During Thursday’s Asian trading hours, the WTI crude oil prices looking directionless despite Wednesday’s decrease US inventory report. However, the crude oil prices trading mostly unchanged on the day near the $25.40. Technically, the 4-hour chart shows prices are confined between the tight price range outlined by the trendlines from May 7 and May 13 highs and May 6 and May 7 lows.

The reason for the confined trading could be attributed to the risk-off market sentient and second wave of coronavirus, which turned out to be one of the key factors that kept a lid on any gains in oil prices. The WTI crude oil is trading at 25.82 and consolidate in the range between the 25.20 – 26.00.

A range breakout would indicate a continuation of the recovery rally from lows below $10 observed in April. However, a bearish reversal would be confirmed if the range is breached to the downside.

Thus, the breakout can’t be rejected because the US inventory report released Wednesday showed the 1st-decline in outputs since January. The US crude inventories dropped by 745,000 barrels last week, the Energy Information Administration said, compared with analysts’ expectations in a Reuters poll for a 4.1 million-barrel rise.

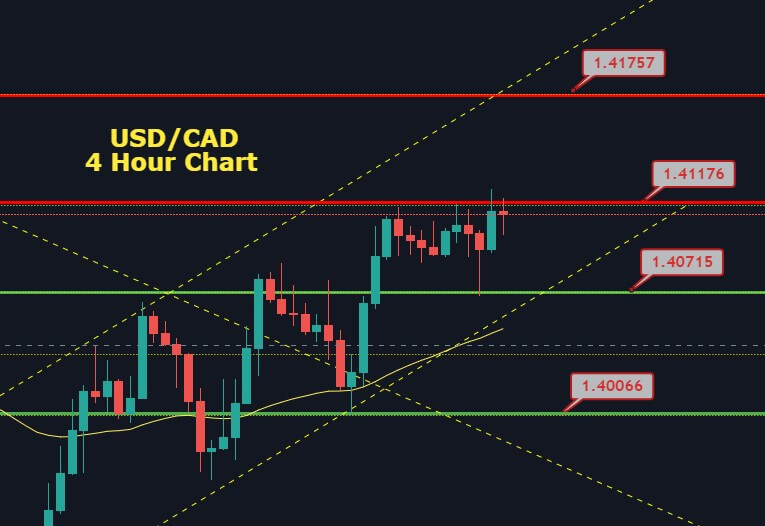

Support Resistance

1.4032 1.4144

1.3962 1.4186

1.3919 1.4256

Pivot Point 1.4074

For the time being, the investors are cautious about placing any strong position mainly due to the fear of coronavirus second wave caused y easing lockdowns. As well as, the reason for the risk-off market sentiment could also be attributed to the renewed concerns concerning the economic slowdown.