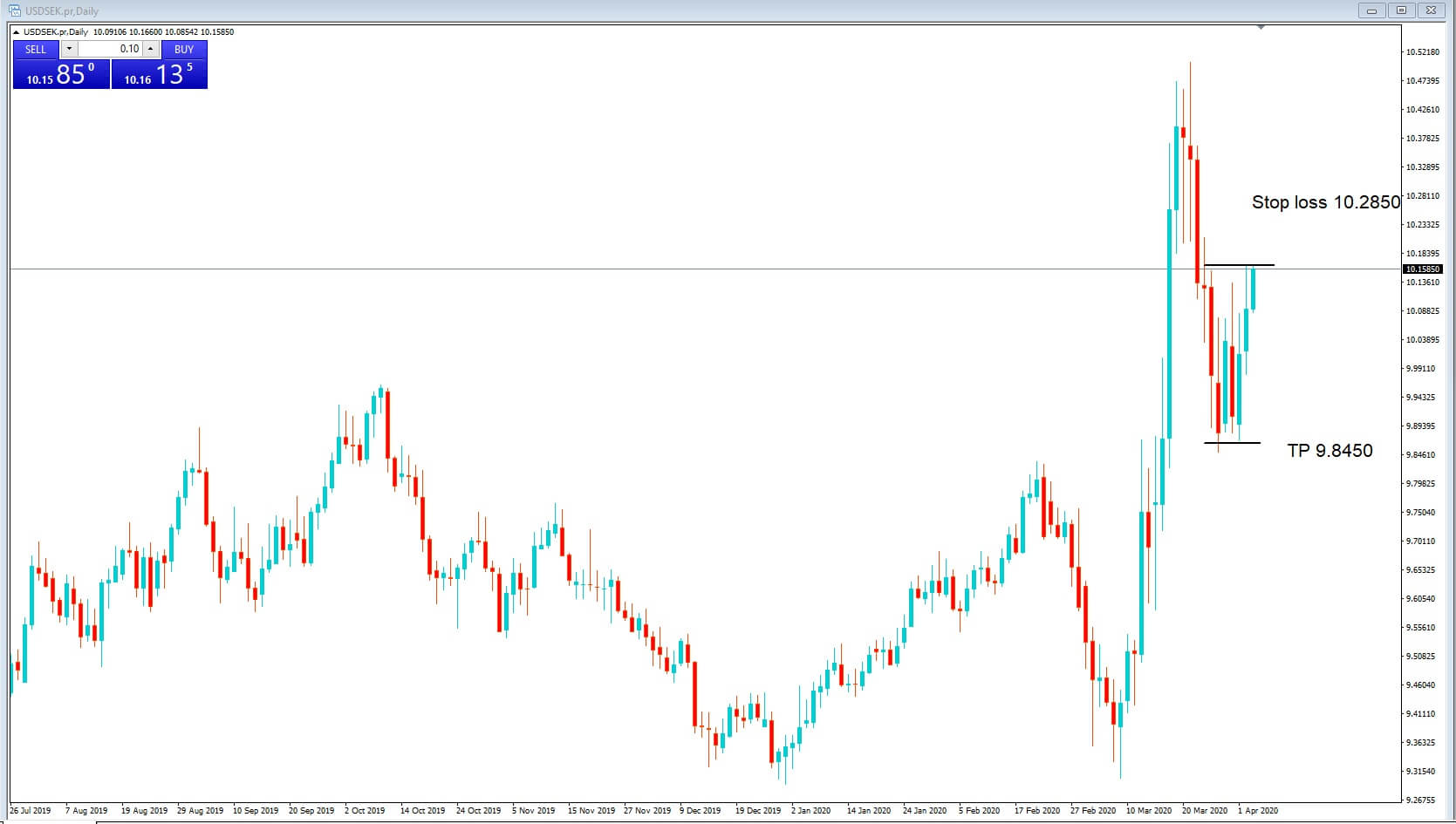

01 USDSEK Daily chart price consolidation

The pair has been confined in consolidation in most of its time frames, including its daily range for over a week and the US Dollar has found high ground with the DXY up at almost 100.00 at the time of writing. We can see a record high for the pair on the daily chart and an aggressive reversal in price action.

With the Non Farm payrolls anticipating a huge hit on unemployment with a possible swing for March at -250K (where we know April’s will be in the millions) we should expect some reversal in Dollar prominence and therefore this pair should move back to the lower bound of its daily range.

In the run-up to the Non farm data release, we should expect some tightening in price action while the market looks for directional bias depending on the numbers. That said, with the knowledge that we are definitely not going to see the kind of growth in jobs that the USA has been used to and in fact a loss, we can be fairly safe in our expectation of a blip to the downside with the Dollar, at least in the interim.

Target 9.8450

Stop loss 10.2850

Market entry

Risk:

Standard lot : $1500

Mini lot $150

Micro lot $15