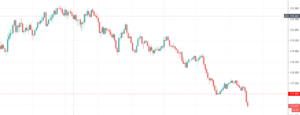

The USD/JPY failed to stop its four-day declining streak and witnessed some further selling near two-weeks lows at 106.65 level, mainly due to the cautious mood around the equity markets, which strengthens the Japanese yen’s safe-haven demand and sent the pair down.

On the other hand, the broad-based US dollar weakness helps the pair to dip further below 107, the triple bottom level. It seems like the trader’s sentiment is badly damaged despite the latest positive hopes about easing coronavirus-related lockdowns worldwide and a push to accelerate the gradual re-opening of the economies.

The safe-haven demand further increased by the fresh downturn in the US Treasury bond yields, which also contributed to the pair’s bearish moves. However, the latest pullback of the US dollar helped limit deeper losses.

On the technical front, the USD/JPY was facing solid support around 107, the round figure, but it got violated over increased demand for safe-haven yen. At the moment, the USD/JPY is facing strong resistance around 107, along with support at 106.500, but this support seems weaker, and we may see USD/JPY prices falling further until 106.240 later today. Consider moving your stop loss at breakeven as soon as the signal starts yielding 20 pips profit.

Entry Price: Sell at 106.744

Take Profit 106.244

Stop Loss 107.244

Risk/Reward 1.00

Profit & Loss Per Standard Lot = -$500/ +$500

Profit & Loss Per Micro Lot = -$50/ +$50