Trading depends a lot on a trader’s mindset. It does not matter theoretically how strong a trader is. If he does not know how to deal with trading pressure accordingly, he will never be a successful trader. One of the biggest issues in trading is encountering losing trades. It diverts the traders’ mindset, which makes him make more mistakes and lose money in the end. We mostly choose winning trade setup in our trading lessons. However, we sometimes chose a trade setup that encounters a loss as a part of our trading psychology lesson. In today’s lesson, we are going to demonstrate a losing trade.

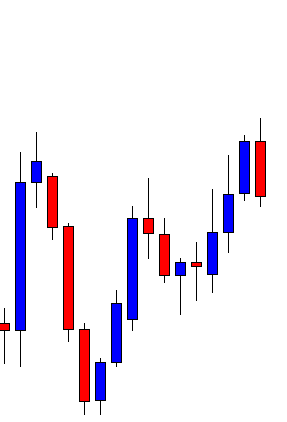

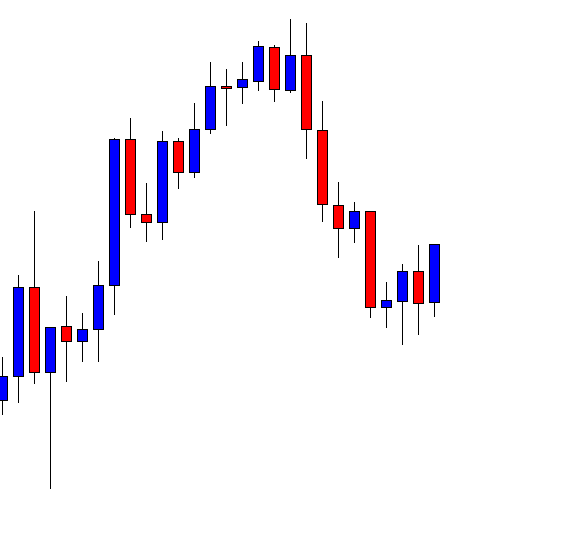

This is a daily chart. The price heads towards the North upon producing a C point. Look at the last candle. It comes out as a bearish engulfing candle producing right at the level, where the price had a rejection earlier. The H4-daily combination traders may flip over to the H4 chart to go short in the pair.

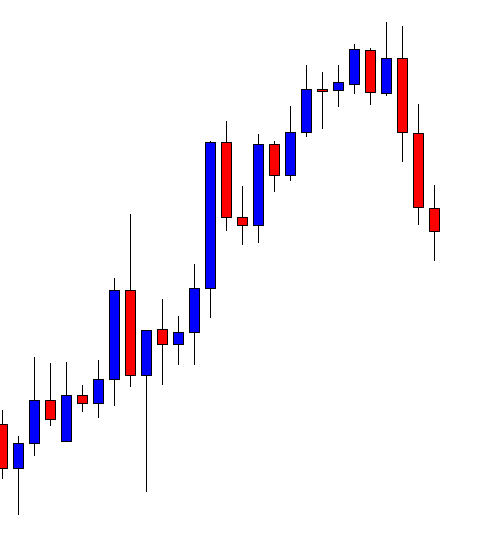

This is the H4 chart. The chart shows that the price heads towards the North with good bearish momentum. The sellers are to wait for the price to consolidate and produce a bearish engulfing candle to go short in the pair.

The chart produces a bullish inside bar. It seems that the chart may produce a short signal for the sellers soon. The H4-daily combination sellers must keep their eyes on the chart.

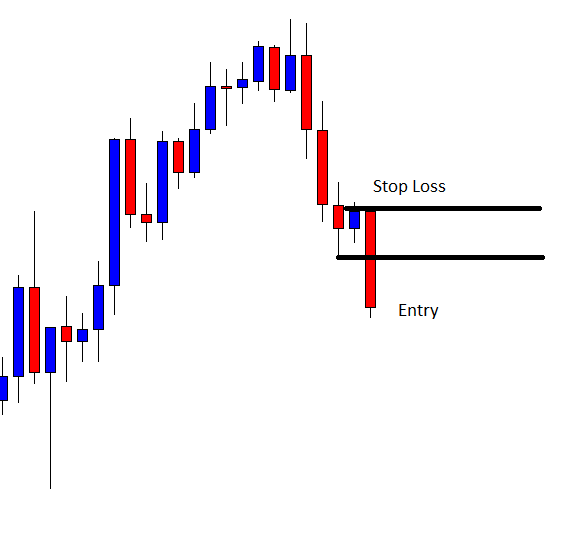

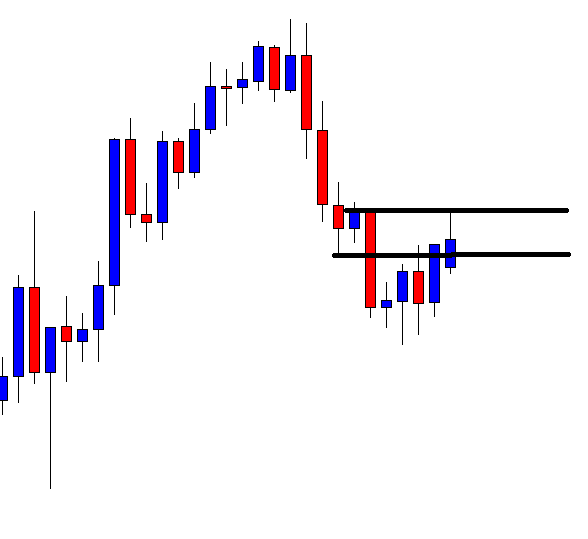

The last candle comes out as a bearish engulfing candle closing well below consolidation support. The sellers may trigger a short entry right after the candle closes. This looks like an A+ trade setup. It seems that the sellers do not have to wait too long to earn their profit.

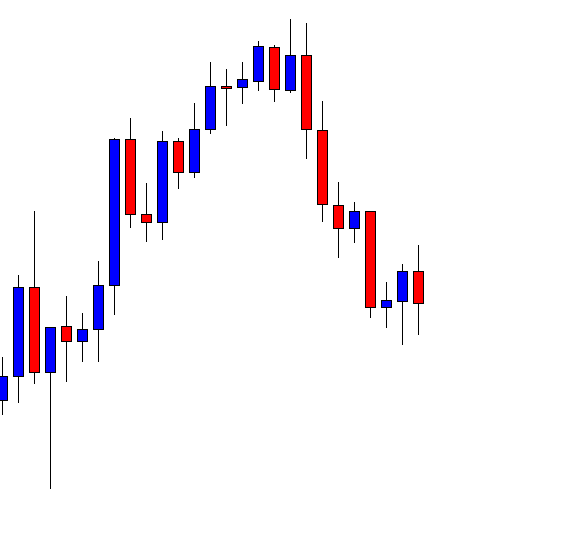

Things do not go according to the sellers’ expectations. The chart produces a spinning top followed by a bullish engulfing candle. Some sellers may want to close their entry with some losses here. Let us assume that we let our trade run. Then, here comes the last candle. It looks good for the sellers again.

The chart produces a bullish engulfing candle again. This must be annoying for the sellers. Let us assume that we keep holding the position with the hope that it goes towards the South and hits Take Profit.

It does not. It hits Stop Loss instead. An A+ entry ends up being a losing trade. If you keep thinking about a losing trade (with your proven strategy) and do not look to find out new entry, it means a losing trade chases you much more than it should. You really have to find out a way to avoid it.