The euro (symbol: €/code: EUR) is said to be used by approximately 341 million individuals each day, thus making it the second most-used currency in the world. The currency’s name was formally adopted in 1995 in Madrid upon then President of the European Commission, Jacques Santer, receiving a letter by Belgian Esperantist Germain Pirlot offering the suggestion. Like other currencies, the EUR used to be a commodity currency before becoming a fiat currency in the 1900s.

The idea of creating the EUR commenced in 1992 when certain documents were signed to initiate the process. Years passed and in 1998 a number of countries officially decided to gather around the same currency and adopt the EUR. Before this happened, each European country used a different currency: Germany – German Mark, France – French Franc, Italy – Italian Lira, Span – Peso, etc. These old currency notes were after 1998 exchanged over the new currency we now know under the name euro. This change allowed for easier migrations, travels, and commerce within the continent where an hour or two can get you from one country to several others.

Having a central currency helped the member states overcome and bypass many of the barriers that had previously existed. The EUR unites 19 of the 27 European Union member states in a monetary union called the eurozone or euro area. Many countries in the European territory have decided against using the currency, such as the majority of the Scandinavian countries and the United Kingdom, among others. The following Euro area member countries use the EUR: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain.

Having a central currency helped the member states overcome and bypass many of the barriers that had previously existed. The EUR unites 19 of the 27 European Union member states in a monetary union called the eurozone or euro area. Many countries in the European territory have decided against using the currency, such as the majority of the Scandinavian countries and the United Kingdom, among others. The following Euro area member countries use the EUR: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain.

Some countries are part of the EU but have yet to meet certain conditions to be able to adopt the EUR: Bulgaria, Croatia, the Czech Republic, Hungary, Poland, Romania, and Sweden. The following European microstates also use this currency: the British Overseas Territory of Akrotiri and Dhekelia, Montenegro, and Kosovo. The EUR is used outside Europe as well, in special territories of EU members, further complemented by other currencies pegged to the EUR. Countries can join the euro area through fulfilling convergence criteria that are binding economic and legal conditions stipulated by the 1992 Maastricht Treaty. The European Commission and the European Central Bank together decide on a country’s candidacy preparedness to adopt the EUR.

After the publishing of the reports stating their joint conclusion, the ECOFIN Council can rectify this decision upon consulting with the European Parliament and Heads of State, formally allowing the adoption process to start. A country’s readiness for euro adoption, the preparedness for the eurozone accession, or the member status may still not grant the full benefits of being a part of such monetary union due to the existence of certain individual financial irresponsibility which causes other countries to suffer. History has shown us how the more responsible member states had to step in in order to help the other struggling countries, and the period between 2008 and 2010 truly pointed to some concern whether the EUR could endure any longer. Greece, Spain, Ireland, and Italy, for example, were debated upon with regards to the question of keeping the membership status or discontinuing the use of the EUR.

Cyprus is another example of a country that would have collapsed a long time ago were it not for the European Central Bank’s approval of emergency funding. The future still has several questions to find answers to – can so many countries with different cultures, ethics, history, economies, and overall individual differences maintain this union, and can the currency survive the continual struggles it undergoes? While the future alone holds these answers, the idea behind so many countries united under the same currency still prevails even in the EUR banknotes ranging in denomination from €5 to €500. The seven colorful bills, Austrian artist Robert Kalina’s work of art, do not display famous national figures but feature Europe’s map, the EU’s flag, and arches, bridges, gateways, and windows, symbolizing the unity of Europe.

European Central Bank (ECB)

European Central Bank (ECB) is one of the seven institutions of the European Union and the governing body responsible for the 19 EU countries which have adopted the EUR. Headquartered in Frankfurt, Germany, the ECB employs more than 3,500 individuals coming from different parts of Europe and collaborates with the national central banks within the euro area (Eurosystem). Unlike the government of the United States, which in contrast only needs to consider its personal interests, the ECB must create monetary policies in a way that would best benefit all countries connected by the EUR. Although directly governed by European law, this institution resembles a corporation due to its structure of three decision-making bodies: the Governing Council, the Executive Board, and the General Counsel.

