Admiral Markets is a well-established forex broker and has been around for the past 18 years. Established in Cyprus, Admiral Markets offer a number of different accounts and platforms to help their clients be the best trader they can, we will be taking a closer look at what services are being offered and if they are a good value for money.

Account Types

Admiral Markets have four different account types which are divided by the platform used to trade with, we will get into the available platforms a little later but will briefly mention them in relation to the account names, let’s take a little look at what the account perks and requirements are.

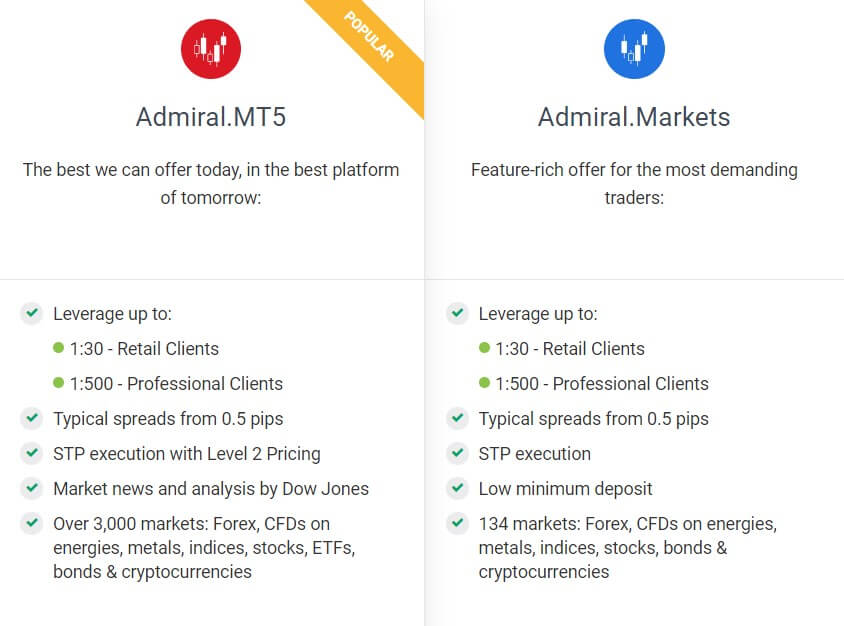

Admiral.MT5 (MetaTrader 5 account):

The Admiral.MT5 account as you can probably guess, uses the MT5 platform, it has a minimum deposit of $200, £200 or other equivalents, the base currency of the account can be EUR, USD, GBP, CHF, BGN, CZK, HRK, HUF, PLN or RON. There are a large number of assets available to trade on this account including Forex, Cryptocurrencies, Metals, Futures, and Stocks, we will go into more details regarding all assets later in this review. Retail clients can have leverage between 1:30 and 1:20 and there is a floating spread with a minimum of 0.5 pips. There is no commission charged except with Single Share & ETF CFDs where it is from 0.01 USD per share. Minimum trade size is 0.01 lots and a maximum of 100 lots (Forex), there is also a max open position figure of 500 trades, stop out is at 50% for retail clients and 30% for professional clients.

Admiral.Invest (MetaTrader 5 account):

The Admiral.Invest account is more based around investing in stocks, there is a minimum deposit of $1 or the equivalent in your currency and base currency can be any of the following: EUR, USD, GBP, CHF, BGN, CZK, HRK, HUF, PLN or RON. There are over 4000 stocks to trader and 200 ETFs for retail clients and 500 ETFs for professional clients. There is no leverage offered and no spreads. As you are buying stocks there are no minimum or maximum trade volumes and no stop out as the value of the stock is always available.

Admiral.Markets (MetaTrader 4 account):

This account is also known as the standard account from Admiral Markets, this account uses the MT4 platform, it has a lot of similarities to the Admiral.MT5 account has a minimum deposit of $200 or your currency equivalent and has the same base currencies available, it differs in the way that the maximum number of open trades is reduced to 200. In fact, all the other features of this account are the same as Admiral.MT5 except for the fact that it uses MT4 instead of MT5.

