Description

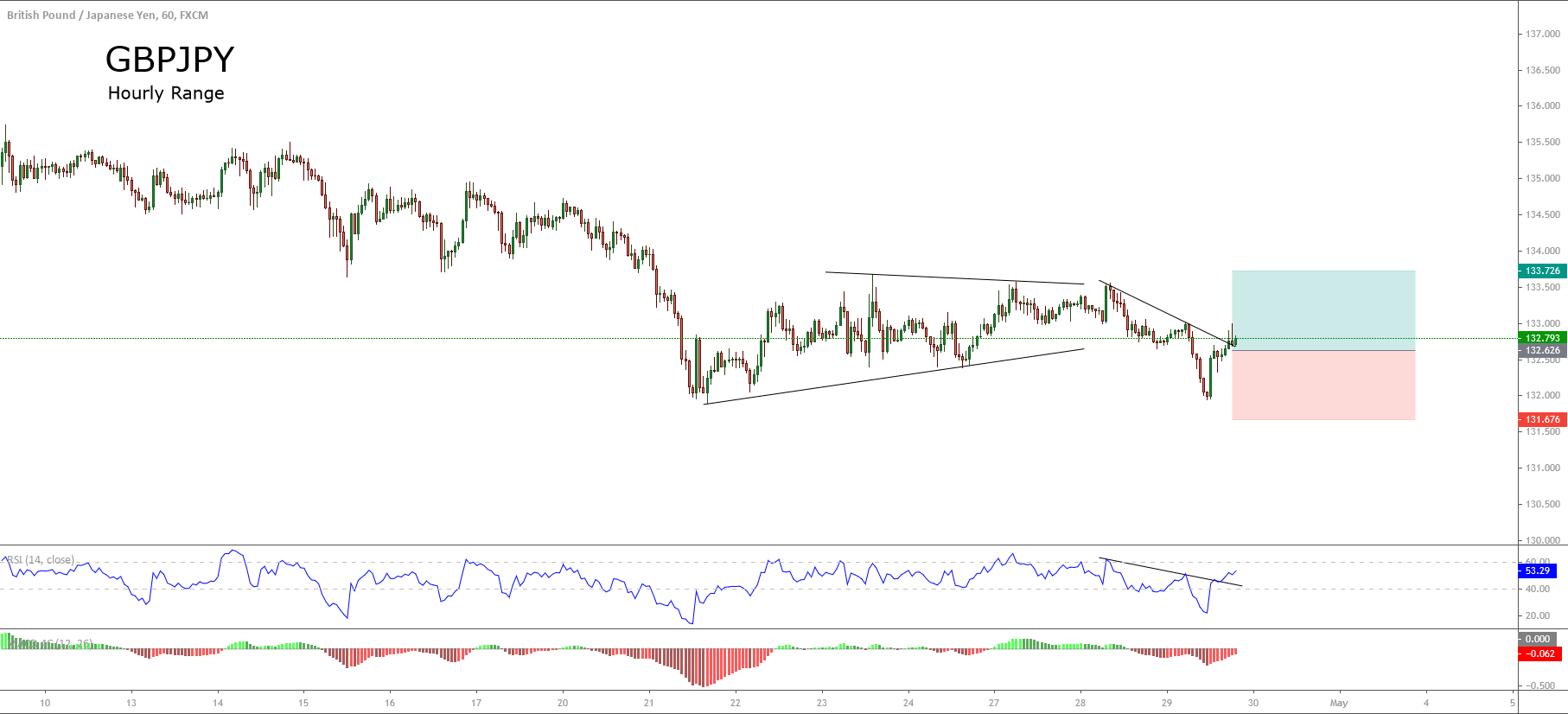

The GBPJPY cross in its hourly chart shows an intraday upward reaction leaving an engulfing candle. This movement suggests the possibility of a bullish sequence, which could continue in the trading sessions ahead.

On the other hand, the RSI oscillator exposes a bullish breakout of the descending trendline corresponding to the last decline developed by the cross.

Our bullish scenario considers the possibility of a retrace of price action until the area of the previous pivot candle at level 132.62. This retracement could allow the incorporation of fresh bull traders supporting the movement left by the engulfing candle.

In our conservative scenario, we expect an upside above the previous highs at level 133.76. The level that invalidates our upward setup locates at 131.67.

Chart

Trading Plan Summary

- Entry Level: 132.62

- Protective Stop: 131.67

- Profit Target: 133.72

- Risk/Reward Ratio: 1.16

- Position Size: 0.01 lot per $1,000 in account.