The yellow metal prices extended its Thursday’s winning streak and took further bids around well above the $1,900 level, mainly due to the risk-off market sentiment. That was witnessed by the negative performance of the S&P 500 Futures. However, the reason for the downbeat trading sentiment could be associated with the worrisome headlines concerning the U.S. and China relationships. In the meantime, the COVID-19 and Brexit story’s pessimistic signals also weighed on the market trading sentiment. This, in turn, helped the gold prices to put safe-haven bids.

Furthermore, the latest headlines surrounding U.S. President Donald Trump’s infection of the coronavirus (COVID-19), as well as the U.S. policymakers’ inability to break the coronavirus (COVID-19) stimulus deadlock, provided a further boost to the safe-haven metal prices. On the contrary, the broad-based U.S. dollar strength, backed by the combination of factors, becomes the key factor that capping further upside momentum for the gold. The precious metal prices are currently trading at 1,912.43 and consolidating in the range between 1,889.93 – 1,917.12. However, the bullion traders seem inactive to place any strong position amid Beijing’s Golden Week holidays.

The equity market has been flashing downbeat signals since the day started and ending this week with losses, witnessed by the S&P 500 Futures’ negative performance. However, many downbeat catalysts kept the market trading sentiment under pressure. Be it the worrisome headlines concerning the Brexit or the tension between the US-China, not to forget the coronavirus issues, the market trading sentiment flashing red on the day, which ultimately keeps the safe-haven assets supportive.

At the US-China front, the Sino-China tensions further bolstered after the news that the Americans Senators are pushing for a trade deal with Taiwan over China, which can renew the Sino-American tension. Additionally, the Financial Times (F.T.) spots a massive deployment of military forces in Hong Kong to tame the democracy protest, indicating an acceleration in the Sino-US tension and heavy the market’s mood.

Nevertheless, the grounds for the downbeat trading sentiment could also be attributed to the prevalent coronavirus (COVID-19) woes, which fueled the worries about the global economic recovery. The global death toll has crossed the 1 million mark, and the world is becoming a gloomy place once again. In America, the pandemic has infected more than 7.2 million and killed more than 206,000. Meanwhile, Europe’s worst COVID-19 center, Madrid, is considering fresh lockdown restrictions in the coming days, as well as Moscow’s mayor ordered companies to send at least 30% of their staff home, as many European countries reported records in new infections. This, in turn, exerted downside influence on the market risk tone and contributed to gold gains. On the other hand, the rumors concerning Trump administration employee Hope Hicks’ virus infection and the President’s fears also got infected on the market trading sentiment, which also favors the gold prices.

The U.S. dollar extended its early-day gains and took further bids on the day due to the Thursday’s upbeat US ADP report, which showed that private-sector employers added 749K new jobs in September. Besides this, the gains in the U.S. dollar was further boosted by the risk-off market sentiment. The Bullish sentiment around the U.S. dollar was further bolstered by the final version of the US GDP print, which showed that the economy declined by 31.4% during the second quarter of 2020 against 31.7% estimated. Apart from this, Chicago PMI beat expectations by a significant margin and surged to 62.4 for September. Looking forward, the traders will keep their eyes on the ongoing drama surrounding the U.S. elections and updates about the U.S. stimulus package. Meanwhile, the U.S. employment data for September will be key to watch on the day.

Daily Support and Resistance

S1 1863.51

S2 1883.52

S3 1894.92

Pivot Point 1903.52

R1 1914.92

R2 1923.53

R3 1943.53

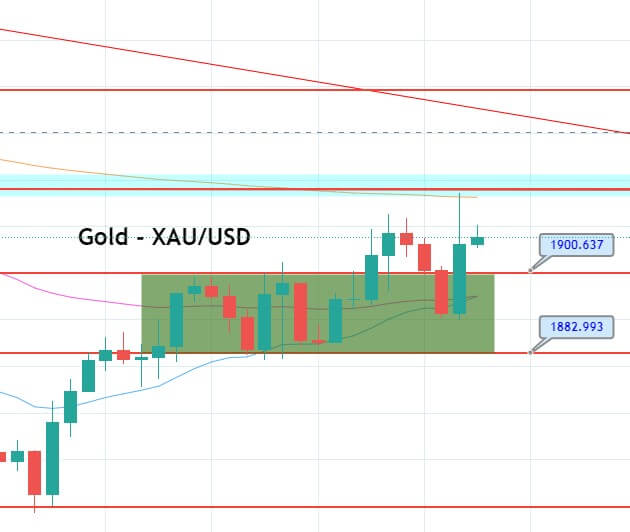

Gold displays excessive volatility as it plunged distinctly from 1,906 mark to 1,890 and then again turned to trade at 1,906. It appears like the traders are bolstering for the high impact of Non-Farm Employment change and from the U.S. economy. Economists are anticipating mixed data; therefore, gold can trade choppy until the data comes out. On the higher side, gold may find resistance at 1,920 upon the breakout of 1,911 level. In contrast, a bearish breakout of 1,900 level can trigger selling unto 1,892. Good luck!