The Ichimoku Kinko Hyo System

When I use the Ichimoku Kinko System in my trading, I can look at a chart and immediately know whether a trade can be taken in less than a minute. Ichimoku means, at a glance. Use this system enough, and you will be able to glance at a market and know if a trade is viable or not. What is singularly fascinating about this trading system more than any other is that it encompasses nearly every element of Japanese and Technical Analysis in a single system with just five components. The system measures momentum, volatility, breadth, depth, and even incorporates things we associate with the later part of the 20th century Western analysts like ATR (average true range) and the Bollinger Squeeze (see Bollinger Bands by John Bollinger).

This lesson will be an introduction to the components of the Ichimoku Kinko Hyo system. While Ichimoku is often listed as an indicator in much charting software, it is not an indicator. It is a trading system. It is a trading system made up of 5 indicators.

Books you should own

I loathe the illegal dissemination and downloading of technical analysis literature. One of the significant deterrents for expert traders and analysts in our field from publishing their work is that it is to easily copied and pirated. Additionally, there is a substantial amount of incorrect, incomplete, and false information regarding the Ichimoku system. I am recommending that the books below be on your trading bookshelf. The authors are experts in the field of technical analysis and traders themselves. I am very grateful that they have risked the fruit of their labors from being stolen so that they can share their knowledge for a fair price in a medium that will last for many, many years.

Trading with Ichimoku: a practical guide to low-risk Ichimoku strategies. – Karen Peliolle

Trading with Ichimoku Cloud: the essential guide to Ichimoku Kinko Hyo technical analysis – Manesh Patel

Cloud Charts: trading success with the Ichimoku technique – David Linton

Ichimoku Charts: An introduction to Ichimoku Kinko Cloud – Nicole Elliot

The 5 Components that make up the Ichimoku system

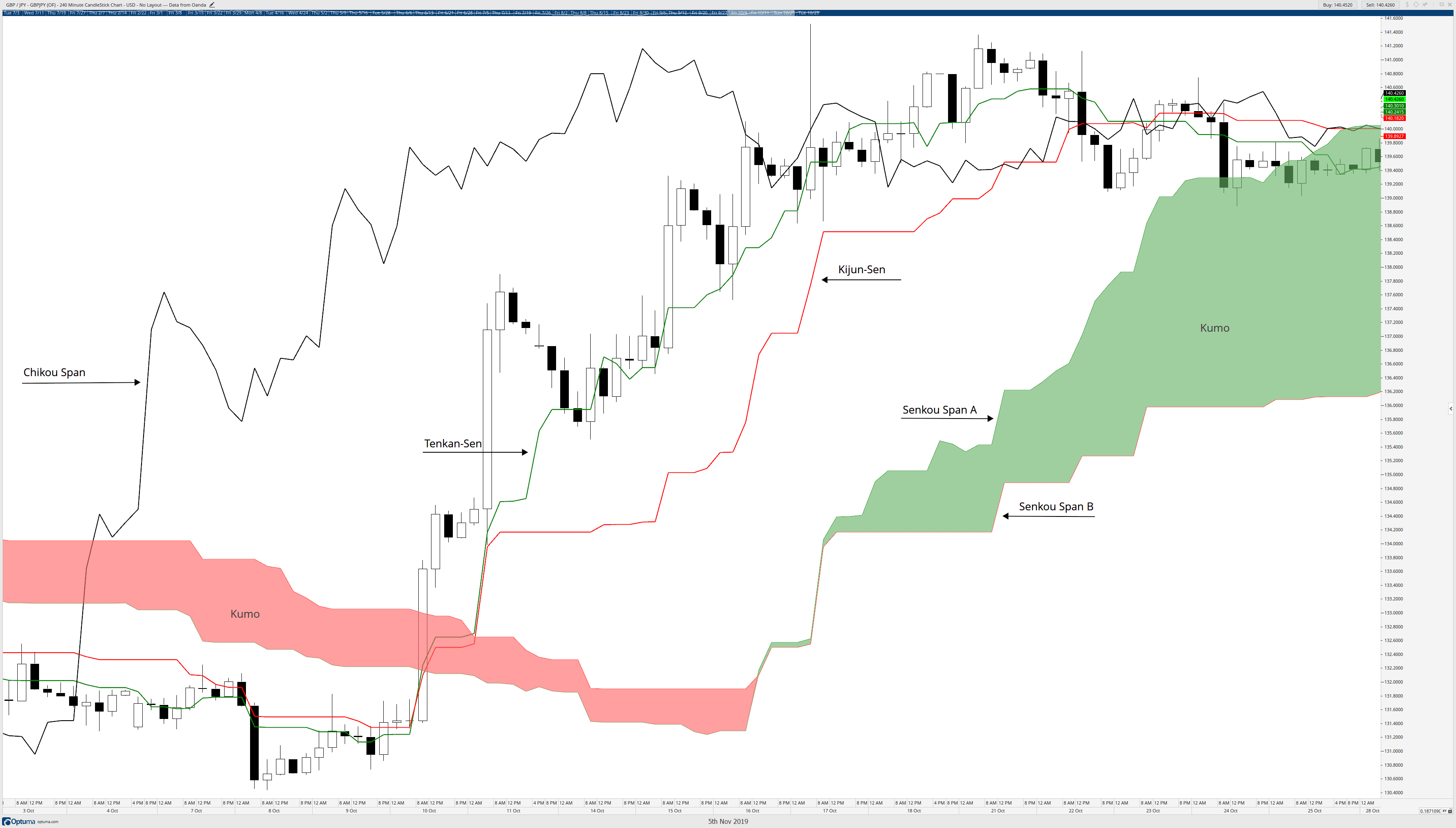

You will more than likely observe that the system appears to made up of several moving averages. And you would be correct. While I a staunch opponent of the use of any moving average based trading system, the Ichimoku system is an exception. If you remember the first article in this series, I ended it by pointing out the importance of ‘balance’ and ‘equilibrium’ in Japanese technical analysis. This system is a pure form of equilibrium in a market. The moving averages that you will first learn about are the Tenkan-Sen and Kijun-Sen. These are not moving averages calculated using the close of a candlestick. Instead, these moving averages are calculated by determining the highest high and lowest low of a period and then dividing that number by two. The moving average then plots the average of that line. Equilibrium, balance, and the mean is a consistent behavior in this system.

