China and USA, the fire just got stoked

Thank you for viewing this forex academy educational video. In this session, we will be looking at the continuing tensions which have been escalating between China and the United States of America.

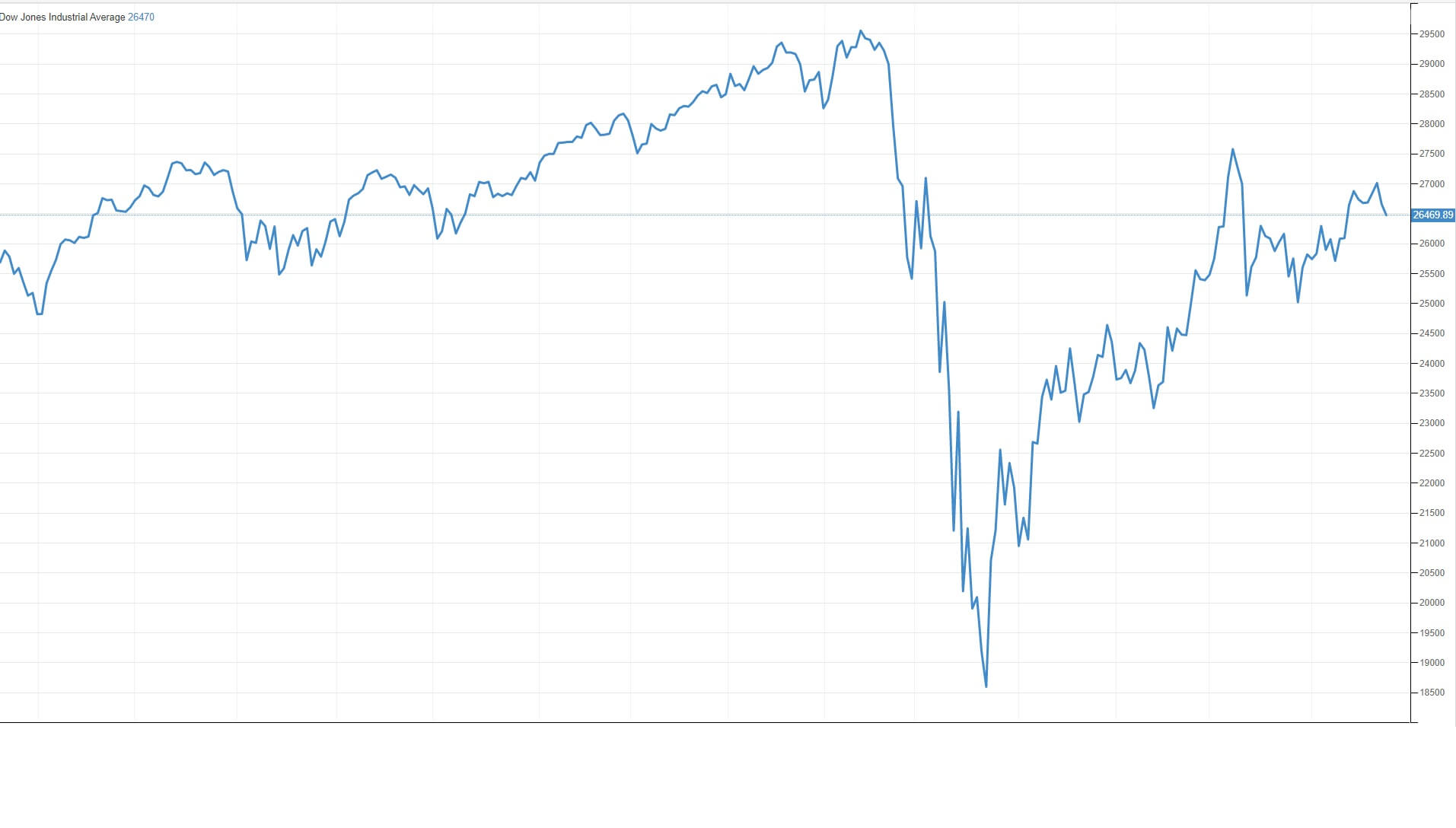

Tensions began to rise just after the Chinese phase 1 trade deal purchasing agreement with the United States came into effect after causing a record-breaking move higher on US equities,

especially the Dow Jones 30, as the market expected the US economy to grow as a result. The ink was barely dry on the agreement when the coronavirus broke out in China and eventually spread across Europe before catching hold in the United States of America.

President Trump often refers to the disease as the China virus, and an escalation between the two nations has been growing ever since. Recently, President Trump banned:

WeChat and TikTok from being used by the American public and organizations in the United States and where President Trump has been putting pressure on European countries to stop using Huawei for 5G g-technology. The reasoning behind this is that the Chinese companies which own the technologies might send the collated personal data of US citizens and firms to the Communist Party of China. This has led to tit-for-tat escalations building between the nations, which could not have come at a worse time bearing in mind the global slowdown with economies suffering due to the ongoing Covid pandemic.

On Saturday, the 15th of August, the United States, and China were due to have had a videoconference meeting to discuss the 6-month anniversary of the signing of the phase one trade deal between the two Nations. However, this was surprisingly canceled, with American officials citing a delay due to apparent scheduling conflicts and where the United States requested more time to allowed China to purchase more United States exports.

This should have been a 6-month compliance review you wear the US trade representative Robert Lighthizer, US treasury secretary Steven Mnuchin and Chinese vice-premier Liu He had agreed should have taken place. Bearing in mind that this would have been arranged six months ago, it seems rather than usual that all of a sudden, there should be a scheduling issue. Surely this must be down to the fact that there is a growing breakdown in the relationship between the two Nations. One has to wonder what is going on in the background? Are the Chinese sticking to their part of the deal with the enormous purchasing requirements of American goods and services, especially products from United States farmers, which runs into millions of tons of products. And as a result of which saw US equities pushed to record highs.

With the United States in the grip of the worst economic turndown in its history, the last thing it needs at the moment is for the Chinese to renege on the deal.

Donald Trump has said that the trade is, and I quote: ’’ is doing very well’’, but has not so far commented on the delay of the meeting. The Chinese side is saying that, and I quote: ’the new date has not been finalized yet’’.

But it is known that China is behind with the purchasing agreement. However, markets are predicting that this is purely a knock-on effect from the Coronavirus lockdown they had earlier on this year ear and that this is the reason for them not being able to honor the agreement which would contain a clause such coving a force majeure.

Nonetheless, the financial markets have been twitchy as the escalation grows, but US stock indices have not suffered, but where the American dollar is currently on the back foot due to the ongoing pandemic within in the United States and, no doubt, tensions between America and China will be playing a part also.

The failure of the phase one deal would be a political scoring point for the democratic presidential candidate Joe Biden who recently said that the historic agreement was ‘’failing’’.

So, what can we expect? Certainly, escalations in relationships between these two Nations is likely to continue, and we will see market turbulence as a result. Stock indices in the United States seem to be running on helium and are largely unaffected by the coronavirus. However, should the Chinese pull out of phase one deal, this would cause a potential sharp fall in the United States equities.

The American dollar remains under pressure, and this would also see great volatility should any such announcements occur. During these times, which are unprecedented, and where no end seems to be in sight, traders are advised to tread with caution and used tight stop losses at all times.