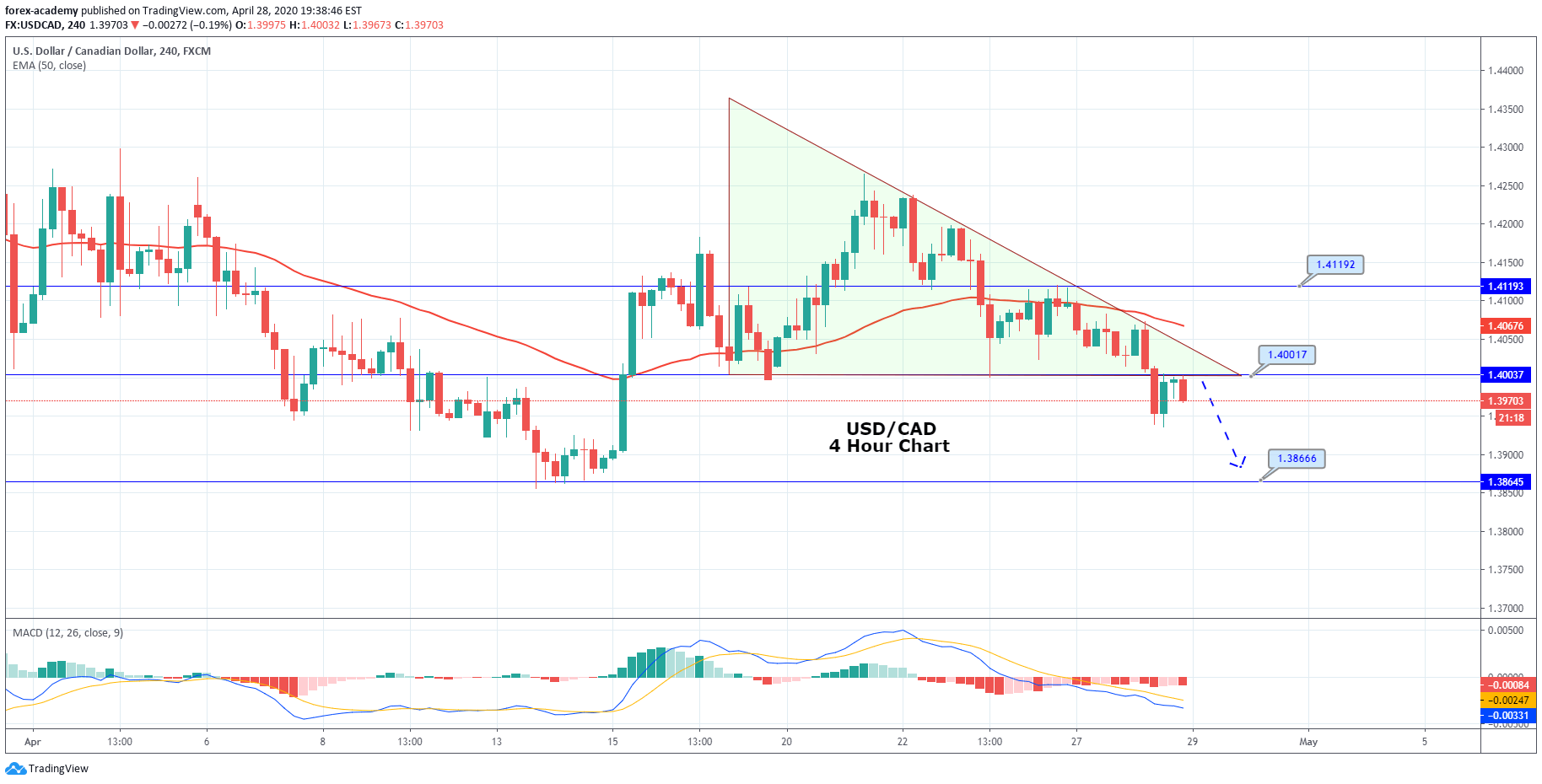

The USD/CAD is trading with a bearish bias at 1.3970 level since the pair has violated the descending triangle pattern, which supported the pair around 1.4000. It seems like most of the selling is triggered in the wake of increased crude oil prices. The WTI prices soared despite on-going worries about oversupply and a lack of storage space across the world. These concerns come after the most significant US exchange-traded fund said it would sell all its front-month crude contracts to avoid further losses, which eventually weakened the Canadian dollar.

Traders failed to cheer the latest optimism about the easing of coronavirus-related restrictions globally, mainly due to the latest declines in crude oil prices. As in result, the traders lost their confidence during the current cautious moo in the equity markets.

Consider the bearish breakout of the descending triangle pattern; we may see USD/CAD prices to go after 1.3866 support level, while resistance continues to stay at 1.4000. The 50 EMA is holding at 1.4067, and the MACD is below 0, suggesting chances of bearish trend continuation. Hence, we have opened a selling trade in USD/CAD.

Entry Price: Sell at 1.39725

Take Profit .1.38925

Stop Loss 1.40225

Risk/Reward 1.60

Profit & Loss Per Standard Lot = -$500/ +$800

Profit & Loss Per Micro Lot = -$50/ +$80