A quick note regarding the nomenclature of this system: Depending on the charting software you are using, the labels for the components will be in Japanese or your native language. For traders utilizing the beginners trading software of TradingView, TradingView utilizes the non-Japanese labels. I will be using the Japanese names. I believe it is essential that you learn to use the Japanese titles for these five components.

- Tenkan-Sen (Turning Line or Conversion Line)

- Kijun-Sen (Standard Line or Base Line)

- Senkou Span A (Cloud Span A, Span A, or Span 1)

- Senkou Span B (Cloud Span B, Span B, Span 2)

- Chikou Span (Lagging Line or Lagging Span)

Tenkan-Sen (Conversion Line)

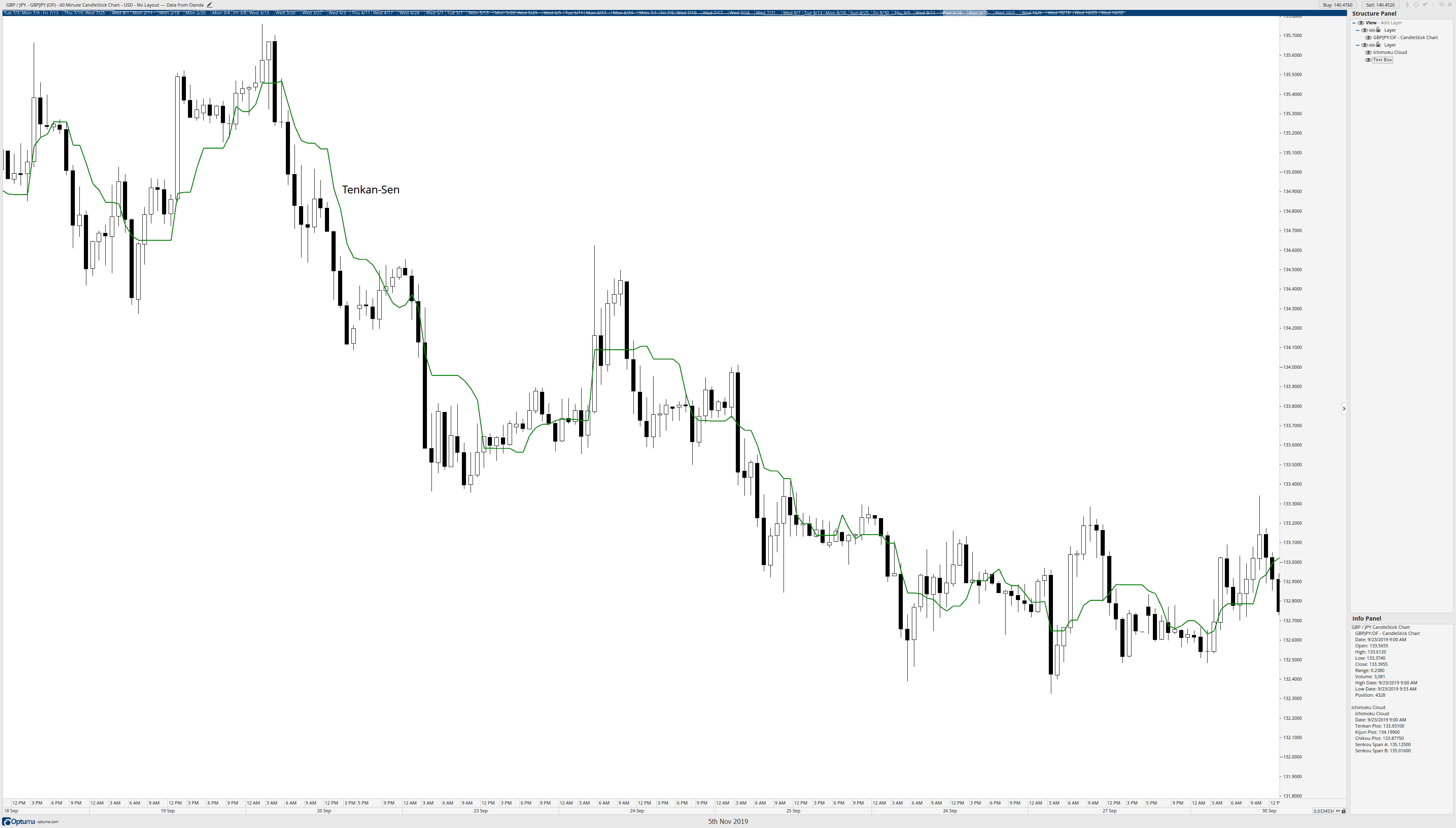

The first component of the Ichimoku Kinko system is the Tenkan-Sen. The Tenkan-Sen is the fastest and weakest line of the Ichimoku system. It is a 9-period moving average that is plotted by adding the highest high and lowest low of the last 9-periods and then dividing that number by two.

Key Points

- Price should not be very far away from the Tenkan-Sen.

- If price and the Tenkan-Sen are both moving close together (up or down), then this means there is little volatility, and the move may be very persistent. Do not trade against an instrument that is displaying this behavior.