The ECB is a single-mandate institution tasked with setting the interest rates for the eurozone, managing the eurozone’s foreign currency reserves, ensuring the supervision of financial markets and institutions and the functioning of the payment system, authorizing eurozone countries’ production of the EUR banknotes, monitoring price trends, and most importantly assessing price stability (inflation). Unlike other central banks, the ECB is not responsible for promoting employment or growth; however, this approach appears to be slowly changing, realizing the need to foster economic development. With regards to decision-making, the main body within the ECB responsible for this task is the Governing Council and all decisions are based on the majority of the votes of the body’s members. It consists of the six members of the Executive Board, accompanied by the governors of the national central banks of the 19 eurozone countries.

The ECB is a single-mandate institution tasked with setting the interest rates for the eurozone, managing the eurozone’s foreign currency reserves, ensuring the supervision of financial markets and institutions and the functioning of the payment system, authorizing eurozone countries’ production of the EUR banknotes, monitoring price trends, and most importantly assessing price stability (inflation). Unlike other central banks, the ECB is not responsible for promoting employment or growth; however, this approach appears to be slowly changing, realizing the need to foster economic development. With regards to decision-making, the main body within the ECB responsible for this task is the Governing Council and all decisions are based on the majority of the votes of the body’s members. It consists of the six members of the Executive Board, accompanied by the governors of the national central banks of the 19 eurozone countries.

The Governing Council typically meets twice a month at the premises of the ECB, yet the monetary policy will be announced in only one of these meetings. The current President of the ECB, Christine Lagarde, who was born in Paris, France, has been performing this task since November 2019. The ECB President, who has the tie-breaking vote, bears a variety of responsibilities: heading the executive board, governing different bodies within the ECB, and representing the bank abroad.

Key Economic Reports

Eurozone’s economic reports differ greatly from the ones of other countries outside Europe. Australia, for example, creates a report that only concerns the country in question. When it comes to the Eurosystem, there are as many reports as there are member countries. Nonetheless, only the reports of France and Germany are said to be of importance for forex traders, as the former holds 40% and the latter holds 20% of the eurozone’s GDP, making the two countries 60% holders of the entire GDP of the Eurosystem. Therefore, due to the previously mentioned percentage, the occurrences within Germany and France should carry more meaning than those in smaller countries.

The main reports traders should be concerned with are then the GDP and employment reports of France and Germany. Moreover, apart from these independent reports, traders should also look into the Eurozone’s employment reports, providing information for the entire Eurosystem. Last, French, German, and eurozone inflation reports (CPI and PPI), are also vitally important as the ECB’s main goal is to combat inflation and its monetary policy will cover all territories governed by the EUR. As the eurozone tends to be growing, the reports in question will cover more and more territories, and traders should keep up with the relevant information in order to be on top of the events pertaining to the EUR.

The Most Traded Pairs

The most traded pairs involving the EUR are EUR/USD, EUR/JPY, EUR/CHF, EUR/GBP, EUR/CAD, and EUR/AUD. As the most traded pair in the world, EUR/USD 36% of all trading volume in the world, which is almost half of all transactions worldwide. As traders interested in news events primarily define liquidity, such great interest in this currency pair probably originates from the fact that it has the most liquidity. The second currency pair in line, EUR/JPY, is said to have the most liquidity, alike EUR/CHF which rounds up the three most traded currency pairs that overall do the most business. The other crosses, EUR/CAD and EUR/AUD appear to be quite popular in the currency market due to their overall good movement and predictable patterns, but the liquidity is not as good as with the first three pairs. Unlike EUR/USD, EUR/JPY, and EUR/CHF, these two currency pairs are increasingly more prone to slippage and volatility. Finally, EUR/GBP is believed to be less volatile than other EUR- or GBP-based crosses owing to the economic closeness and mutual dependence, but changes in the currencies’ respective central banks’ monetary policies could render this pair highly sensitive.

