Let’s dedicate this article to speaking about Forex trading platforms. In the market, there are thousands of brokers and platforms, and all promise to be the best. Each may be different in different ways, but what really interests you? What do you ask a trading program to do? Let’s discuss…

What is a Trading Platform?

I know you know what it is, a trading tool. Let’s go a step further, in the market, there are different types of platforms according to their function broadly:

To chart: if you know me a little you will know that I am not in favor of making decisions by looking at charts. Decisions as a result of emotions, there is no objective plan. Is not what is intended of this article so will not give you the ember with this. Some of the best known for their graphics are Pro Real-Time, Visual Chart, Ninja Trader.

To create strategies: there are also tools to develop trading strategies, most of them already automated. For example, MetaTrader allows you to create these types of trading strategies called EAs (Expert Advisors).

To do trading: Platforms to buy and sell through them. Some of the previous ones allow buying directly.

Don’t get bogged down by seeing many platforms, some offering everything (graphics, automation, and execution). This ranking is just so that you understand that a trading program can be anyone who fulfills one of these functions.

How Does a Trading Platform Work?

What this type of software tries to do is make life easier for you in your work as a trader. For example, if you like a guy’s e graphics and presentations you’re going to prefer a platform that can give it to you. If instead you develop and execute automatic trading systems as is my case you will prefer another type or you will prioritize based on it. They all try to give service in exchange for commissions through the purchases and sales you make in that same program or by paying a fee in some cases.

Which Trading Platform is Best?

The usual question. The most optimal will be the one that meets your needs. As I said previously there are different types of traders, so there are also different types of platforms based on it. It’s like we’re trying to agree on the best bank. It depends on the type of customer.

In my case to implement systems and for the operational issue, I do it with Metatrader because it is very versatile and has a great community behind it. Besides, it’s free of charge.

Which Platform Costs Less?

If it is for development and graphics I would not pay for it except some point case, but in reality today there are so many that it seems to be an unnecessary expense. As for brokers, a commission set as low as possible and reduced forks with DMA execution. If you trade in OTC markets like Forex, keep this in mind.

The Best Platforms

The best trading platforms don’t advertise aggressively or offer bonuses for two reasons. First, they don’t need one. Second, the conditions are usually good and tight, they focus on giving good service to the trader and can’t afford all this money in marketing.

The good ones are those who want you to do well and take care of you because their business is that you trade for a long time and you do well. Build long-term relationships with aligned interests and you’ll have a lot going for you.

Forex Trading Platforms

Depending on whether you trade in futures, stocks, cryptocurrencies. you may be interested in one platform or another, especially when trading. Most brokers are specialized and competitive in some of them and very few are in all or most of them. I’ll tell you in case you do Forex trading.