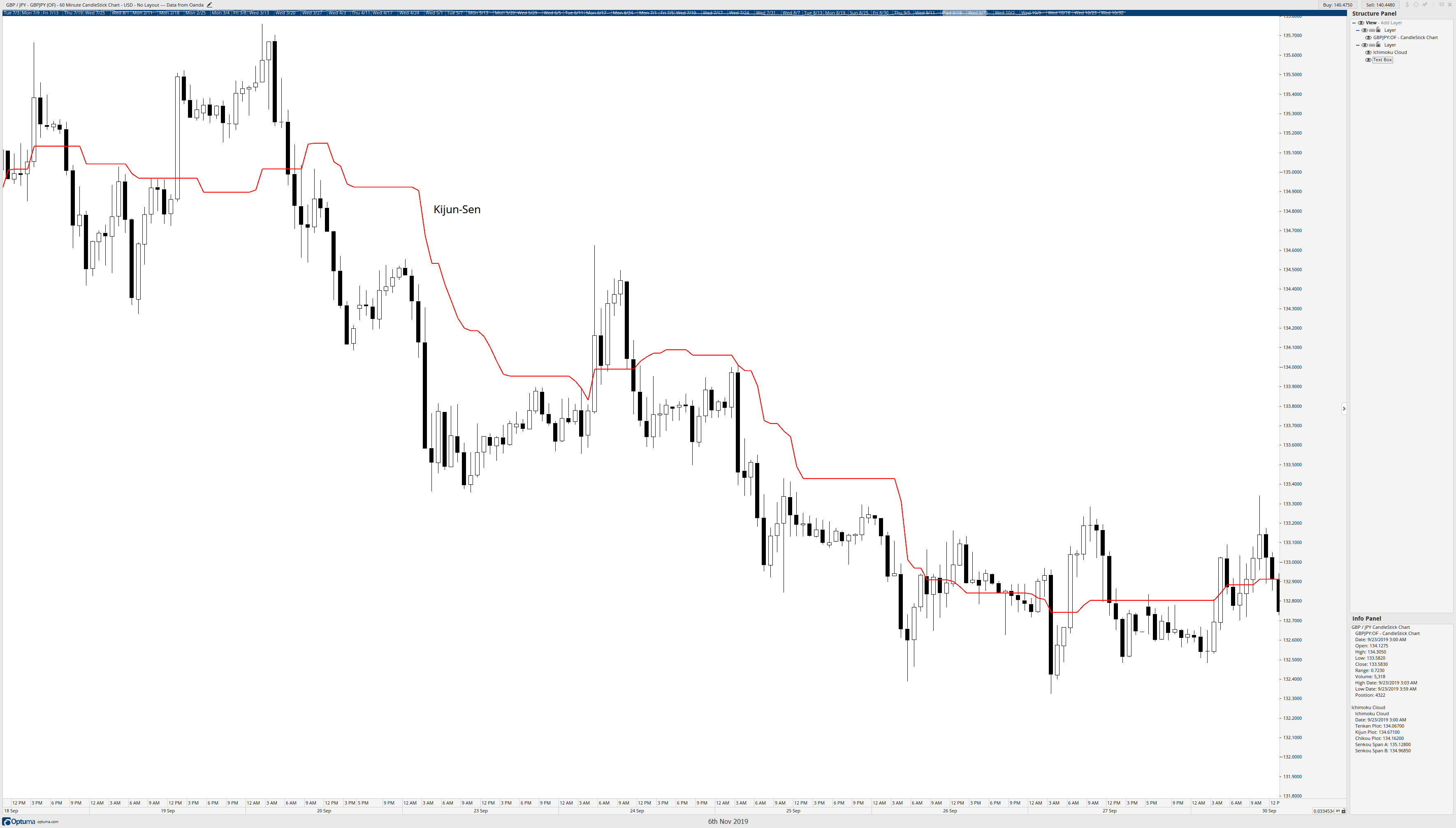

Kijun-Sen (Base Line)

The second component of the Ichimoku Kinko Hyo system is the Kijun-Sen. The Kijun-Sen represents medium-term movement and equilibrium. It is a 26-period moving average that is plotted by adding the highest high and lowest low of the last 26-periods and then dividing that number by two.

Key Points

- Many entry and exit signals are derived from the Kijun-Sen (Peliolle).

- Price should not be very far away from the Kijun-Sen

- Use an ATR x2 to gauge how far is ‘too far.’ (Patel)

- Ichimoku trader Jon Morgan suggests identifying what calls ‘max mean.’ This is done by recording the last 17 major highs and lows away from the Kijun-Sen, adding those values together, and then divide by 17. If price gets close to that number of pips/ticks/points away from the Kijun-Sen, it will more than likely snap back to the Kijun-Sen or range until the averages catch up. (Morgan)

