The safe-haven-metal prices were flashing green and were recovering gradually from the intraday low above $1,700 level, mainly due to the risk-off market sentiment in the wake of intensifying trade tussle between the United States and China. On the other hand, the positive news from Gilead about the vaccine of virus seems to have eased the coronavirus fears in the market, which turned out to be one of the key factors that kept a lid on any additional gains in the gold prices.

At the press time, the yellow metal prices are currently trading at 1,702.27 and are consolidating in the range between 1,692.34 and 1,702.27. However, when gold slipped to $1,692.30 during the early-Asian session, it was possibly due to US dollar strength.

The good news from Gilead about coronavirus vaccine successful trials which seem to reduce the coronavirus (COVID-19) fears at the start of the week in the market. The company making the vaccine reported that it has been exporting the anti-viral drug to the United States and making it available to US patients with the help of the US government.

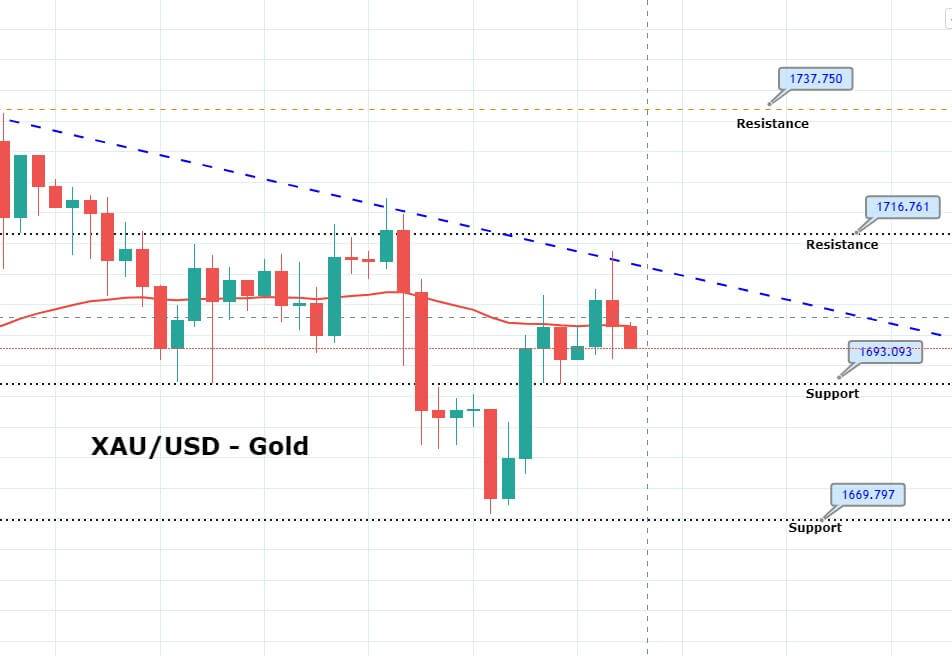

Daily Support and Resistance

S1 1621.49

S2 1656.9

S3 1678.78

Pivot Point 1692.32

R1 1714.19

R2 1727.73

R3 1763.15

Gold prices have closed drawing a hanging man pattern, which is keeping the precious metal gold supported 1,692 level. Closing of candles below a downward trendline may keep the gold prices bearish below 1,711 level. On the lower side, gold may find support around 1,692 and 1,681 level. Conversely, a bullish crossover of 1,717 resistance can drive buying until 1,732/36 level. Good luck!