The AUD/USD pair was closed at 0.73658 after placing a high of 0.73732 and a low of 0.73248. The AUD/USD pair extended its gains on Wednesday after falling to the 0.73200 level. The pair fell in an earlier trading session on the day but reversed its direction after releasing U.S. macro-economic data.

At 05:30 GMT, the Construction Work done in the third quarter in Australia came in as -2.6% against the forecasted -2.0% and weighed on the Australian dollar. From the U.S. side, at 18:30 GMT, the Prelim GDP for the third quarter came in line with the expectations of 33.1%. The Unemployment Claims from last week surged to 778K against the estimated 732K and weighed on the U.S. dollar that added gains in AUD/USD pair. The Core Durable Goods Orders for October rose to 1.3% against the estimated 0.5% and supported the U.S. dollar. The Durable Goods Orders raised to 1.3% from the anticipated 1.0% and supported the U.S. dollar. The Prelim Wholesale Inventories for October surged to 0.9% against the projected 0.4% and weighed on the U.S. dollar that added further gains in AUD/USD pair.

The New Home Sales for October surged to 999K against the estimated 972K and supported the U.S. dollar. The Personal Income dropped to -0.7% from the anticipations of 0.0% and weighed on the U.S. dollar. The Personal Spending rose to 0.5% from the projected 0.4% and supported the U.S. dollar.

The rising unemployment claims and personal income data weighed on the optimism that economic recovery was near and faded the risk sentiment. The risk rally deteriorated after the mixed macroeconomic data from the U.S. and weighed on the risk perceived Aussie that caused the pair to fall in an earlier session.

The pair managed to end its day on a bullish stance due to U.S. dollar weakness in the absence of any major fundamental. The market mood was smooth on Wednesday and the risk perceived AUD/USD continued following the previous optimism regarding the vaccine development from AstraZeneca and Moderna. Pfizer and BioNtech were close to getting approval from the US FDA for emergency use authorization of their vaccine, causing an immediate rise in risk rally and supporting further the AUD/USD currency pair. Investors also remained cautious on Wednesday and followed the previous daily movement ahead of the release of FOMC minutes from the November meeting.

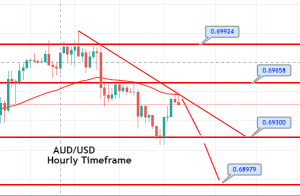

Daily Technical Levels

Support Resistance

0.7333 0.7383

0.7304 0.7404

0.7284 0.7433

Pivot point: 0.7354

The AUD/USD long term view of the market is bullish. We were approaching a resistance level at 0.73400, which has now been violated and the AUD/USD pair has the potential to go after the 0.7397 level. We have already captured this trade and enchased 30+ pips in a trade. For now, we will be looking for a retracement until the 0.7395-90 area to take another buying position in AUD/USD as bullish bias seems dominant today. Good luck!