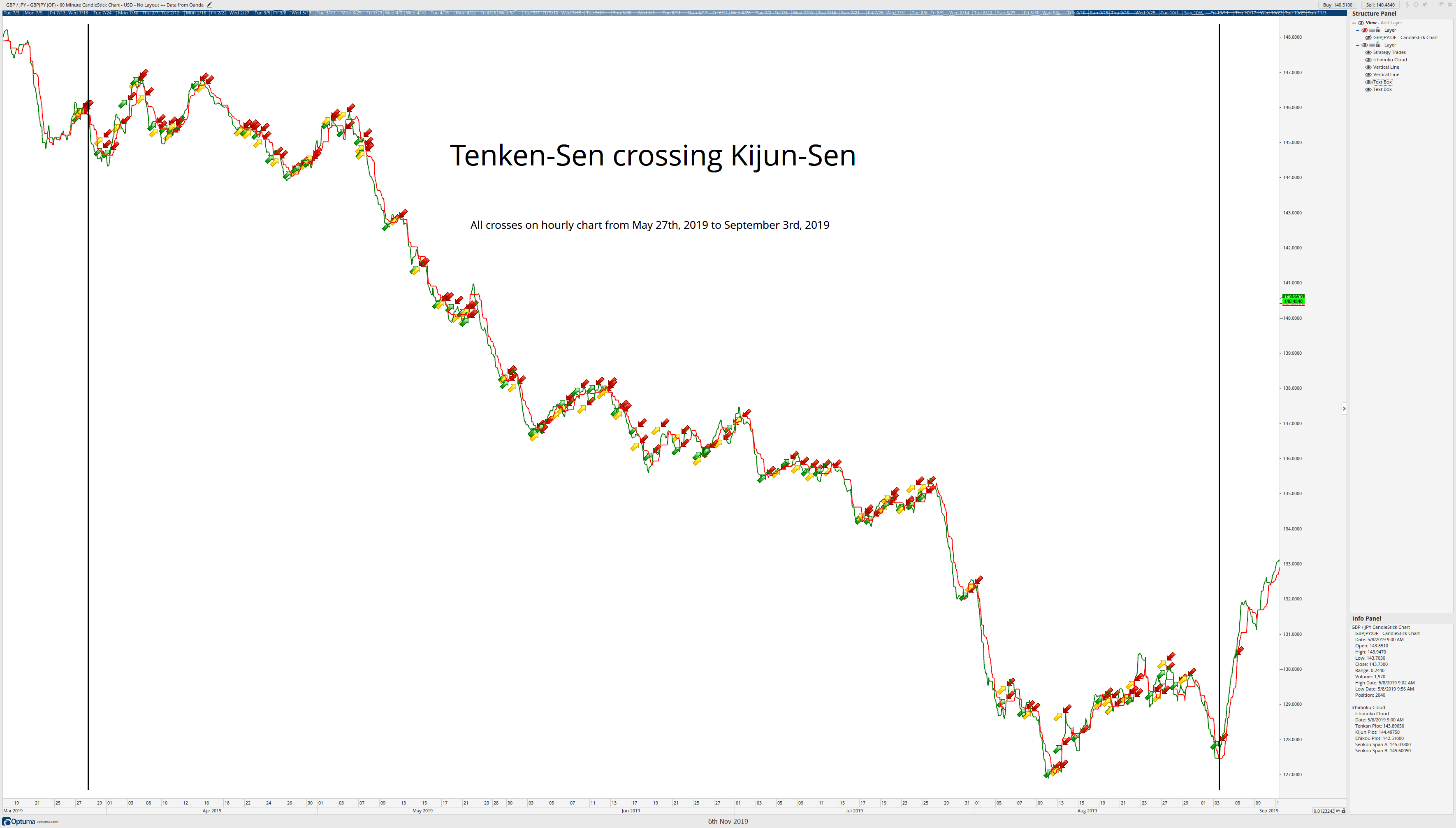

The T-K Cross and the relationship of the Tenkan-Sen with the Kijun-Sen

The Tenkan-Sen and Kijun-Sen represent the market’s pulse. The Tenkan-Sen indicates price volatility and the strength of a given movement through its slope. The Kijun-Sen establishes levels upon which equilibrium occurs, calling back prices when a state of disequilibrium can no longer sustain itself. (Peliolle)

Key Points

- Crosses of the Tenkan-Sen and Kijun-Sen are not a signal.

- In Forex markets, Morgan suggests that crosses may be an essential signal but only on daily and higher charts (3-day, Weekly, Monthly, etc.). This is especially true if there has been a significant amount of time since the last T-K Cross occurred. It can be an early warning sign of an impending corrective move or trend change. (Morgan)

