When we speak about investing we think about the long-term period of holding some assets in expectation their value will increase. Therefore, investing is not the same as trading where we can also go short and use leverage in case we use CFD derivatives. Inverse investment with inverse ETFs is also an option to go short long-term, however, this option is not as extensively used by an average investor.

Now, depending on your goals and analysis you will invest in different assets. Asking this question means you want to follow opinions from other investors. Investors without an analysis of their own now have a dilemma. Advisors may advise going along with some tech companies (Tesla Motors alright), some will praise hard assets and precious metals, others will pump Bitcoin, and so on. You will find many groups with their own story, some are biased, especially those backed up by the government in one way or another.

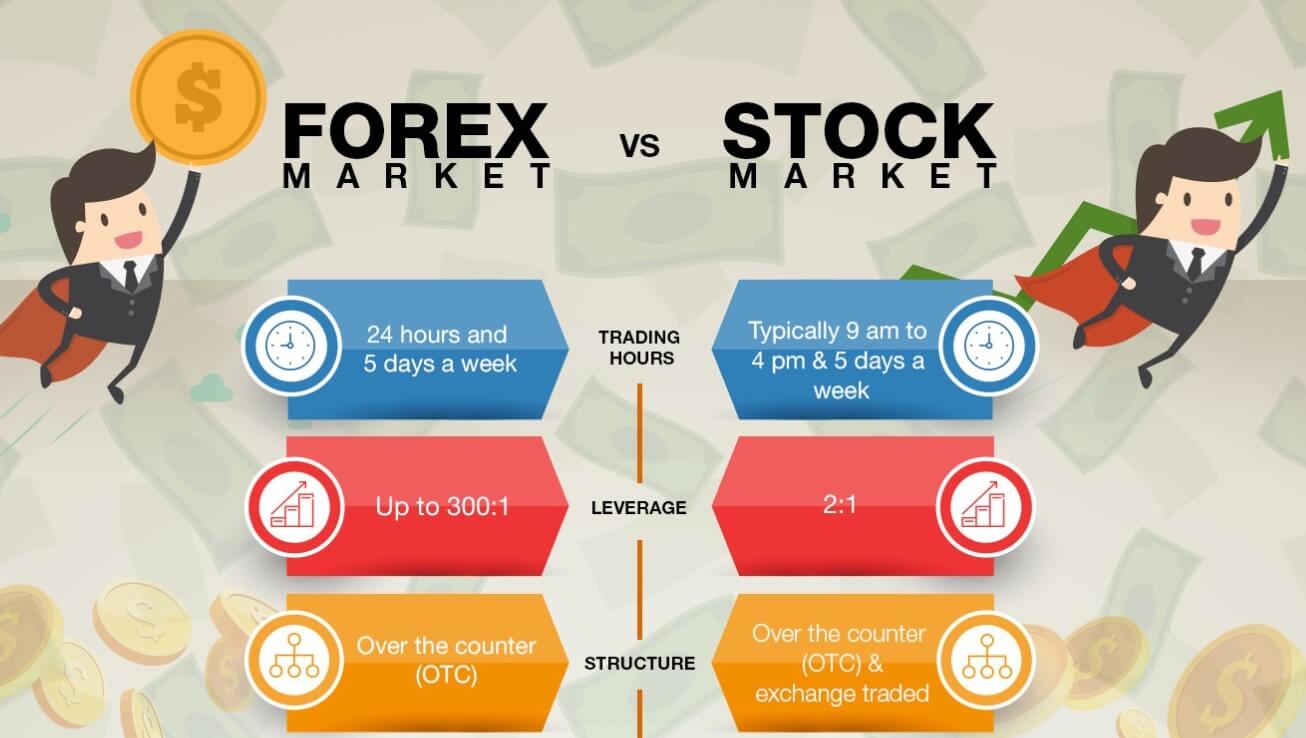

If we compare forex and the stock market, there are huge differences, but you need to understand forex is defined as the currencies market, therefore you will be holding and investing in assets that are backed up by governments or states. Are there better options than equities or fiat investing? Crypto enthusiasts will say yes, precious metal holders will say yes, others may so no, leading you to the answer is probably in between. Diversification is the best way to reduce risk, so diversify your investments and choose different markets, you do not have to choose between forex or stocks, go wide.

