In today’s lesson, we are going to demonstrate an example of a chart, which ends up offering two breakout entries for the price action traders. There is a saying, “do not put all your eggs in the same basket.” Forex traders are to maintain this as well. However, sometimes we may have to do things a bit differently. Let us find out why and how.

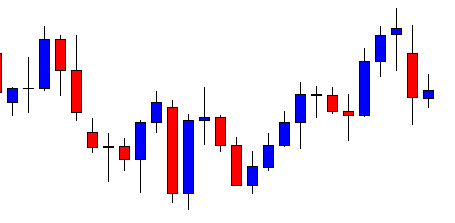

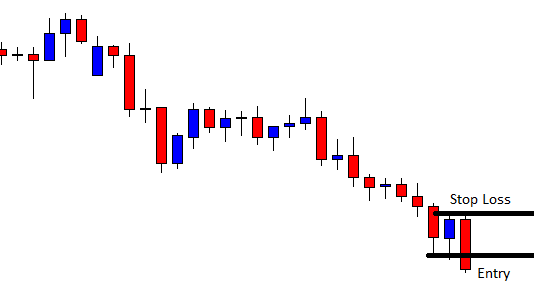

This is a daily chart. The chart shows that a bearish engulfing candle followed by a bullish inside bar sets a strong bearish tone in the chart. If a bearish candle closes below consolidation support, the sellers may go short on the pair.

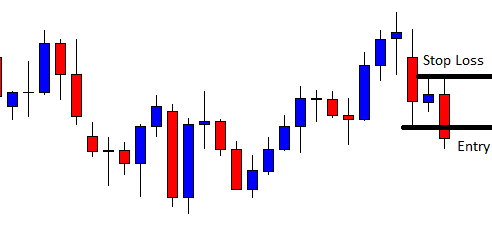

Here it comes. The last candle on this chart closes below consolidation support. This is an explicit breakout. The daily breakout traders may trigger a short entry right after the candle closes by setting their stop loss above the signal candle’s highest high and by setting their take profit with 1 R.

Here is something interesting you may have noticed. Since the daily chart is bearish biased, the H4 chart shall be bearish as well. Let us flip over to the H4 chart.

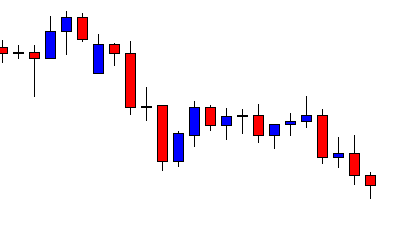

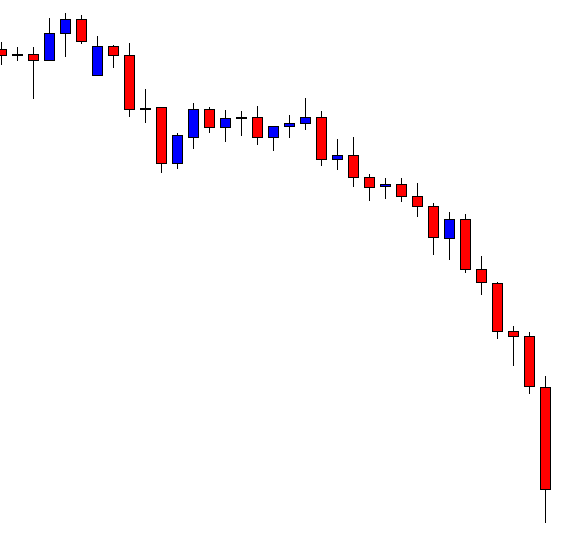

This is how the H4 chart looks. The price consolidates and produces a bearish reversal candle already, although it is not a deep consolidation. Let us not talk about it. Let us proceed to the next chart.

The last candle comes out as a bullish inside bar. This time there is a deep consolidation as well. If the chart produces a bearish engulfing candle, the sellers may trigger a short entry. Let us not forget that the daily breakout traders have already taken an entry.

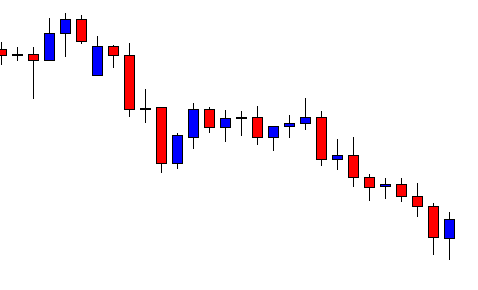

The H4 chart produces a beautiful bearish engulfing candle closing below consolidation support. The H4 breakout traders may trigger a short entry right after the last candle closes by setting stop-loss above the signal candle’s highest high and by setting take profit with 1R. Let us find out how the trade goes.

The price heads towards the South with extreme bearish pressure. Some H4 breakout traders may get 3R from this chart. Now the question may arise here is whether we should take an entry on the H4 chart as well? If we go by saying, “do not put all your eggs in the same basket’, we may not.

We actually should take the entry on the H4 chart as well after taking the first entry on the daily chart. First, we are not taking the second entry based on the daily chart. It is a different setup, although the strategy is the same. If we are confident and experienced in trading different charts, we are all right to take entry in the same pair. This usually brings us a bagful of pips.