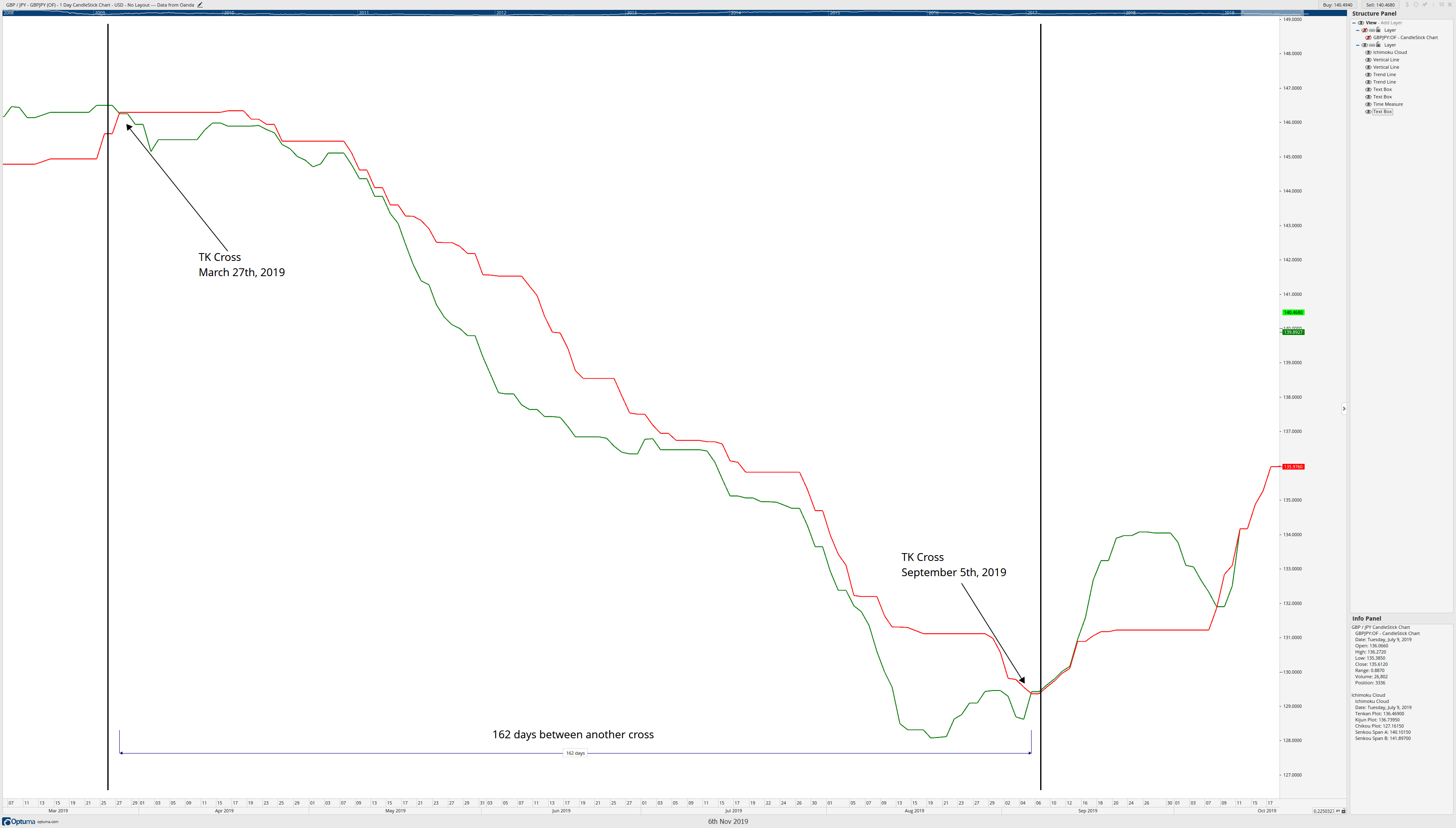

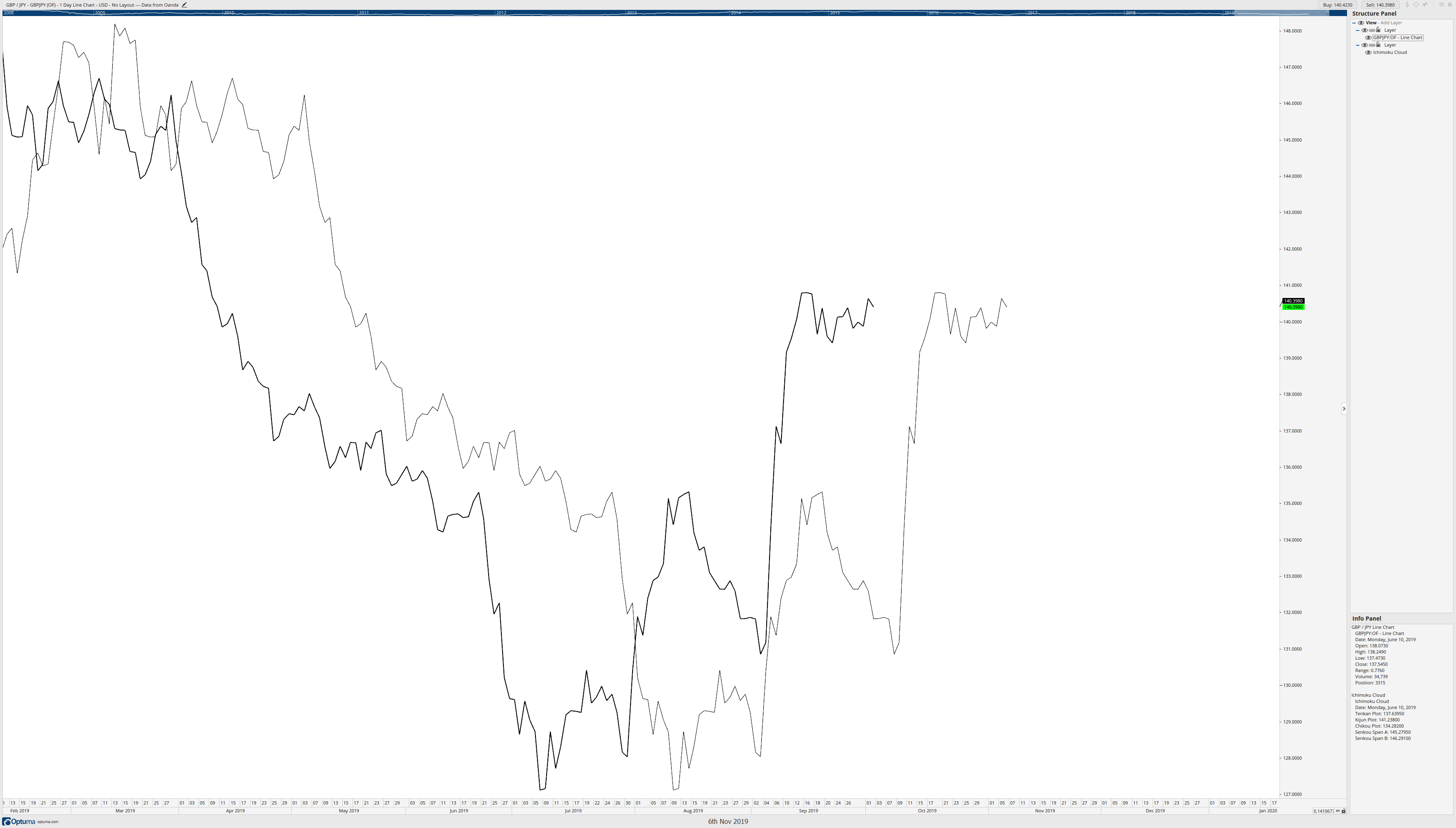

The chart above is the hourly chart for GBPJPY. The black vertical lines delineate a test period that records when the Tenkan-Sen crosses the Kijun-Sen. You can see how many whipsaws and trades you would have taken (136 to be exact). Compare that to the daily chart below and how important T-K crosses are when there is a significant gap between the last cross.

You can see that the difference in time between these two crosses is significant. From the Tenkan-Sen crossing below the Kijun-Sen on March 27th, 2019, it took 162 calendar days before the Tenkan-Sen crossed above the Kijun-Sen on September 6th, 2019.