Admiral.Prime (MetaTrader 4 account):

The Admiral.Prime account works in exactly the same way as the Admiral.Markets account apart from a few key differences, it has more forex currencies to trade, however less of the others such as no stocks or bonds. It has a 0 pip (floating) spread however it charges a commission, it differs depending on what you are trading, but the commission will sit anywhere between $0.05 to $3 per lot traded.

Platforms

Admiral Markets offers a couple of different platforms to work with and they are both from the MetaQuotes company, we will outline them in a little bit of detail down below:

Admiral Markets offers a couple of different platforms to work with and they are both from the MetaQuotes company, we will outline them in a little bit of detail down below:

MetaTrader 4 (MT4):

MT4 is one of the world’s most popular and widely used trading platforms, it was designed to give large amounts of customization options and is compatible with thousands of expert advisors and indicators. It is available with Admiral Markets as a desktop download, applications for iOS and Android devices and as a WebTrader to trade directly within your internet browser.

MetaTrader 5 (MT5):

MT5 is MT4’s little brother, it is cleaner sleeker and faster, it offers similar levels of flexibility and customization, and has access to thousands of expert advisors and indicators, not quite as many as MT4, but the number is constantly growing. Similarly to MT4, MT5 is available as a desktop download, an app for Android and iOS devices and finally as a WebTrader within your internet browser.

MetaTrader Supreme Edition:

While this is not technically an additional platform to trade with, we thought we would mention it. MetaTrader Supreme Edition is an additional plugin that can be used with both MT4 and MT5 to add some extra functionality. It adds additional analysis tools, as well as additional monitoring tools and techniques to help you in your trading.

Leverage

The leverage that you are offered with Admiral Markets is based on whether or not you are considered a retail or professional trader. The majority of us would be classed as retail and so would be able to use a leverage of either 1:20 or 1:30. Those classed as a professional trader will be able to use a leverage of anywhere between 1:10 and 1:500.

Trade Sizes

All accounts apart from the Admiral.Invest account come with a minimum trade size of 0.01 lots, also known as a micro lot. The maximum trade size will depend on your account type, the Admiral.Markets and Admiral.MT5 accounts come with a maximum trade size of 100 lots, the Admiral.Prime account has an increased maximum lot size of 200 lots. The Admiral.MT5 account has a maximum number of open trades sitting at 500, while the Admiral.Markets and Admiral.Prime accounts have the maximum number of open trades as 200.

The Admiral.Invest account does not have a minimum or maximum lot size or a limit to the number of open trades as it is more to do with investing and not trading.

Trading Costs

The Admiral.Markets and Admiral.MT5 accounts use a spread based charge, which is set at a minimum of 0.5 pips, this number often goes higher due to fluctuations. There is only a commission charged on these accounts when trading shares and EFTs, this commission starts from 0.01 USD per share.

The Admiral.Prime account has a 0 spread (although there often is a very small one) due to it being a commission-based account, the commissions being charged are as follows:

Forex & Metals – from 1.8 to 3.0 USD per 1.0 lots

Cash Indices – from 0.05 to 3.0 USD per 1.0 lots

Spot Energies – 1 USD per 1.0 lots

The Admiral.Invest account has a commission starting at 0.01 USD per share.

Assets

Different accounts have access to different assets, so to make things easier to understand we have broken them down by account type.

Admiral.MT5:

Currencies – 37

Cryptocurrency CFDs – 32

Spot Metal CFDs – 5

Spot Energy CFDs – 3

Spot Agriculture CFDs – 7

Index Futures CFDs – 21

Commodity Futures – 10

Cash Index CFDs – 19

Stock CFDs – over 3000

ETF CFDs – over 300

Bonds CFDs – 2

Admiral.Invest:

Stocks – over 4000

ETFs – over 200 for Retail Clients and over 500 for Professional Clients

Admiral.Markets:

Currencies – 37

Cryptocurrency CFDs – 5

Spot Metal CFDs – 4

Spot Energy CFDs – 3

Index Futures CFDs – 3

Cash Index CFDs – 16

Stock CFDs – 63

Bonds CFDs – 2

Admiral.Prime:

Currencies – 45

Spot Metal CFDs – 3

Cash Index CFDs – 10

Spot Energy CFDs – 3

As you can see, there is a wide range of different instruments to trade, including Cryptocurrencies which are quickly becoming one of the most traded assets with newer and experienced traders looking towards them due to their added volatility and profit potential. There is plenty to choose from with Admiral Markets, so you shouldn’t ever be left with nothing to trade.

