IRS Coming Down on Crypto Users

Every American citizen filing taxes for the year 2020 will have to tell the Internal Revenue Service whether they used cryptocurrencies this year, according to new drafts coming from the tax agency.

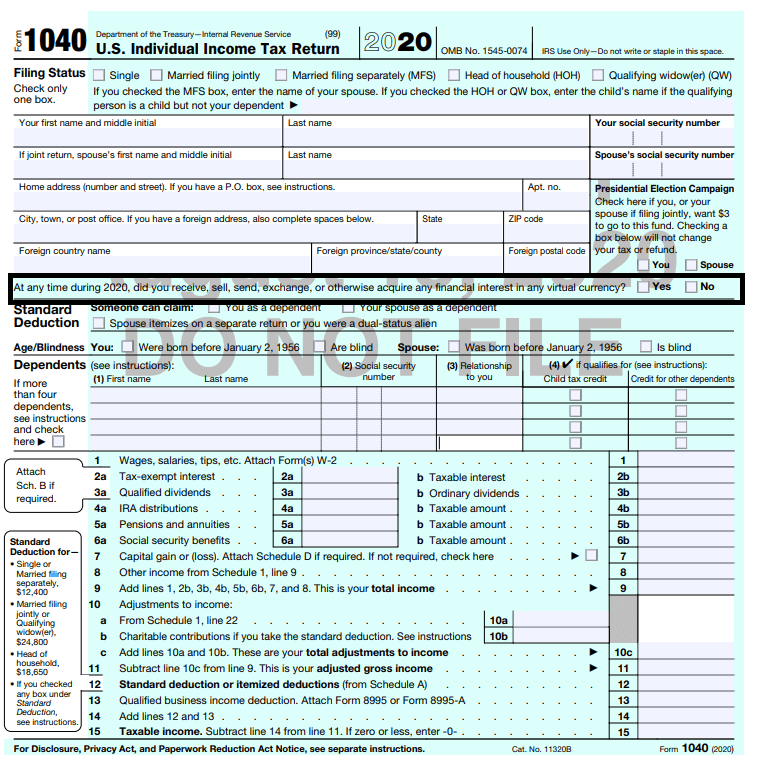

The IRS released drafts of how its income tax forms will look like for the year 2020 on Aug 19. As the draft shows, the IRS requires every American filing income for the year to declare whether or not they used crypto over the course of the year.

Early into its very first page, the new and updated 1040 form asks: “At any time during 2020, did you receive, send, sell, exchange, or otherwise acquire any financial interest in any virtual currency?”

Thoughts on crypto regulation

The founder of crypto tax software firm Cointracker, Chandan Lodha, spoke about the draft of the 1040 form, saying that “The cryptocurrency question is now the front and center on the IRS Form 1040 for 2020. This pretty clearly shows that the IRS is taking crypto taxes even more seriously.”

With an increasing number of people starting to use crypto, it is only natural that governments all around the globe would be interested in possibly taxing crypto usage. As one of the countries with the most strict taxing rules in the world, the US is a frontrunner in designing taxing forms and trying to regulate the usage of crypto.

While people may argue whether cryptocurrencies should be regulated at all, or in what way they should be regulated, it is a fact that everyone must comply with their countries’ tax policies.