During Monday’s European trading session, the USD/JPY currency pair succeeded in stopping its early-day losses and took some modest bids above the 107.00 marks. However, the currency pair is trading with a mild bullish bias mainly due to the risk-on market sentiment triggered by incoming positive economic data, which raised hopes of a swift economic recovery and remained supportive of the upbeat market mood. However, the risk-on market sentiment undermined the safe-haven Japanese yen and provided a modest lift to the USD/JPY pair.

On the other hand, the broad-based U.S. dollar weakness in the wake of risk-on market sentiment kept a lid on any additional gains in the currency pair, at least for now. At this moment, the USD/JPY currency pair is currently trading at 107.08 and consolidating in the range between 106.78 and 107.09.

The holding of bonds and other assets by the U.S. Federal Reserve was contracted for a fourth straight week and declined below $7 trillion. According to Central banks, the total balance sheet size of the Fed fell about $88 billion to $6.97 trillion on Thursday. It was the largest weekly drop in 11 years, from $7.06 trillion of last week to $6.97 trillion this week.

The main driver of the Fed’s balance sheet decline was the outstanding repurchase agreements (repos) – that fell to zero from $51.2 billion a week earlier.

Gilead Sciences announced that its antiviral drug Remdesivir could reduce the risk of death for severely sick coronavirus patients by 62%; however, more research was needed. This positive news weighed on the safe-haven Japanese Yen and capped on additional losses in USD/JPY pair.

Moreover, the risk-on market sentiment was further bolstered by the hopes of further stimulus from the U.S. due to the downbeat Producer Price Index (PPI), also backed by the comments from the President and CEO of the Federal Reserve Bank of Dallas Robert Kaplan.

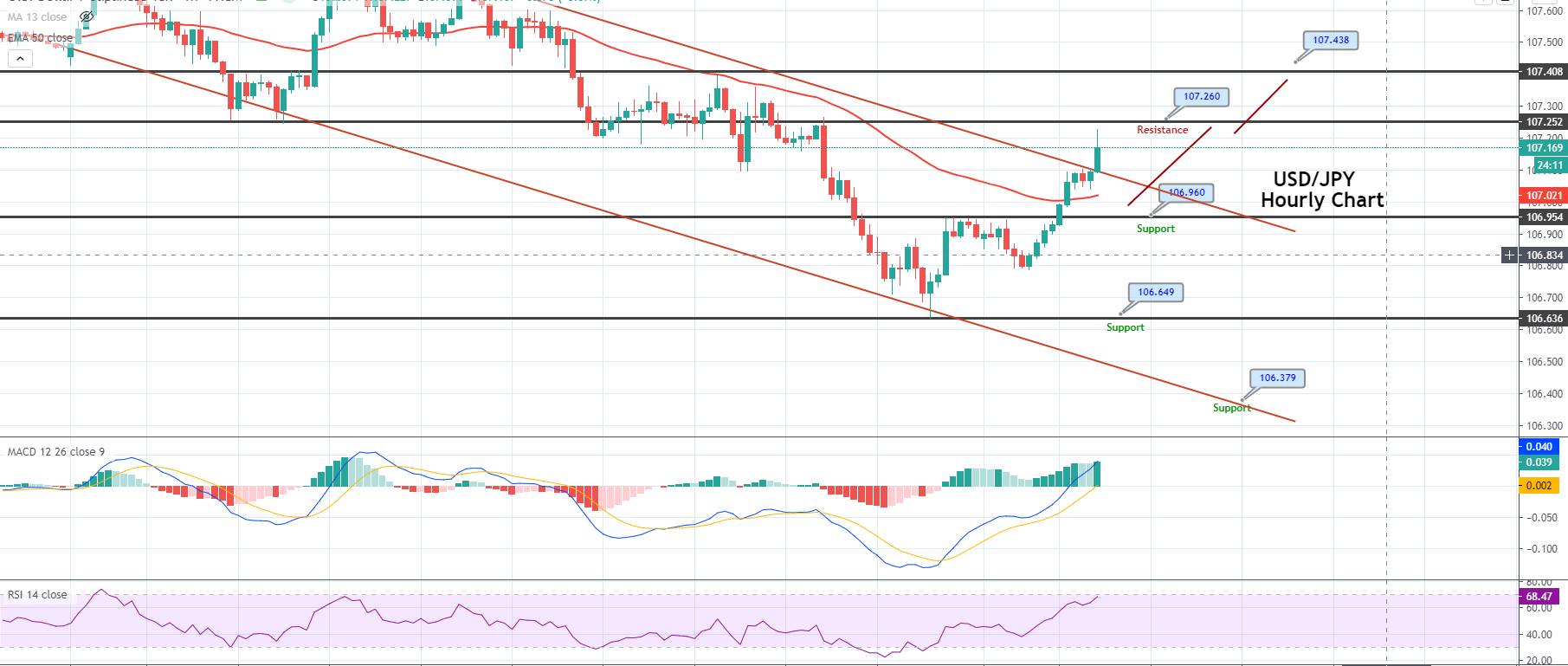

Technically, the USD/JPY is crossing over 106.850, which will provide support to the Japanese pair. The pair is trading with a bullish bias of above 106.850 support, and crossing above 106.850 is likely to lead the USD/JPY prices towards 107.400 level. Here’s a quick update on our signal.

Entry Price – Buy 107.134

Stop Loss – 106.734

Take Profit – 107.534

Profit & Loss Per Standard Lot = -$400/ +$400

Profit & Loss Per Micro Lot = -$400/ +$400

Fellas, now you can check out forex trading signals via Forex Academy mobile app. Follow the links below.

iPhone Users: https://apps.apple.com/es/app/fasignals/id1521281368

Andriod Users: https://play.google.com/store/apps/details?id=academy.forex.thesignal&hl=en_US