The Kumo (Cloud) – Senkou Span A and Senkou Span B

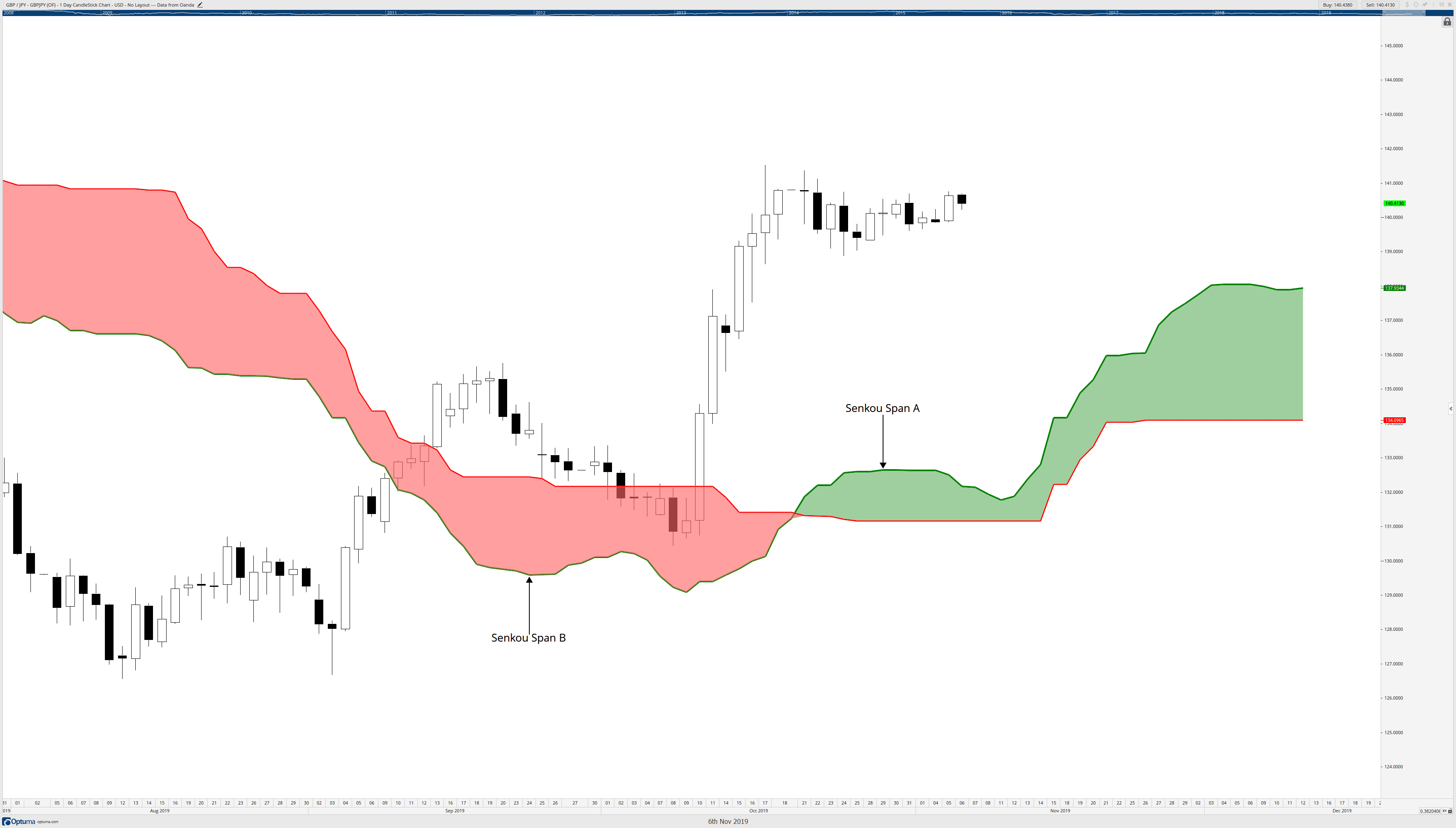

The Kumo (Cloud) is made up of the third and fourth components of the Ichimoku Kinko Hyo system, Senkou Span A and Senkou Span B. The ‘Cloud’ is the most distinguishing feature of the Ichimoku system. This ‘blob’ of color on the screen is perhaps one of the most ingenious applications of technical analysis theory in all of Technical Analysis. I say this because it is one of the very few forms of Technical Analysis that actively projects non-trend line-based data into the future – essentially turning lagging analysis into leading analysis. The Cloud is nothing more than the space between the two averages of Senkou Span A and Senkou Span B. Most software will then shade the area between these zones to correlate to the position of Senkou Span A to Senkou Span B. If Senkou Span A is above Senkou Span B, space is shaded green. If Senkou Span A is below Senkou Span B, the area is shaded red. The Cloud’s construction and interpretation is one that can cause significant confusion for someone new to this system, so I am going to break it down for each level.

Senkou Span A is the ‘faster’ line and is a measure of market balance and past volatility. (Peliolle) Senkou Span A is plotted by taking the average of the Tenkan-Sen and Kijun-Sen (Tenkan-Sen + Kijun-Sen) and dividing that number by two. It is then projected forward 26 periods.

Senkou Span B is the most powerful support and resistance level in the Ichimoku Kinko Hyo system. Senkou Span B is plotted by taking adding the highest high and lowest low of the last 52-periods, dividing that number by two, and then projecting it forward 26 periods.

Key Points

- A flat Senkou Span B represents strength.

