The USD/CAD pair was closed at 1.27217 after placing a high of 1.27504 and a low of 1.26884. The currency pair USD/CAD dropped on Thursday amid the rising crude oil prices and the US dollar weakness. The USD/CAD pair came back to declining momentum after reversing from Wednesday’s high above 1.2790. The Canadian dollar benefited from a weaker US dollar and rising crude oil prices on Thursday that dragged the currency pair USD/CAD on the downside. On Thursday, the US dollar was weak across the board amid the combination of rising hopes for US stimulus, a rising number of coronavirus cases, increased bond purchases by Fed, and the disappointing jobs report from the US labor department.

The ADP Non-Farm Employment Change in November came in as 40.8K and supported the Canadian dollar that resulted in the declining USD/CAD prices on Thursday. From the US side, at 18:29 GMT, the Philly Fed Manufacturing Index in December dropped to 11.1 against the expected 20.1 and weighed on the US dollar and added further losses in the USD/CAD pair. At 18:30 GMT, the Unemployment Claims from last week advanced to 885K against the expected 817K and weighed on the US dollar, and supported the USD/CAD pair’s downside momentum. For November, the Building Permits advanced to 1.64M against the expected 1.55M and supported the US dollar, and capped further downside in the USD/CAD pair. The Housing Starts in November remained flat as expected 1.55M.

Meanwhile, the greenback was weak across the board as the total number of coronavirus cases surpassed about 17M in the US and weighed on the local currency. The rising hopes for the US stimulus also added in the US dollar pressure as the Democrats and Republicans were moving closer to reach a deal by the end of this week. Furthermore, the Federal Reserve’s latest decision to increase its bond purchases to support the economy through the second wave of the pandemic also added pressure on the US dollar and dragged the USD/CAD prices on the downside.

Furthermore, the WTI crude oil prices also increased on Thursday and reached $48.58 per barrel, supporting the commodity-linked currency Loonie. The strong Loonie then ultimately added further losses in the USD/CAD pair.

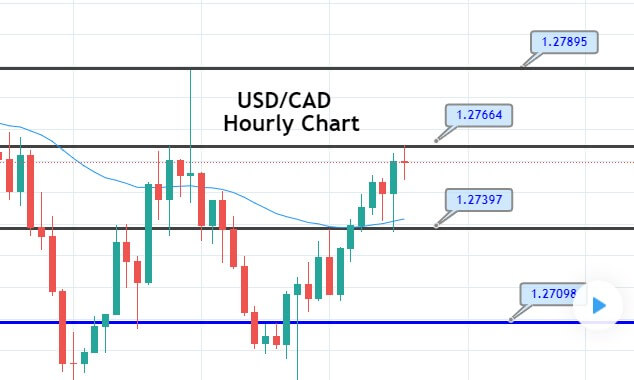

Daily Technical Levels

Support Resistance

1.2694 1.2790

1.2646 1.2838

1.2597 1.2886

Pivot Point: 1.2742

The USD/CAD pair’s technical side is extending double top resistance at 1.2766 area, and bullish crossover of this can lead USD/CAD price further higher until the next resistance level of 1.2789 level. On the lower side, the support holds around 1.2740 and 1.2709 level. The 50 periods EMA is supporting buying trend. Thus it may extend upward movement until 1.2790 level upon the breakout of 1.2766 support. Overall, the market is lacking volatility as we are heading towards the holiday session. Let’s consider staying bullish over 1.2766 resistance and selling below the 1.2740 support level. Good luck!