Description

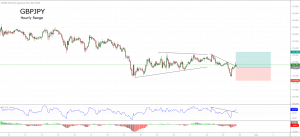

The GBPJPY cross in its hourly chart exposes the price action moving below an ascending wedge that found resistance in the zone of level 139 from where the cross started to retrace.

In this context, the pierce and close below the level 138.3 could represent a short-term resistance from where the price could confirm potential bearish incorporations. On the other hand, the RSI oscillator moves below level 40, which leads us to confirm the intraday bearish bias.

We expect a limited recovery toward the zone of 138.25 from where the price could find fresh sellers, which could drag the cross until the level 136.6, which corresponds to last July 23rd high.

Finally, the invalidation level of our bearish scenario locates at 138.83.

Chart

Trading Plan Summary

- Entry Level: 138.23

- Protective Stop: 138.83

- Profit Target: 136.58

- Risk/Reward Ratio: 2.75

- Position Size: 0.01 lot per $1,000 in trading account.

Check out the latest trading signals on the Forex Academy App for your mobile phone from the Android and iOS App Store.