Description

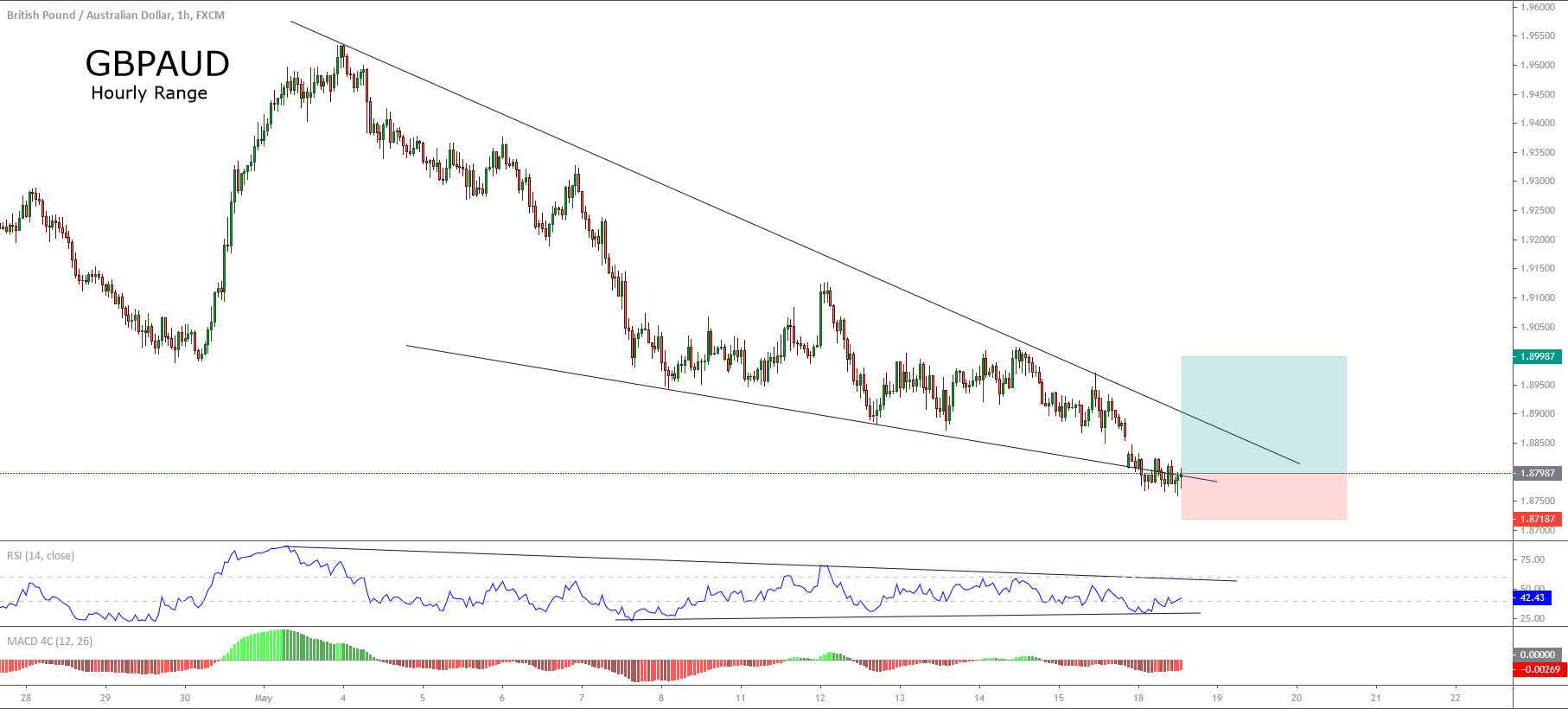

The GBPAUD cross, in its hourly chart, advances in a downward structure that follows the Elliott wave sequence as an ending diagonal pattern, which suggests a potential scenario of upside.

According to the textbook, the ending diagonal pattern is a structure that reflects the exhaustion of the trend, and its reversion would be imminent.

Currently, the price action advances below the lower guideline of the diagonal pattern, which warns us about the potential bearish failure continuation.

Our bullish scenario considers the long-side entry in the current area, looking for the upward move until the previous consolidation area at 1.8998. Our upward outlook considers the invalidation level at 1.87187

Chart

Trading Plan Summary

- Entry Level: 1.87987

- Protective Stop: 1.87187

- Profit Target: 1.89987

- Risk/Reward Ratio: 2.5

- Position Size: 0.01 lot per $1,000 in trading account.