EUR Correlations

- EUR/GBP

A vast quantity of trade the United Kingdom does is with Europe and vice versa, which is what brought on this prominent correlation in the first place in addition to the two both belonging to the eurozone. Despite them using two different currencies, we can with almost absolute certainty predict that if Europe is struggling at a specific point in time, the UK will most likely follow. In the past few years, this correlation has been impacted by various events that took place across Europe. The 2007/2008 financial crisis affected the entire world, but the UK managed to quickly take action to preserve its economy and currency. The UK’s official currency did plummet and the British economy was on the path of collapsing when in late 2008 the GBP reached its all-time low of €1.02. However, they considered revising their monetary policy and offering quantitative easing which eventually helped the country stabilize the economy.

Europe, on the other hand, took more time to come to terms with what had happened and, in the first two years after the crisis had occurred, Europe created the laws that would later prevent them from enacting bailout plans. Changes had to be made and soon after, between 2013 and 2015, Europe would face the emergence of great debt problems in Portugal, Greece, Spain, and Italy. With the announcement of Brexit in June 2016, the GBP suffered the greatest one-day fall of 6.02% against the EUR. Before the COVID-19 pandemic, the GBP was slowly getting back on its feet, but the current ongoing viral threat and the expectation of a new trade deal between the EU and the UK still make the EUR/GBP imitate the strained relationship between the two. The currency pair even went from its worst (1 EUR equaled 0.8301 GBP in February 2020) to its best exchange rate (1 EUR equaled 0.9427 GBP in March 2020) in one month.

- EUR/CHF

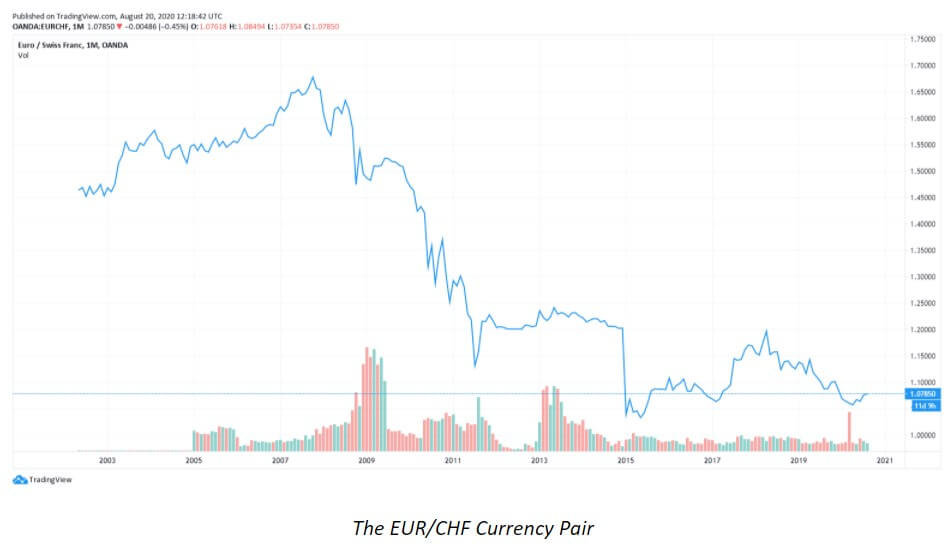

The correlations between the two currencies have been said to near 100% in particular due to the Swiss policies that have tied the CHF to the EUR. In the times of the EUR crisis, when the currency was plummeting, a great amount of money was directed to Switzerland. The Swiss banks are said to be some of the strongest ones in Europe and their neutral government was believed to be extremely stable, which is why many decided to send their euros in that direction. Owing to this great sell the EUR-buy the CHF movement was reflected in the currency pairs huge moves. At the peak of the crises, the pair would move from 1.40 to 1.05 in a matter of a few months. The moment this happened, the Swiss National Bank (SNB) decided to take action, particularly because their currency was that strong at the time. They put a peg at 1.20 and the chart moved 1500 pips up in approximately one hour. The correlation is still quite high and this generally indicates that the currency pair in question is not the best pair to trade. The EUR/CHF is currently believed not to be the pair from which traders can earn the most because if the EUR moves up, so will the CHF and vice versa. These simultaneous moves will often be of the same amounts and the opportunities to make money are thus limited with this currency pair. Instead of trading this pair, some professional traders believe that one should simply choose to trade other EUR-based pairs due to the greater liquidity of the currency.

