Introduction

CAD/JMD is an exotic currency pair. CAD is the Canadian Dollar, and JMD is the Jamaican Dollar. The CAD is the base currency in this pair while the JMD is the quote currency; meaning that the exchange rate of the CAD/JMD pair is the quantity of JMD that can be bought by 1 CAD. If the exchange rate for the pair is 105.68, it means that 1 CAD buys 105.68 JMD.

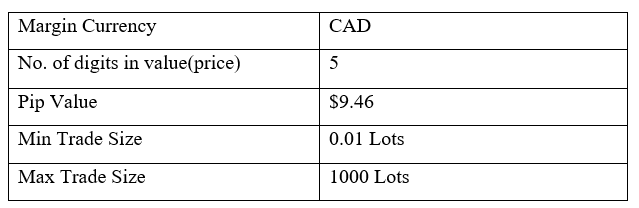

CAD/JMD Specification

Spread

In forex trading, the spread represents the difference in the value at which you can buy a currency pair and that at which you can sell. The spread varies with different currency pairs.

The spread for the CAD/JMD pair is:

ECN: 2.4 pips | STP: 7.4 pips

Fees

When trading forex with an ECN account, the broker charges a commission for every trade. With STP accounts, no fees are charged on trades.

Slippage

In times of market volatility or if the execution of trade is not instant, there will be a discrepancy between the price at which you initiate a trade and the price it executed. This discrepancy is called slippage.

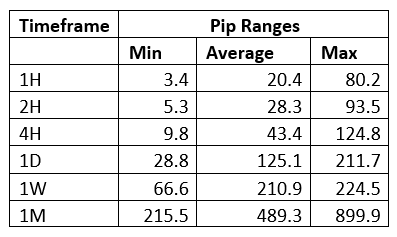

Trading Range in the CAD/JMD Pair

Since the price of a currency pair constantly changes, knowing by how much the price changes across different timeframes can help forex traders better understand volatility. This knowledge is vital, especially when estimating potential loses or gains. If, for example, the CAD/JMD pair has a volatility of 20 pips during the 4-hour timeframe, it means that trading the pair has a potential profit or loss of $189.2

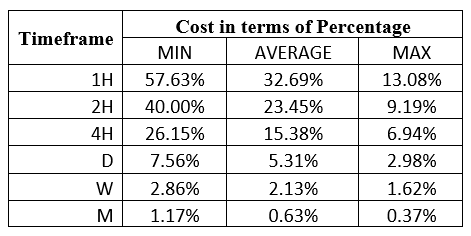

Below is a table showing the trading range for the CAD/JMD pair.

The Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can determine a larger period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

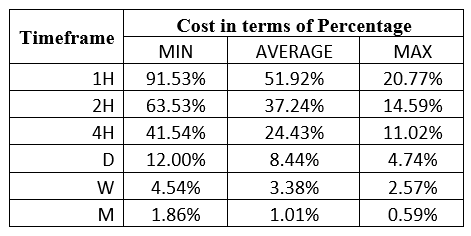

CAD/JMD Cost as a Percentage of the Trading Range

Trading any currency pair comes at a cost. These costs vary across different timeframes and volatility. Expressing them as a percentage of the trading range will help to inform the trading decision for the pair.

Below are analyses of the trading costs for the CAD/JMD pair across different timeframes.

ECN Model Account

Spread = 2.4 | Slippage = 2 | Trading fee = 1

Total cost = 5.4

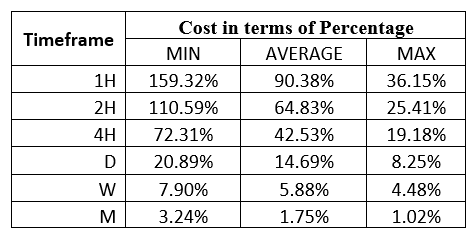

STP Model Account

Spread = 7.4 | Slippage = 2 | Trading fee = 0

Total cost = 9.4

The Ideal Timeframe to Trade CAD/JMD

From the above cost analyses, we observe that lower timeframes and low volatility correspond to higher trading costs with the CAD/JMD pair. For both the ECN and the STP accounts, the highest costs are when volatility is the lowest at 3.4 pips. The lowest cost is when volatility is the highest at 899.9 pips.

The long-term trader enjoys lower trading costs that intraday traders. However, across all timeframes, trading when volatility is average lowers the cost and the risks associated with high volatility. Furthermore, traders can lower their costs by employing the use of forex limit orders as opposed to market orders. Limit orders eliminate the cost of slippage. Here are the trading costs when limit orders are used.

ECN Account Using Limit Model Account

Total cost = Slippage + Spread + Trading fee

= 0 + 2.4 + 1 = 3.4

We can notice a significant reduction in the trading costs of the CAD/JMD pair. The highest cost has reduced from 91.53% to 57.63% of the trading range.