Let’s discuss why investing in forex (the currency market) and not in other types of products (stocks, warrants, CFDs, etc.) or other markets (IBEX, DAX, NYSE, NASDAQ, etc.) is arguably the best plan for modern traders. Before diving headfirst into Forex, we need to cover a few topics first…

What is Forex? What is the main advantage of Forex? It is, with a marked difference from the others, the largest market in the world where the traded product is currencies. The daily trading volume amounts to a whopping $6 trillion ($6,000,000,000,000).

Why does this interest us? What brings us a large volume of transactions? The more liquid a market is, that is, the more money is traded in the market, much less difficult for us to enter and exit at the price we want (are always willing many sellers and buyers of each price level).

The more volume is negotiated, the more difficult it will be for someone to control the market, we will be “more protected”, although we will have to be attentive to the movements that hedge funds can make (groups of capital-intensive investors, which at certain times may move the market in their favour) to go in the same direction as them. Another time we will discuss how to read the market and see where the big investors buy and sell.

Commissions, how much do we pay on the stock exchange versus FOREX? Bank commissions will be less aggressive on our money the more money we have. Therefore, if we are a small investor, entering the stock market will drown us before the first operation.

On the other hand, in forex, you will pay 2 or 3 market points, a variable commission for each trade you make. It’ll always be cheaper than doing it through a bank. Depending on the amount of capital, these 2-3 points can be reduced to 0.5-1 market point.

To view it numerically suppose that you choose ING direct (one of the cheapest banks) and we choose a standard forex broker (2 pips commission). We will both invest €10,000 in the market:

ING

10.000€ * 1.25% = 125€ of commissions.

As compared to…

Standard Forex Broker

10,000€ is equivalent to buying a mini-lot of forex, each pip of a mini-lot is 1€.

1€ * 2pips = 2€ commission.

Therefore with the same amount of money invested we pay very different commissions, in ING when investing 10,000€ in shares, we take 125€, in Forex we are charged only 2€. This is considering that in Forex we leverage and take advantage of the advantages of doing this strategy.

Other Advantages

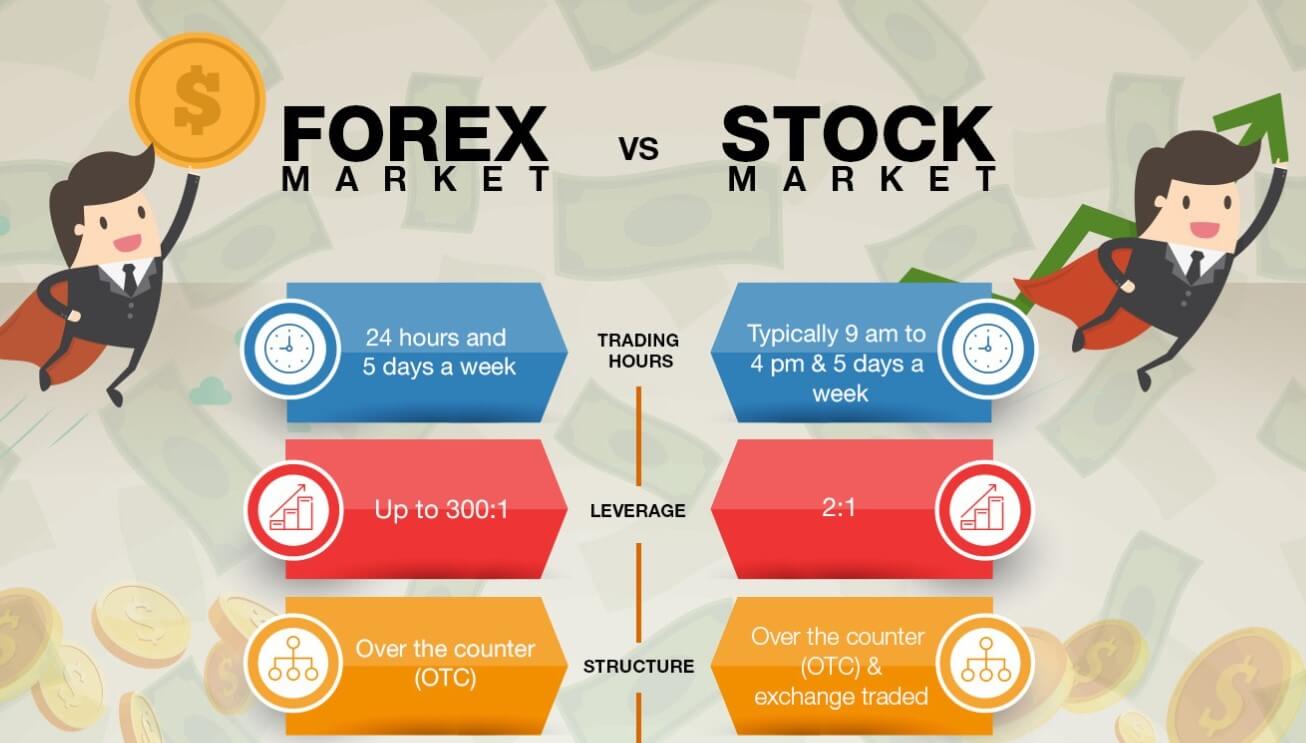

The forex market is open 24/7, less on weekends (since, for example, when it is 8:00 AM in Europe, the Japanese are closing their day, and when it is 14:00 – 15:00 in the afternoon, they open the American markets, until 10:00 at night. Therefore, we have a wide range of possibilities). There are plenty of currencies you can trade with (although there are about 12 more traded pairs, with the extra liquidity this represents).

It’s practically impossible for a currency to go bankrupt, especially if we trade in the major currencies, instead, if we buy Apple or any other company, there’s always the risk of bankruptcy, and if not, look at Lehman Brothers, with more than 150 years of history, and that in 2008, he filed for bankruptcy.