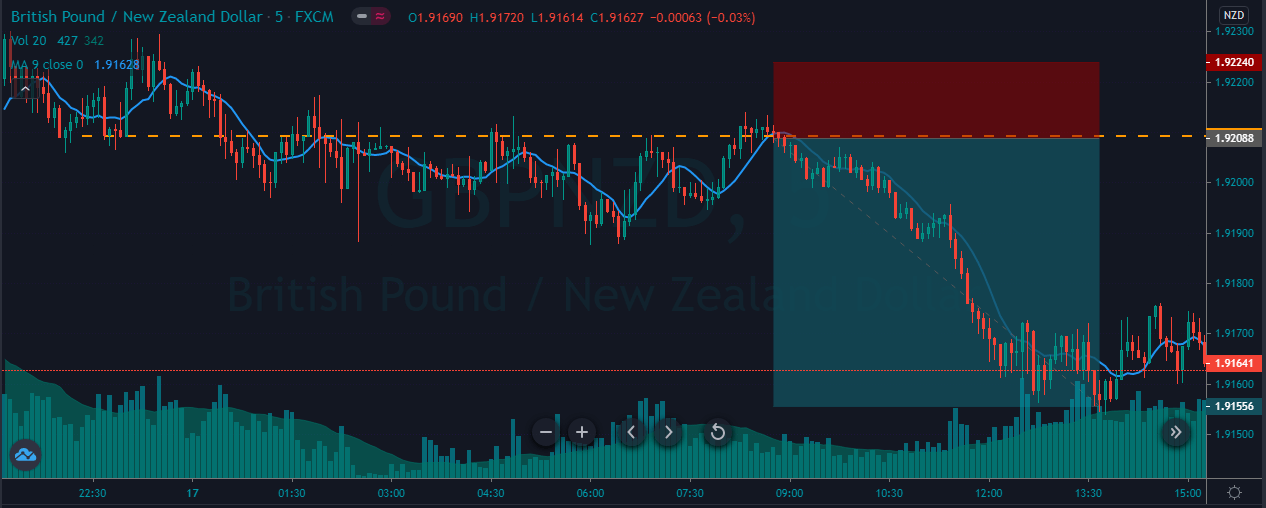

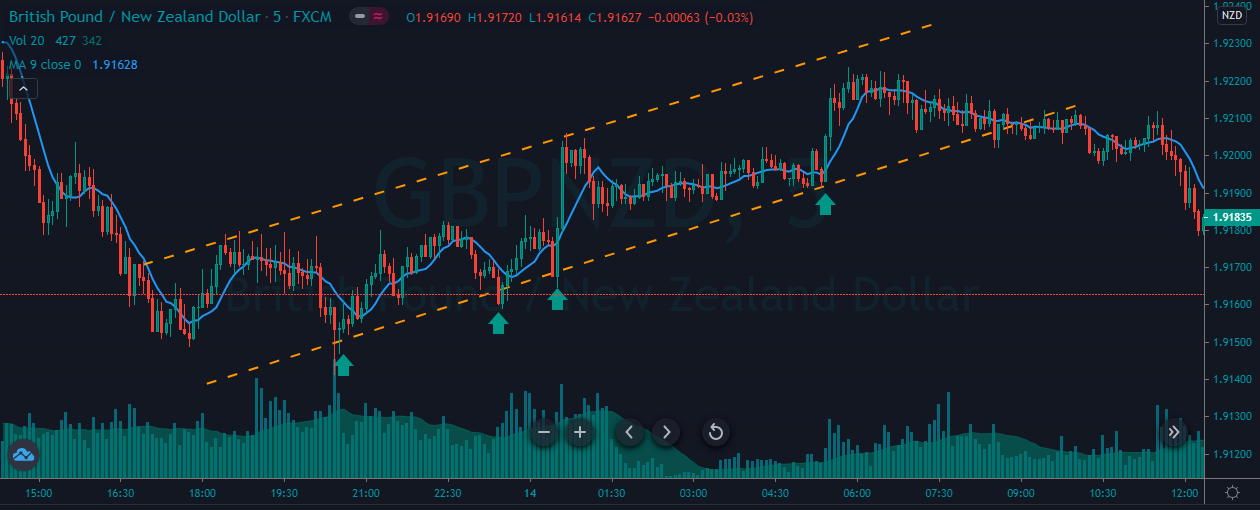

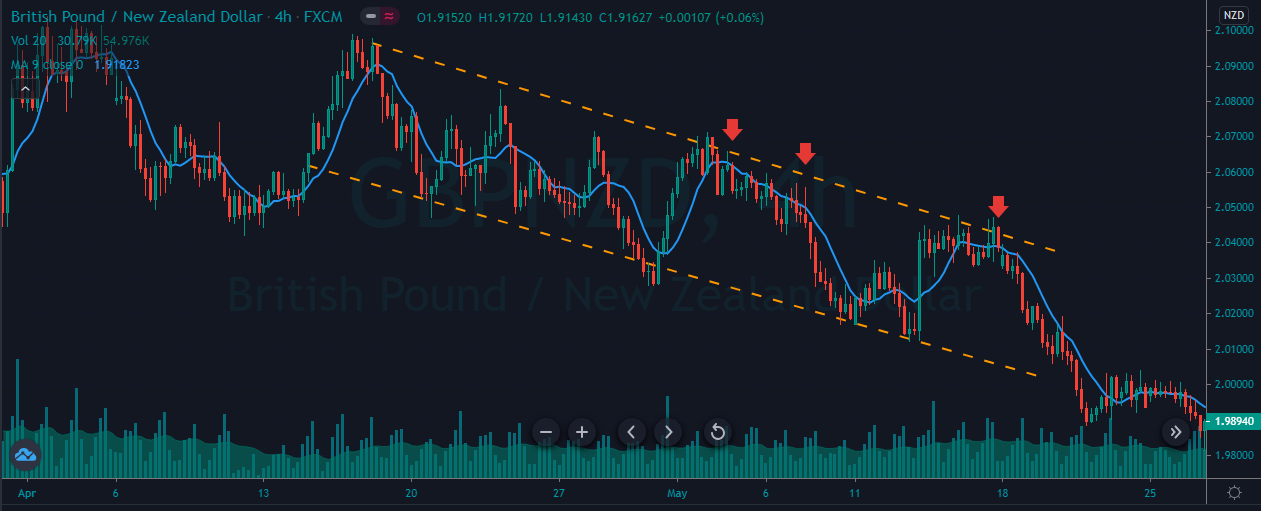

The image below represents the selling market in the GBPNZD forex pair.

The image below represents the entry, exit, and stop-loss in the GBPNZD forex pair. The pair was in an overall downtrend, and during the pullback phase, it holds below the significant resistance level, and when the moving average goes below the price action, it was a sign to go short. Soon after our entry, price smoothly dropped downside, and it prints the brand new lower low.

TRADING THE CHANNELS BY USING THE 15 PERIOD MOVING AVERAGE.

Channel trading is when price action has a hard time to print higher high, or the price action is about to end its trend. In his strategy, we will show you how to trade the 15-period averages to book intraday profits.

FOR BUY.

- Look for price channel on any trading asset.

- Moving Average must be below the price action.

- Go long when the price action approach to the lower channel line.

- Avoid trading short trades.

- Scale in the next opportunities.

- Exit your position when price action breaks the Channel.

- Put the stops below the Moving Average.

The image below represents a couple of buying trades in a buying channel, as you can see in a channel we only choose to trade the buying opportunities, and we ignored all the selling trades, this is because we were looking for the good reliable trades and the selling trades wasn’t good enough to take. So whenever the price action hits the lower Channel and the MA is below the price action, it is a sign for us to scale in each position.

FOR SELL.

- Look for price channel on any trading asset.

- Moving Average must be above the price action.

- Go short when price action approach to the upper channel line.

- Avoid trading long trades.

- Scale in the next opportunities.