Trading the EUR

Country Stability

The JPY and the USD are believed to be the safe-haven currencies, yet the USD may at times exhibit some unfavorable behavior. Traders would in such cases naturally divert to the other currencies with the greatest liquidity, i.e. the JPY and the EUR. The USD generally performs well in times of crisis, while in times of economic prosperity these currency pairs such as AUD/USD or USD/JPY seem to be too small liquidity pools. Naturally, the EUR is a favored alternative due to its high liquidity.

Interest Rates

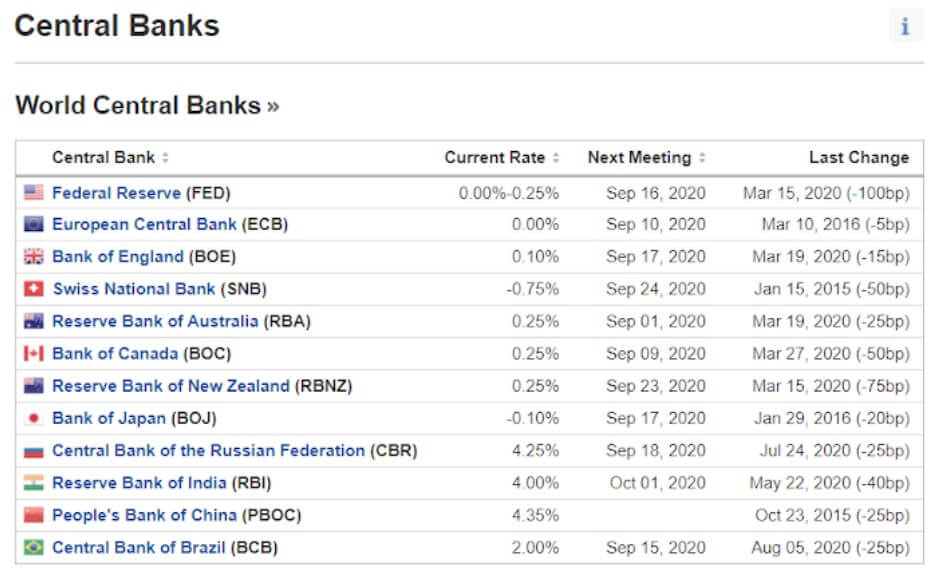

The interest rates within the eurozone averaged 1.84 percent between 1998 until 2020, with an all-time high of 4.75% reached in October 2000 and a record low of 0% in March of 2016. Currently, the ECB’s interest rate is still set at 0%, last confirmed in July this year. The EUR is typically expected to be in the middle compared to other central banks’ rates (available below) and according to some econometric models the Euro area’s interest rate is projected to trend around 0.00 percent in 2021 as well.

Inflation

The topic of inflation is the European Central Bank’s most important aspect and is, thus, an extremely important indicator to which traders should be attentive when looking into Europe’s reports. Each European country has its individual CPI and PPI, but the same of the eurozone is also extremely important and informative. If inflation is below 2%, the ECB is likely to ease the monetary policy, while the approach may change towards the other end of the spectrum should it exceed 3.5%.

Trade Deficits

Unlike the GBP or the USD, the EUR generally does not suffer from trade deficits, as this has traditionally not been a cause of concern in trading with foreign countries with regard to this currency.

Economic Activity

In terms of the overall economic activity within the Eurosystem, traders should look into GDP reports discussed earlier in the text and, in particular, Germany as the largest European economy and the biggest driver.

