Thank you for visiting the Forex.Academy FX Options Expiries Section. Each day, where available, we will bring you notable maturities in FX Options of amounts of $100 million-plus, and where these large commutative maturities at specified currency exchange rates often have a magnetic effect on price action, especially in the hours leading to their maturities, which happens daily at 10.00 AM Eastern time. Each option expiry should be considered ‘in-play’ if labelled as Hot, Warm or ‘out of play’ if labelled Cold with regard to the likelihood of price action meeting the strike price at maturity.

……………………………………………………………………………………………………..

FX option expiries for Apr 30 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

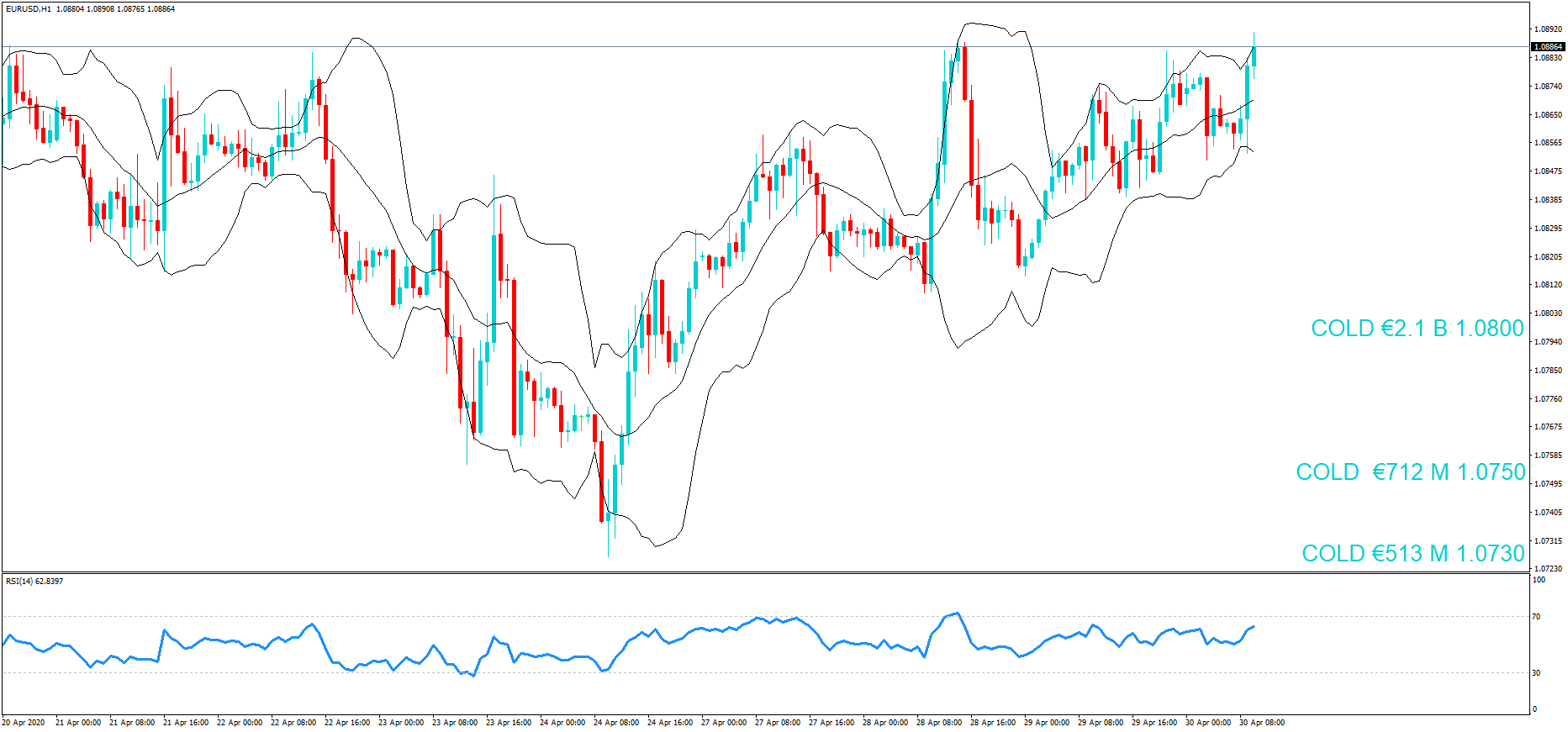

– EUR/USD: EUR amounts

1.0730 513m

1.0750 712m

1.0800 2.1bn

1.0947 1.1bn

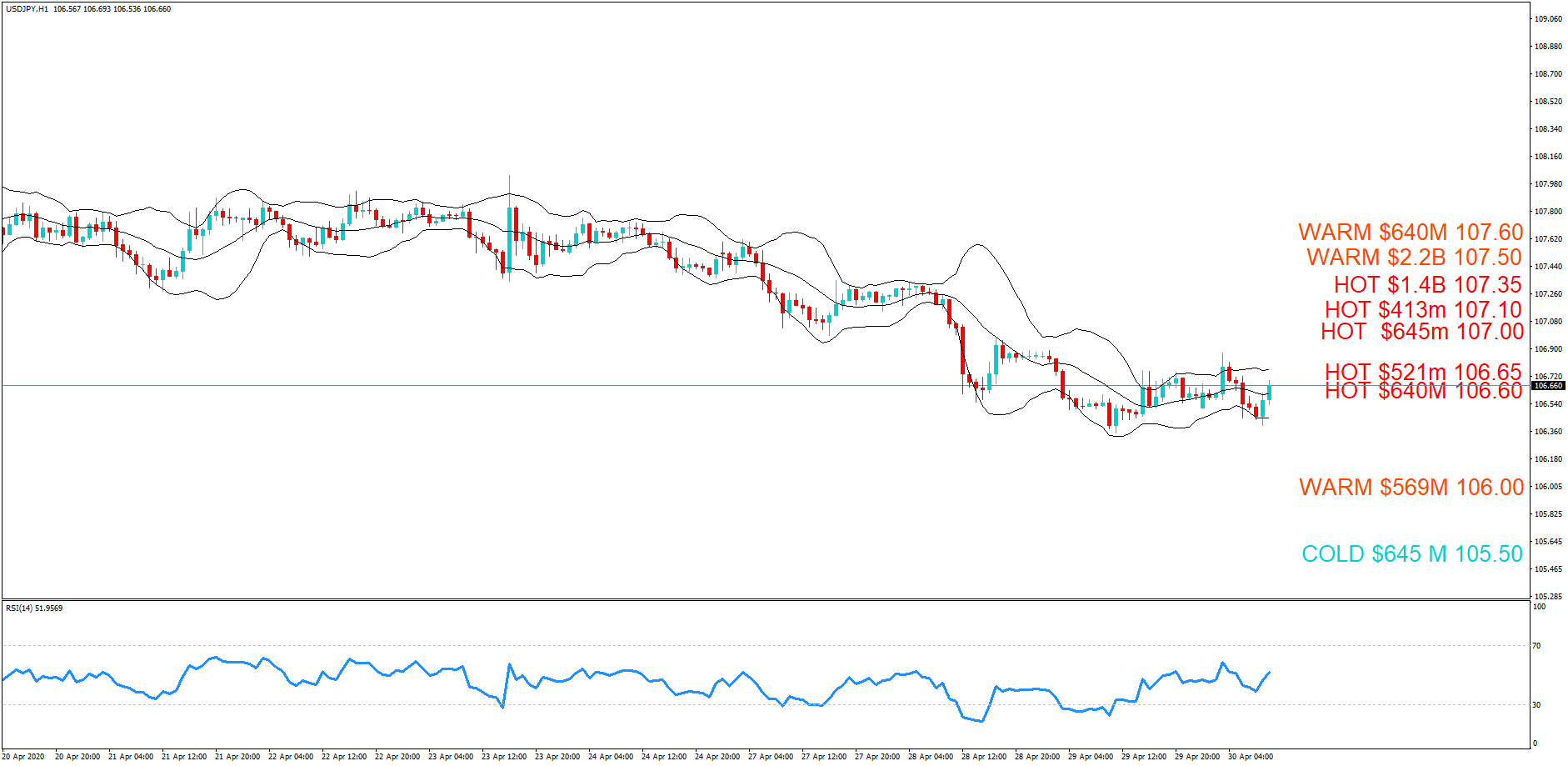

– USD/JPY: USD amounts

105.50 645m

106.00 569m

106.60 640m

106.65 521m