- Thick Clouds equal strength. Thick Clouds also represent consolidation. (Linton)

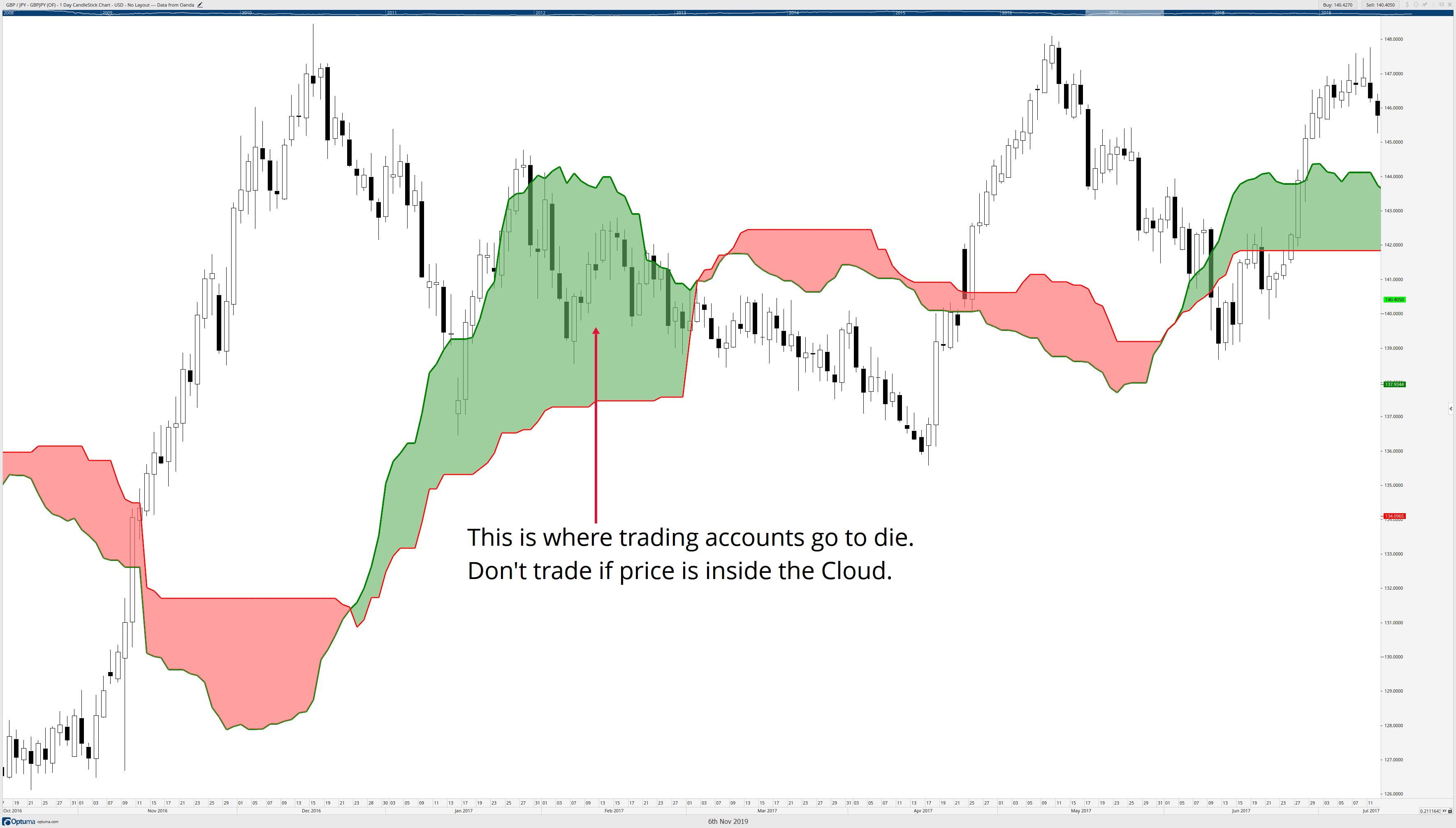

- Thick Clouds tell us when not to trade. If you see price inside the Cloud, move on to another chart! (Morgan)

- Kumo Twists (Senkou Span A crossing Senkou Span B) are indicative of likely changes. Sometimes a Kumo Twist is the most immediately visible sign of a trend change. (Linton)

- The Cloud represents volatility.

The First Question You Should Ask Yourself

When using the Ichimoku Kinko Hyo system, the first question you should ask yourself is this: Is price inside the Cloud? If the answer is yes, then ignore that chart. Leave it alone. Find something else to do, find another chart to look at. That chart is dead to you if the price is inside the Cloud.

The Chikou Span (Lagging Span)

The fifth and final component of the Ichimoku Kinko Hyo system is the Chikou Span. I believe that this is the secret weapon of the entire system. If you have taken any classes or watched videos of the Ichimoku system anywhere else, the author or presenter may have removed the Chikou Span. I’ve read and observed a shocking number of people disregard the Chikou Span and treat it like it’s some pointless component that is not needed. People treat like it’s the gallbladder and just cut it out and think everything’s going to be just fine. That is a horrible idea.