Market Analysis

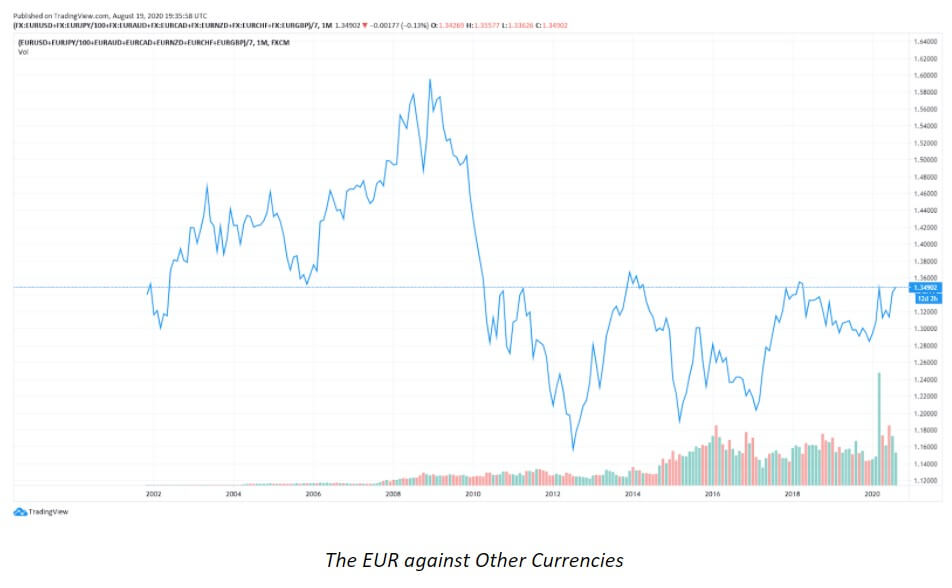

Currently, we are witnessing a decline in overall market volatility with an impactful momentum building up across the markets. As the market keeps moving up, the volatility appears to be further declining. The pattern we are witnessing now, forming towards the end of the chart below, shows how the price broke out and pulled back only to change direction upwards. The EUR crosses rarely appear to be short of such interesting patterns and they seem to be preferred to the upside.

The EUR crosses seem to be developing really well and the EUR/NZD chart, for example, reveals some moving average crosses towards the end of the chart (see all charts below). The EUR/AUD pair also demonstrates this positive development, although we could potentially see a turn of events should the AUD weaken. The EUR/JPY is revealing a momentum taking place, especially when assessing a wider time frame. The EUR/USD activity is unfolding slowly and should it break at some point soon, the price could potentially exceed 1.20. Generally looking at the EUR basket, there seems to be a great possibility for a breakout very soon.

The market has not been showing a great deal of action in the previous few weeks, thus not pushing traders to enter new trades each day. As the final week of August is about to complete the month, we are looking into September expecting more volatility to break the previous consolation and calm periods. Traders interested in trading news events may need to patiently wait out this quiet period, awaiting new rounds of important reports to come out. The EUR currency pairs are doing well during this period, as it seems from the charts above. Nonetheless, for the time being, it is quite difficult to completely interpret the long-term effects the COVID-19 is going to have on the currency.

The EUR has already undergone crises in the past and yet it has lived to become an even stronger currency. The monetary policy of the ECB seems to be slowly adapting and Europe appears to be working hard to promote the currency and ensure its autonomy. The EUR has never challenged the USD and the EUR’s share in international is significantly lower. Still, the media shows an interest in the development of the EUR in these times of crisis, highlighting the belief that the currency’s potential has not been fully reached on a global scale. The EUR has certainly struggled in the past, in particular when the stronger countries had to step in and provide assistance to the weaker ones.

Despite the global viral threat and the history of this unusual currency, the ECB maintains a positive outlook with regard to the EUR, hoping to further promote the currency through a series of vital steps as well as fiscal and monetary policy changes. Currently, we are looking into the future where the EUR is directed towards stabilizing the monetary union, increasing the currency’s influence, and granting more benefits to the eurozone’s member states.