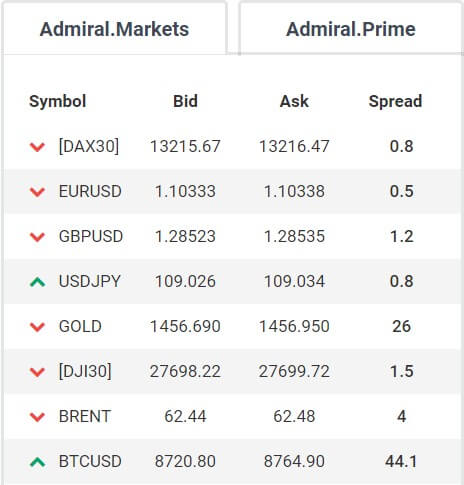

Spreads

The spreads at Admiral Markets are relatively low when looking at the competition, the Admiral.MT5 and Admiral.Markets accounts are the two accounts that use spreads and these start from as low as 0.5 pips, these are also viewable on the site, at the time of writing, a selection of spreads included: EURUSD 0.6 pips, GBPUSD 0.9 pips, USDCHF 2.4 pips, and USDJPY 0.8 pips.

Other instruments like cryptocurrencies have their spreads available on the site too and a few examples of them are BTCUSD 40, ETHUSD 1.81, LTCUSD 0.77 and XRPUSD 0.003.

Minimum Deposit

The minimum deposit for trading accounts (Admiral.MT5, Admiral.Markets and Admiral.Prime) is 200 EUR, 200 USD, 200 GBP, 200 CHF, 500 BGN, 5,000 CZK, 1,400 HRK, 70,000 HUF, 1,000 PLN, 1,000 RON

The minimum deposit for the Admiral.Invest account is 1 EUR, 1 USD, 1 GBP, 1 CHF, 2 BGN,

25 CZK, 8 HRK, 350 HUF, 5 PLN, 5 RON

Deposit Methods & Costs

There are a number of different methods for depositing with Admiral Markets, as each one has its own individual requirements we will outline them below, all amounts will be listed in USD unless otherwise stated), however other limits may be enforced for other currencies:

- Bank Transfer – No Fee – No Min / No Max

- Klarna – No Fee – 50 Min / 10,000 Max (EUR)

- Visa / MasterCard – No Fee – 50 Min / 5,000 Max

- Skrill – 0.9% or min 1 Fee – 50 Min / 5,000 Max

- Neteller – 0.9% or 1 Fee – 50 Min / 10,000 Max (EUR)

- SafetyPay – No Fee – 1 Min / 5,000 Max

- Przelewy – No Fee – 50 Min / 30,000 Max (PLN)

- iBank & BankLink – No Fee – 10 Min / 5,000 Max (EUR)

- iDEAL – No Fee – 50 Min / 5,000 Max (EUR)

Withdrawal Methods & Costs

There are fewer withdrawal methods available with Admiral Markets, we will outline the details of these methods below:

- Bank Transfer – 2 free per month (USD = $25) – No Min / No Max

- Skrill – 1% or min 1 – 1 Min / 10,000 Max

- Neteller – 1% or min 1 – 1 Min / 10,000 Max

It is a shame to see fees being charged when withdrawing, this is something that a lot of modern or more popular brokers have phased out so it would be nice to see Admiral Markets follow suit and phase out their withdrawal fees.

Withdrawal Processing & Wait Time

Withdrawal times are pretty standard within the industry, if you use Bank Transfers it can take up to 3 business days to process while using Skrill or Neteller, the funds will be transferred straight away with very little processing time.

Bonuses & Promotions

A quick sweep of the Admiral Markets website does not turn up any information regarding any active bonuses or promotions. The only thing that could be classed as a bonus is the Pro.Cashback scheme, however you need to be classed as a professional trader to receive $1 every time you trade 1 million worth of trades.