- Exit your position when price action breaks the Channel.

- Put the stops above the Moving Average.

The image below represents a couple of selling trades in the GBPNZD forex pair. The selling channel is an indication of a choppy trend, and also it is an indication of sooner the trend might reverse. So whenever the Channel and the price action gave us the trading opportunity, we choose to go short and at every opportunity we choose to scale.

CONCLUSION.

Moving average is an extremely popular indicator in the industry; without this indicator, trading wasn’t secure. There are infinite numbers of averages exists and use them according to your trading approach. Intraday traders should go for lower averages, whereas the higher timeframe traders should go for the higher averages. Do not think the Moving Average as a holy grail in the market; instead, it depends on you how you use this indicator and manage the risk effectively to make cash from the market. Keep the things simple and do not add too many MA on one price chart, it will create confusion, and even it required additional analysis to scan the asset. So for intraday trading, keep your strategies very simple and to the point. As an intraday trader, we suggest you do not expect home runs as it is nearly impossible for the price actions to give more significant moves, so avoid the habit of trying to make million dollars in just one trade. Trading is an everyday process; stay consistent in your approach, go for the smaller targets, and smaller stops to make a good amount of cash in the longer run. Stay disciplined, stay persistent, control your mindset, follow the rules, do not fall into the emotions, focus on the process, or fall in love with the process, and you will end up making a handsome amount of profit from the market. SIMPLICITY IS THE KEY. Hope you like the article, have a good day. God bless you.