Introduction

By now, we know that trading Forex market involves trading of currencies pairs rather than just a single currency. The working mechanism of this is quite different from that of the stock market. In the previous lessons, we learned how the buying and selling of a currency pair work. However, this is still insufficient to take a trade on these currencies. Though you have the knowledge of which pair is strong or weak, choosing the right currency pair plays a vital role. There are times where you make a loss even if your analysis of the currency was correct. In this lesson, we shall try keeping you away from incurring these events.

Strength of the currency pairs

As discussed in the previous lessons, in a currency pair, we have something called as a base currency and a quote currency. To brush things up, the left currency on currency pair is called the base currency, and the one on the right is called the quote/counter currency. To trade the forex market successfully, one must do their analysis on both the currencies of the currency pair. For example, if you wish to trade the EURUSD currency pair, having knowledge in either EUR or USD is insufficient. Instead, you must have insights on both the currencies. This will not only prove the rightness of your analysis but will also reduce your risk considerably. Now, let us understand this in detail.

The answer to ‘why’ you must consider both currencies in a currency pair in your analysis rather than just one currency lies in the previous lessons. Well, when you go long/short on a currency pair, you are actually buying one currency and simultaneously selling the other one. So, if you analyze only one currency, you will be blindly be hitting a buy or sell on the other currency. Hence, it becomes equally important to consider the other currency in your analysis as well. For example, if you buy AUD/USD thinking that AUD is strong, there is no certainty that the prices of this pair will rise, as USD has its role to play as well.

Choosing the apt pair to trade

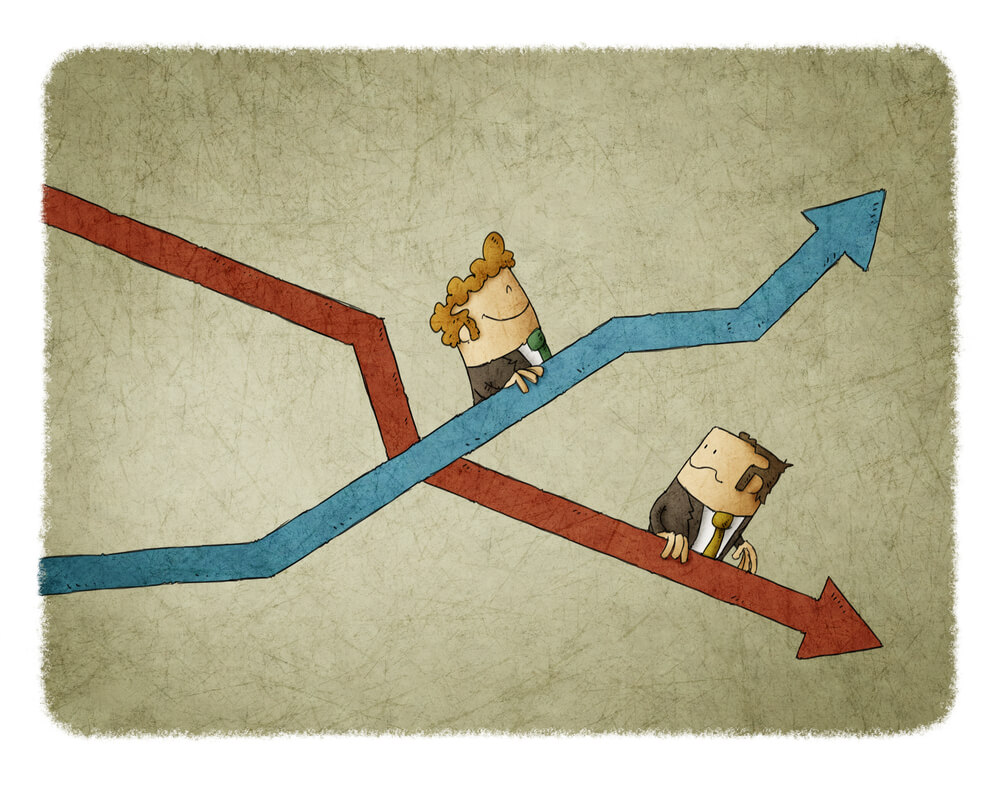

The answer to choosing the right currency pair is self-explanatory. It is always recommended to choose a currency pair where one of them is strong, and the other is equally weak. For example, let’s say in the USD/CHF pair, USD is strong, and CHF is weak. Ideally, one would buy a currency that is strong and would sell a currency pair that is weak. Coming to the case of USD/CHF, if you buy this currency pair, you are buying the USD and even selling CHF at the same time. Hence, you are basically doubling your success probability or halving your failure probability. If we were to visualize this currency pair, the USD would be shooting to the north while the CHF would be dropping towards the south. And in the form of a currency pair (where the base currency is taken into consideration), the chart would visually look in one direction, which is upward.

Apart from strong vs. weak pairs, you can even trade strong/weak vs. neutral pairs as well. But, note that it is highly risky to trade a strong vs. strong or weak vs. weak as the overall direction of the market becomes hard to predict. We hope you understood this concept. Now, let’s take a quick quiz.

[wp_quiz id=”44815″]