If you are thinking of joining Admiral Markets then be sure to check back regularly just in case something does come up.

Educational & Trading Tools

There are a number of tools available on the site however each one is very similar to the next, they are designed around an analysis of the markets, with different sections for Fundamental Analysis, Technical Analysis and then things such as a Forex Calendar. While it could be helpful for someone just starting out with trading, those that have been around a while would be looking for something a little more in-depth.

There are a number of tools available on the site however each one is very similar to the next, they are designed around an analysis of the markets, with different sections for Fundamental Analysis, Technical Analysis and then things such as a Forex Calendar. While it could be helpful for someone just starting out with trading, those that have been around a while would be looking for something a little more in-depth.

There is a Traders Blog that gives more detailed posts in terms of what is happening in the markets and is worth a read if you are currently trading with Admiral Markets and they can be quite informative.

In terms of education, there are a number of webinars taking place, we did not get to see one to see what the quality is like, but it appears that they are quite regular so you should always be able to get onto one. There are also articles on things like Risk Management and a glossary of terms that can be helpful for newer traders. There is nothing that will make you an expert trader, but enough to help kick start someone’s trading career.

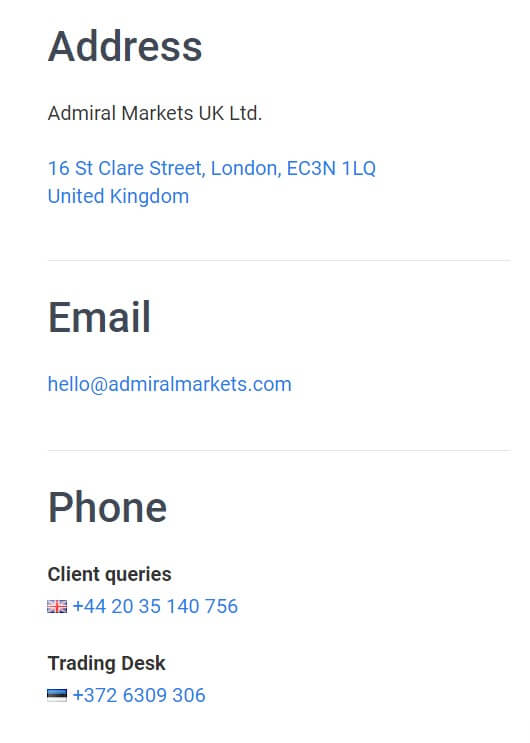

Customer Service

Customer Service

The customer service being provided by Admiral Markets seems to be of high quality, there are a number of ways to get in contact or to ask questions. The online form allows you to send a message and receive a reply via email. There is also a direct email address available, along with a phone number for both client queries and the trading desk, finally, there is also a physical address available.

We tested both the online form and the phone number, we got a reply from the form within about 17 hours, while our phone call was answered within 60 seconds, which is always positive, the person on the end of the line was helpful and prompt in answering questions.

Demo Account

With a well-established broker, you would expect there to be demo accounts and with Admiral Markets there are. They are easy to set up, simply fill in the short form and it will be created for you. Demo accounts, unfortunately, expire after 30 days, however, if you have a live account, then the demo accounts will not have an expiry date and will remain active until you close them.

It is disappointing that they close after 30 days because serious testing of a broker or strategy can take far more than 30 days, so any progress and results during a test could be lost.

Countries Accepted

Admiral Markets has three different companies all trading under the same brand, each of these companies is regulated by a different regulatory body, ASIC, CySEC and the FCA. Each of these has individual requirements as to which countries are allowed to trade with them. There is no definitive list, so getting in contact with support before signing up may be required.

Conclusion

Admiral Markets is seen as one of the big players and for good reasons, they offer a large number of tradable assets and instruments and a very competitive cost. The customer service was quick and effective and the spreads low. It is unfortunate that there is still a charge to get your money out of the broker and the 30 day limit on demo accounts is a letdown.

If you don’t mind the charge to withdraw, then Admiral Markets would be a good broker to choose, if you would prefer free withdrawals then you may need to look elsewhere.

We hope you like this Admiral Markets review, and if you did, be sure to check out some other reviews to help find the broker that is right for you.