People love trading stocks, it is like a tradition and the first to come to mind when you see charts. The stock market does now have the capitalization as forex, but it is heavily traded. Liquidity is extreme with certain popular companies. Some facts have to be considered with the equities. Assuming you have the money management set up optimally, with stocks you have a high upside proposition. Companies that are hyped or have products in demand are going to multiply their value many times over whereas you cannot lose more than what is already invested. Timing is, of course, also crucial.

You will belong to a very fun market with stock investing. There are so many shows and portals providing very interesting information about companies, their products, and strategies in the future. All this is entertaining as you take part in the action.

Stocks also have dividends, at least some of them. You do not have this passive income with forex. In forex, you have financing swaps that could be credited, depending on the interbank rate and the broker markup, although it is more common to have charges. Companies will have dividends and you get to choose if you want to hold their shares, with forex you will have inconsistent charges or credits and there are just a few currencies you get to choose.

If you are used to stock trading or even investing, you could have some sort of attachment to a particular company. There is no such feeling in forex. Whatsmore, any information about a specific currency is not as easily translated for investing purposes. There is a lot of hidden pointers where could some currency go long term whereas companies are easier to follow. Companies you like and even having some of their products (Apple) gives you a unique feeling when you make money with them. Whatsmore, some of the research you make on a specific company could give you an edge to see trends about to happen others do not.

On the other side, as mentioned, it is hard to go short with a stock. The options could be with some ETFs since stocks usually follow the index performance. There are situations where stocks are exposed to other factors that could halve its value. You may sometimes hear very bad news about your company and you would not be able to get out without a major loss. If you are trading indexes you will be protected from this kind of influence and of course with forex. Fundamental analysis is very important with stock investing, the news you get is very late info, you are the last to know. If you are not connected to some kind of insider sources, you just get scraps off the table.

In forex investing you might need some fundamental research, but the kind that deals with reports and politicians’ major attunement with the certain country economy or currency. Stocks require a lot more focus on fundamentals. With forex, you have the big banks’ involvement and manipulation, in the stock market you have the insiders. There is so much going on behind the curtain that drives the stock value you just cannot foresee or control. And you cannot rely on the technical analysis here. Pay attention to mergers and acquisitions, monthly reports (you also need to know accounting and finance to get the underlying picture), how the company capital is managed, have information are they investing and its structure, what the company competitors are doing and so many more these things you have to analyze when you invest with stocks.

After all, when things go bad with your stock, there are a lot of questions you need to answer before moving on. Are you going to keep holding your shares when it losses 50% of its value? Some companies recover, some do not. If you decide to cash out, are you going to hold the Dollar, Euro, or invest in some other companies? How do you find a recession-proof company? Airlines are killed by the pandemic even though they were holding ok during the previous recession.

If you are investing in stocks, it is imperative to get out before the recession. But why not turn this downturn into a benefit. Your stock is unlikely to be immune to the recession so try inverse ETFs. Here are some of the ETF symbols that are inverse of the respective indices: SH – S&P 500, DOG – DOW, PSQ – NASDAQ, MRCO – Beanie Babies.

Forex and currencies are not big movers when we compare indexes or stocks. Are they a “safer” market? Basically, no market is safe for anyone not having a plan and optimal risk management adjusted to work long term. The main advantage of forex trading/investing is that technical analysis is more effective. Some prop traders even completely rely on technical systems. This way they have more control over their emotional state, it reduces the noise, and you rely on the system rules strictly. Forex is more easy-going in this sense, unlike stocks.

Now, let’s get back to diversification. You should diversify both the market assets and the market types with the buy and hold strategies. Diversification is a part of risk management but it is a separate rule in our book. Investors should know USD, CHF, JPY, precious metals, bonds, and to some even bitcoin are the safe heavens when the markets go down. These assets should be at least 50% of your entire portfolio. The other part can go into more risky assets such as stocks ETFs, crypto altcoins, and indexes.

Experienced traders that asked this question a long time ago have some tips. The first one is never to fall into groupthink. People hoarding gold have a nice backup, but they do not take action, they just sit on their piles and complain when the price is going down. Have a plan, never go all-in into a single asset, diversify horizontally and vertically. Also, do not just invest, go short and long, and learn to trade too. See what other options are there except forex and stocks, we live in good times since there are so many opportunities now than 10-20 years ago.