During Thursday’s European trading session, the USD/CAD currency pair extended its early-day losses and remain depressed below 1.3300 level despite the broad-based US dollar fresh strength. However, the US dollar took some fresh bids in the wake of upbeat US ADP numbers. Hence, the US dollar fresh strength could be considered as one of the key factors that help the currency pair to limit its deeper losses.

On the contrary, the reason for the sharp declines in the currency pair could be attributed to the gains in the crude oil prices which underpinned the commodity-linked currency the Loonie, and contributed to the currency pair’s declines.

Despite the US-China tussle, fears of the coronavirus (COVID-19), and political uncertainty, the global market risk sentiment remained well supported by optimism over a possible coronavirus vaccine. Besides this, the US policymakers inched closer to the much-awaited aid package despite Wednesday’s failed negotiations, which also used a positive impact on the trading sentiment and made the US dollar unable to put any safe-haven bids.

At the USD front, the broad-based US dollar tried very hard to stop its previous session bearish bias, but the losses remain on the cards the remained depressed as the investors continue to sell US dollars on the back of risk-on market sentiment. However, the upbeat US ADP data helped the US dollar to stop its deeper losses, which becomes the key factor that put the lid on any additional losses in the currency pair.

At the crude oil front, WTI crude oil prices took bids above $40, mainly after the surprise draw in the official oil inventories, shown by the Energy Information Administration (EIA). Apart from this, the broad-based US dollar weakness, as well as hopes of American stimulus, also helped the crude oil prices to extend its overnight gains. Hence, the upticks in the crude oil prices underpinned the commodity-linked currency the Loonie and exerted some downside pressure on the currency pair.

Looking ahead, the market traders will keep their focus on the key US ISM Manufacturing PMI for September, and the weekly Jobless Claims data. Across the pond, Australia’s AiG Performance Mfg Index and Commonwealth Bank Manufacturing PMI will also be key to watch. Whereas, the headlines concerning Brexit, pandemic, and the US Presidential Election will not lose their importance.

Daily Support and Resistance

S1 1.3187

S2 1.3249

S3 1.3276

Pivot Point 1.3311

R1 1.3339

R2 1.3373

R3 1.3435

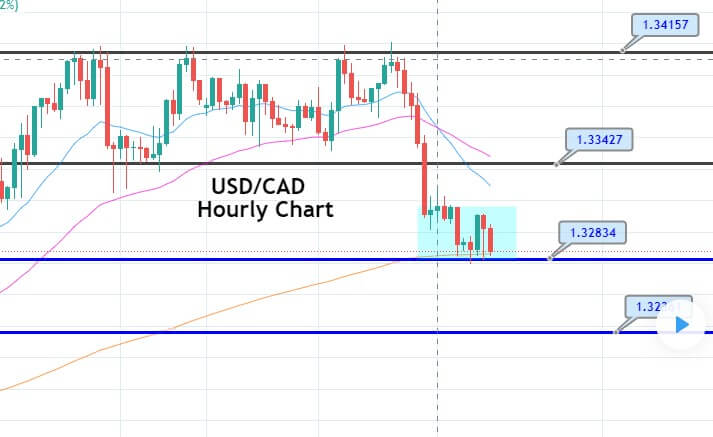

The technical side of the USD/CAD seems bearish as the pair is trading at 1.3287 level, holding right above the double bottom level of 1.3282. On the 2 hour timeframe, the violation of the 1.3282 level, we may see find selling until the 1.3236 level today, and that’s a level which can help us capture a bullish bias around 1.3236. The MACD is supporting bearish bias, but the recent histograms are becoming smaller and smaller, indicating a weakening selling trends. Therefore, we have placed a buy limit of around 1.3252. Check out a full trade plan below…

Entry Price – Buy Limit 1.32523

Stop Loss – 1.32123

Take Profit – 1.32923

Risk to Reward – 1:1

Profit & Loss Per Standard Lot = -$400/ +$400

Profit & Loss Per Micro Lot = -$40/ +$40

Fellas, now you can check out forex trading signals via Forex Academy mobile app. Follow the links below.

iPhone Users: https://apps.apple.com/es/app/fasignals/id1521281368

Andriod Users: https://play.google.com/store/apps/details?id=academy.forex.thesignal&hl=en_US