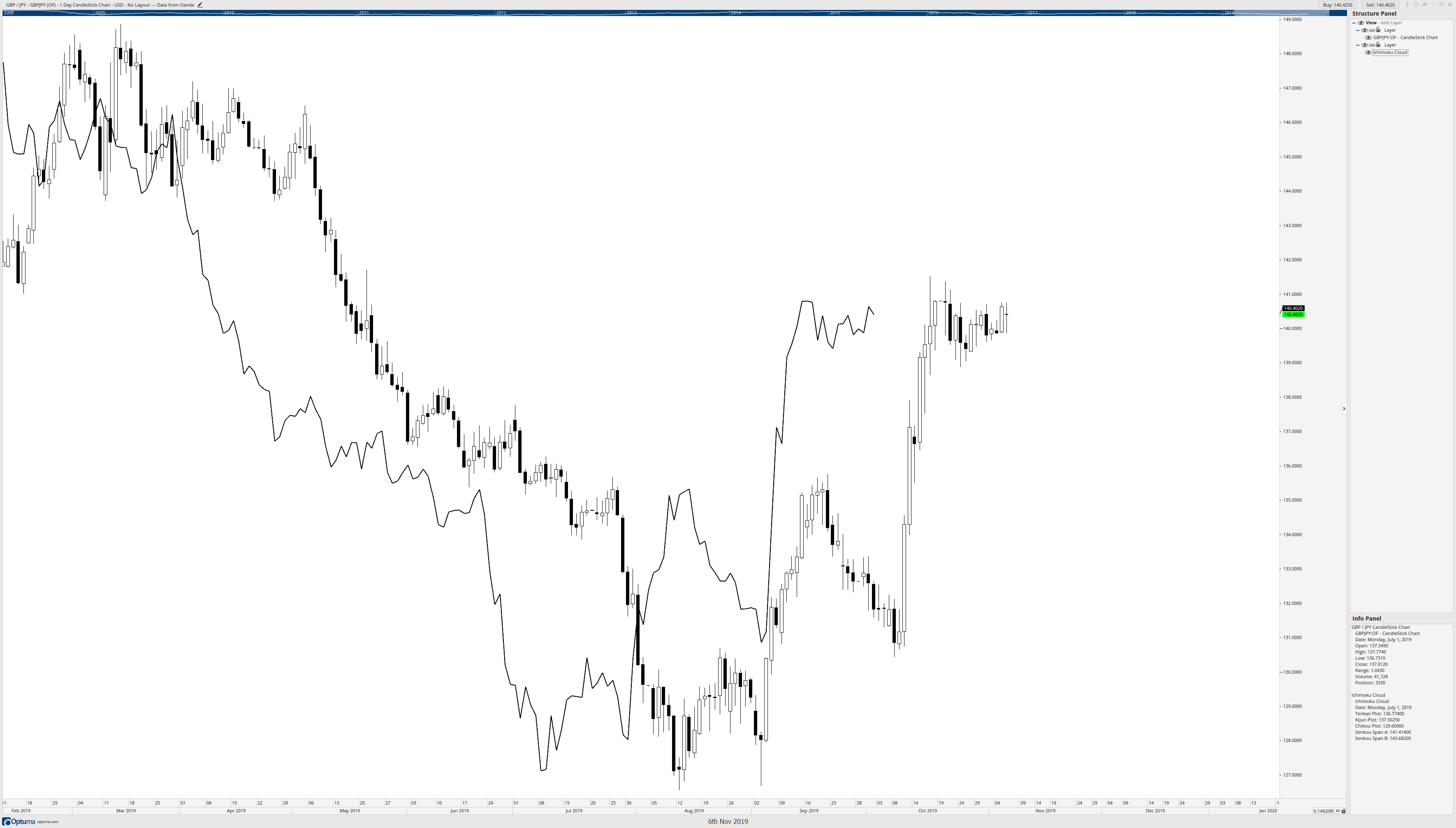

This is my favorite tool in the entire system. It is very, very simple, and requires no averaging. It is merely the current price action shifted back 26 periods. It’s like a mirror image of the current price action. Even though it is simple to understand, visualizing this line can be hard. Look at the image below.

The image above shows the Chikou Span on a Japanese Candlestick chart. If you are new to this trading system, you still may have a hard time ‘visualizing’ what the Chikou Span looks like. I think the easiest way for people to finally get it and experience the ‘ah-ha’ moment is to change the chart from a candlestick chart to a line chart. See below.

When we change from a candlestick chart to a line chart, it is much easier to grasp and visualize what the Chikou Span is – because it is straightforward. The Chikou Span is just our current price shifted back 26 periods.

The Chikou Span represents the market’s memory. (Peliolle) It represents momentum. (Patel) David Linton identified what I consider one of the most crucial signals that can be generated on an Ichimoku chart. He wrote: When the Chikou Span crosses above or below the Cloud, it is THE confirmation signal in Ichimoku Analysis. (Linton)

Key Points

- Look for when the Chikou Span is in ‘Open Space.’ Manesh Patel identified Open Space as a condition when the Chikou Span won’t intercept any candlesticks over the next 5 to 10 periods. This indicates a much easier move for the price with almost no supportive/resistive structure to stop price.

- If the Chikou Span is trading ‘inside’ the candlesticks, the market is beginning to consolidate.

- The Chikou Span responds to the same support and resistance levels as the price does. (Peliolle)

Why 9, 26, and 52?

One of the biggest questions people will ask is, why does the Ichimoku system utilize the periods of 9, 26, and 52? Much of this has to do with history and Japan’s normal trading week. A trading week in Japan was six days, so 9 is 1.5 weeks. (Elliot). There are roughly 26 trading sessions in a month. (Elliot) 52 is approximately two full trading months. Do not change these values.

Let me repeat that.

Do. Not. Change. Those. Values.

You can change your timeframes all you want but never change the base Ichimoku settings. You will read people give reasons why you should do it for this market and that market. You will read reasons why using Western values is useful for Western traders. You will hear a myriad of reasons why you should change the base values. Don’t. The Ichimoku Kinko Hyo system is a time tested, proven profitable, and robust trading system. Don’t muck it up by introducing variables that are not a part of the system.

The following articles in the Ichimoku series will detail advanced Ichimoku concepts such as Hidenobu Sasaki’s Three Principles as well as trading strategies utilizing the Ichimoku system.

Sources: Péloille Karen. (2017). Trading with Ichimoku: a practical guide to low-risk Ichimoku strategies. Petersfield, Hampshire: Harriman House Ltd.

Patel, M. (2010). Trading with Ichimoku clouds: the essential guide to Ichimoku Kinko Hyo technical analysis. Hoboken, NJ: John Wiley & Sons.

Linton, D. (2010). Cloud charts: trading success with the Ichimoku technique. London: Updata.

Elliot, N. (2012). Ichimoku charts: an introduction to Ichimoku Kinko Clouds. Petersfield, Hampshire: Harriman House Ltd.