Today, people have more and more investment options, from classics like gold and silver to recent innovations like Bitcoin and other cryptocurrencies. But there is one type of asset that has stood the test of time: precious metals. Here’s why what may seem like an old-school outdated product is still very interesting from the point of view of a young digital native investor.

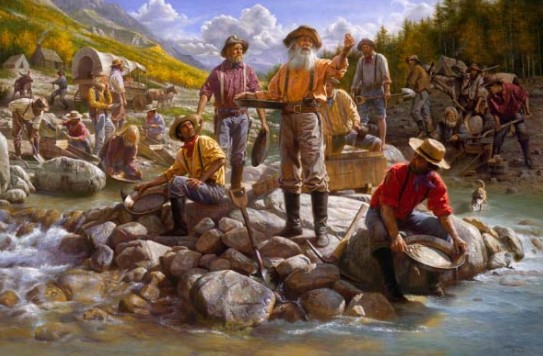

A Brief History of Gold and Silver

The civilization of the Incas referred to silver and gold as “sun sweat” and “moon tears”. In ancient Greek mythology, gold represented the glory of the immortals. And even historical figures like Sir Isaac Newton believed in the long-discredited pseudo-science of “alchemy,” which aimed to turn basic metals into gold. The history of gold as money dates back to around 550 B.C. and government-issued fiat coins, such as the US dollar, used to be directly linked to gold in a monetary system known as the gold standard. And let’s not forget the statues of the Academy Awards, the World Cup trophy, or the medals for first place in the Olympics. All bright, beautiful, solid gold.

In January 2019 the purchase of gold by central banks reached its peak of the last 50 years, mainly because countries like Russia are changing their reserves from US dollar to gold. At the present time, the world consumption of newly produced gold is around 50% in jewelry, 40% in investments, and 10% in the industry. With 440 tons per year, China is the world’s largest gold-producing country. In January 2019 the purchase of gold by central banks reached its peak of the last 50 years, mainly because countries like Russia are changing their reserves from US dollar to gold.

Silver, on the other hand, remains the second most popular precious metal just behind gold. It is also used for jewelry, as an investment asset, and as an industrial resource. Many investors appreciate silver as an investment, as it tends to be more volatile than gold due to its lower trading volume.

Inflation-Proof Investment and Portfolio Diversification

Analysts have long argued that gold acts as a hedge against inflation and protects investors against market volatility and unpredictability. A general rule is to have 5-10% gold exposure in the portfolio.

For younger investors with higher risk tolerance and higher return expectations, gold might look like a conservative investment. But it can complement and enhance an investor’s overall portfolio by balancing technology-oriented assets with a time-tested commodity.

Gold is both a creator of wealth and a keeper of wealth. As young investors, you have to keep your eyes on the finish line, probably several decades in the future. Since people now live and work longer, long-term investment strategies that include stabilizing asset classes are crucial.

Why Digitize Gold and silver?

Possessing physical gold and silver has always been desirable for many. There is something tangible about it. Its physical quality means that you can see it, feel it, weigh it and admire its beauty. From a golden calf, a golden fleece and gold crowns to streets paved with gold, this metal has constituted a fundamental element of our collective human history and its images have filtered even into our language (for example, “as good as gold”, “worth its weight in gold”, etc.). In a word, gold is timeless.

There are companies that offer the best of both worlds: Purchases and possess digitized physical gold or silver. But you can exchange it with the same convenience and user experience you’re used to with other digital assets.

But possessing physical gold or silver has its disadvantages. You need to visit a gold trader or at least order physical coins or gold bullion at your store. Then you have to take care of security on your own and keep it at home. In case someone comes in and steals it, you need proper insurance and also a special safe to cover it. An alternative is to keep it in a safe deposit box at the bank or on a gold trader, which means you have to move there and pay relatively high commissions for it.