107.00 645m

107.10 413m

107.15 573m

107.35 1.4bn

107.50 2.2bn

107.60 640m

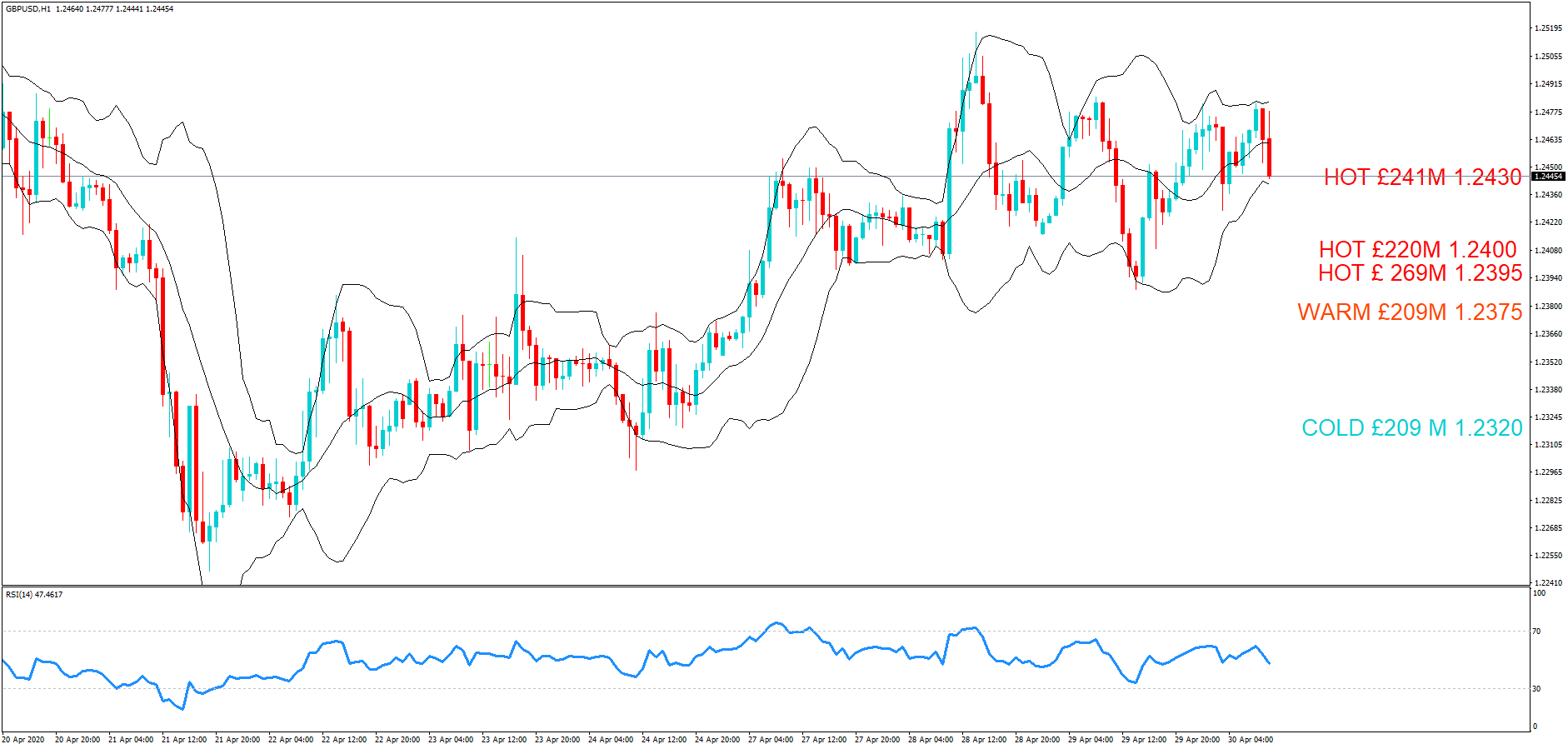

– GBP/USD: GBP amounts

1.2320 209m

1.2375 209m

1.2395 269m

1.2400 220m

1.2430 241m

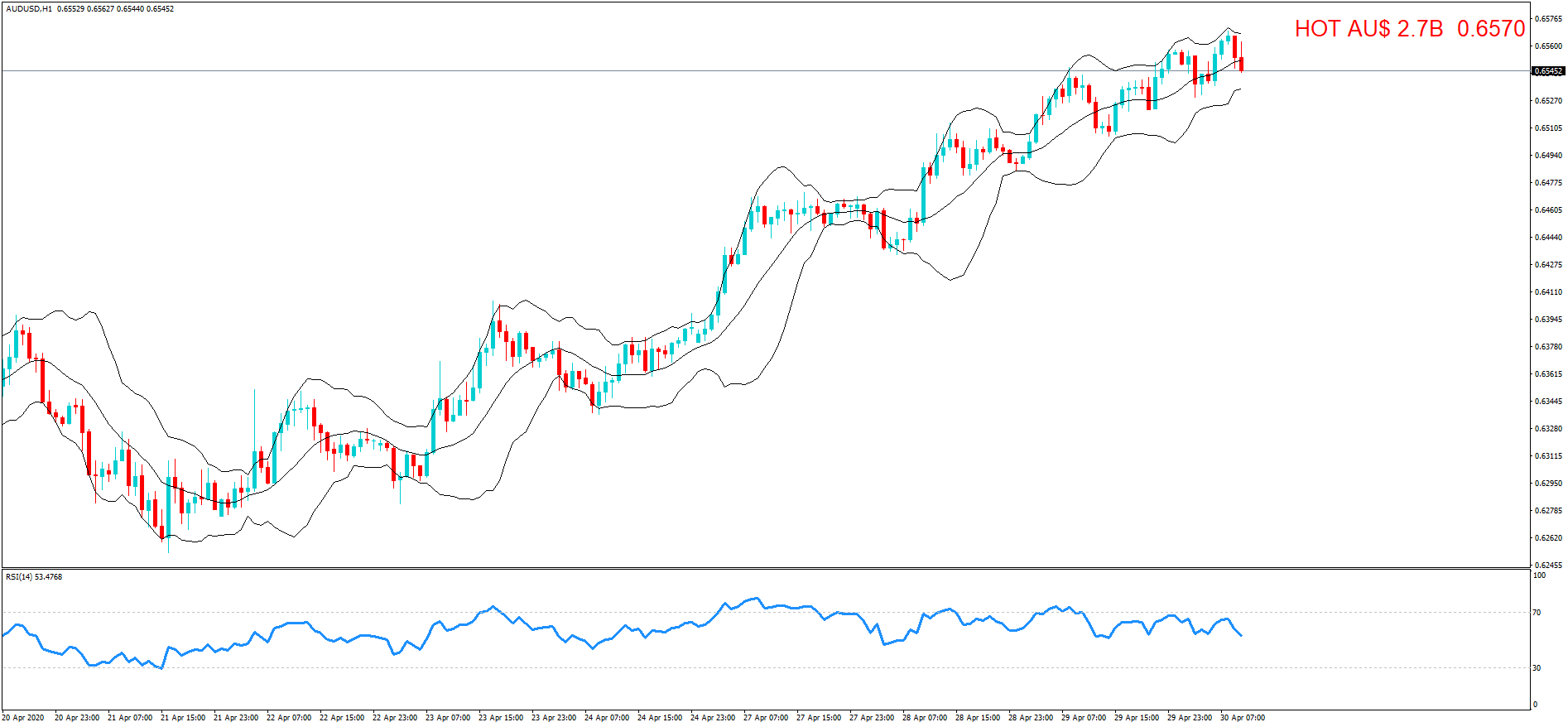

– AUD/USD: AUD amounts

0.6570 2.7bn

Of the notable option expiries which we brought you yesterday: price action hit the 108.65 level for EURUSD pair, which was an official strike at the 10 AM cut. We listed this as Hot

ERUGBP hit 0.8730 at the cut, which was only 30 pips from the 0.8700 option expiry. We listed this as Hot too.

GBPUSD had an expiry at 1.2425 and where we saw price action hit 124.47 at the cut, just 22 pips from the option expiry. We also listed this as Hot

………………………………………………………………………………………………………………

DISCLAIMER: Please note that this information is for educational purposes. Also, heat levels may change throughout the day in line with the exchange rate fluctuations of the associated pairs.