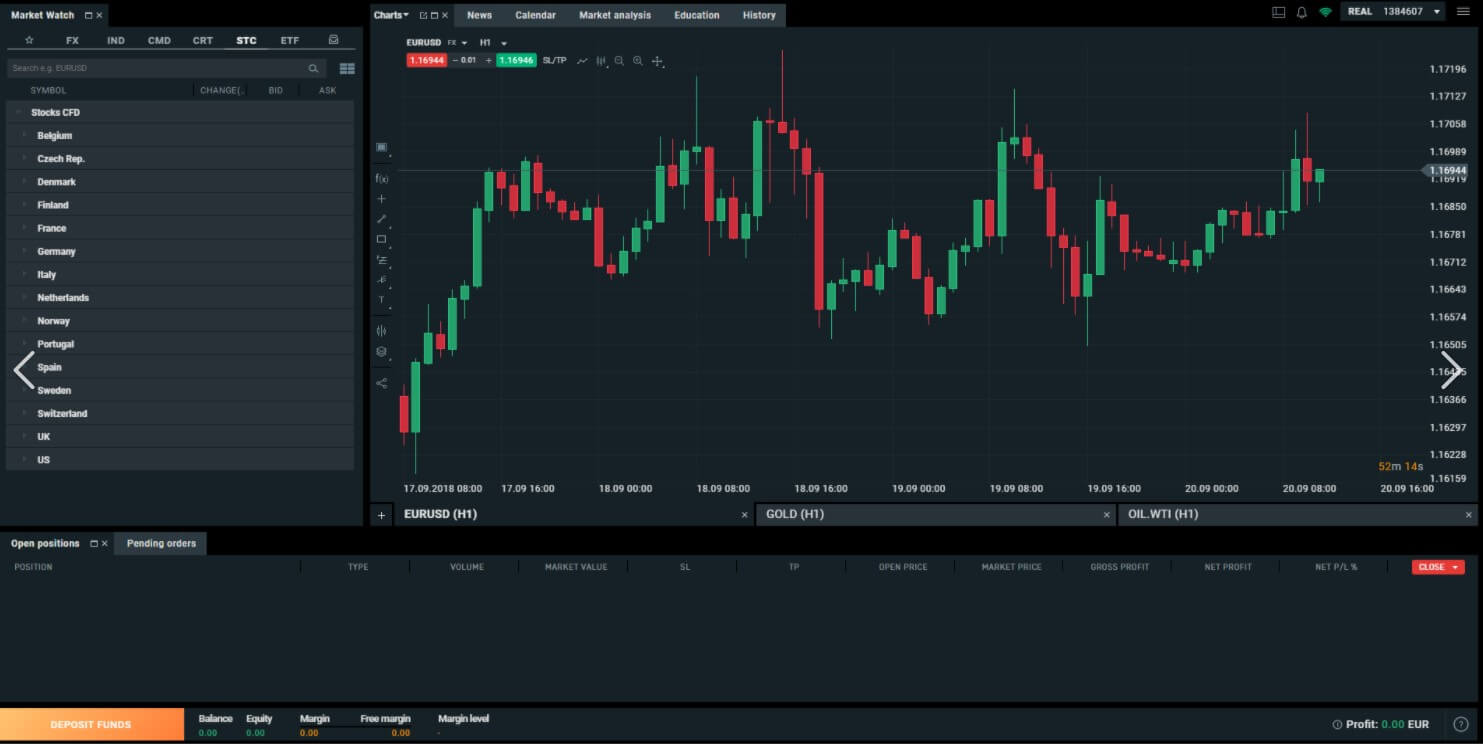

In the currency market for its features, tools like indicators, scripts. the queen is Metatrader. Don’t get me wrong, I’m not telling you it’s the best, but it’s the most used. That is why you will find a multitude of resources and this coupled with the fact that it is free in the vast majority of brokers makes it have a great community behind it. This is very important because you will find solutions faster with software that thousands of people use than just a few.

Like the vast majority, it has defects and many things to improve. The positive thing is that there are many people every day working for it.

Free Trading Platforms

The vast majority of brokers offer various associated trading programs. This is because it is convenient for traders to have the tools to be able to trade through competent software, an attractive interface, speed. It is simple. If the trader feels comfortable makes trades and the broker wins. In addition, if you offer good alternatives at the platform level is attractive so you can open up count on it and start working. Would you open an account with a broker who has trading tools that are not up to the task? It wouldn’t make sense. They know it well and therefore try to offer them.

Most trading platforms are free, especially on Forex. Others instead charge you a monthly, quarterly fee or a payment to acquire the lifetime license as is the case with Ninja Trader for futures. They also offer you a free platform in exchange for a minimum of trades. You’ll finally pay for doing business.

Especially if you’re starting my advice is don’t spend money on software unless you’re looking for something very concrete. Check out, if you have a not very large account at the end of the year this cost can be important. If you don’t know where to start, many brokers offer free Metatrader. Choose a good one based on your conditions.

Demo Trading Programs

I know you may be thinking that you don’t know how to choose a trading platform or how these types of tools work. Don’t worry, most have a demo version so you can practice with virtual money. You won’t have to make any kind of deposit. Don’t pay for something you don’t know or are sure you will contribute.

Download different software and try them, they are free. Take some time to see how they work and stay with the one who feels more how or suits you. From here, choose the one you choose to get to know it well and make sure you know it before starting with real money.

Something important, invest time to let go and not commit than in real failure fools that make you lose money but do not assume that everything that happens in a simulated account will happen in a real. Of course not, brokers will not execute orders so precisely and emotions come into play.

Comparison of Platforms

Are you looking for a listing of major to minor brokers with first and last names? What if that listing was conditioned by what a broker pays me for it? This is very common in this industry and it’s not bad as long as you recommend what you think is best. I will not list you because I do not want to condition you and for this, I have prepared the previous video with some conditions and requirements that will allow you to differentiate between what is a serious trading platform and what is not.