During Wednesday’s European session, the safe-haven metal prices climbed over $1,710 mark mainly because the stocks are reporting losses due to the sharp decline in the oil prices. The intensifying coronavirus fears also keep the gold prices higher as high safe-haven demand in the market.

The gold is currently trading at 1,710, and it has violated the previously traded consolidation range between the 1,696.20 – 1,713.50. One of the major reasons behind such a dramatic bullish trend is lashing red for a second day due to oil futures dropping in the previous session. The yellow metal is witnessing its prices restore its inverse relationship with stocks because investors prefer safe-haven assets in the wake of coronavirus fears.

At the oil front, crude oil, which started this year near $61, dropped into the negative territory earlier this week due to the oversupply concerns in the wake of coronavirus pandemic, which has caused demand destruction of oil. The risk sentiment is getting worse day by day while the US 10-year Treasury yields declined by 2-basis points (bps) to 0.55%, after dropping 4-bps on Tuesday, while the most stocks in Asia-Pacific flashing losses by the pres time.

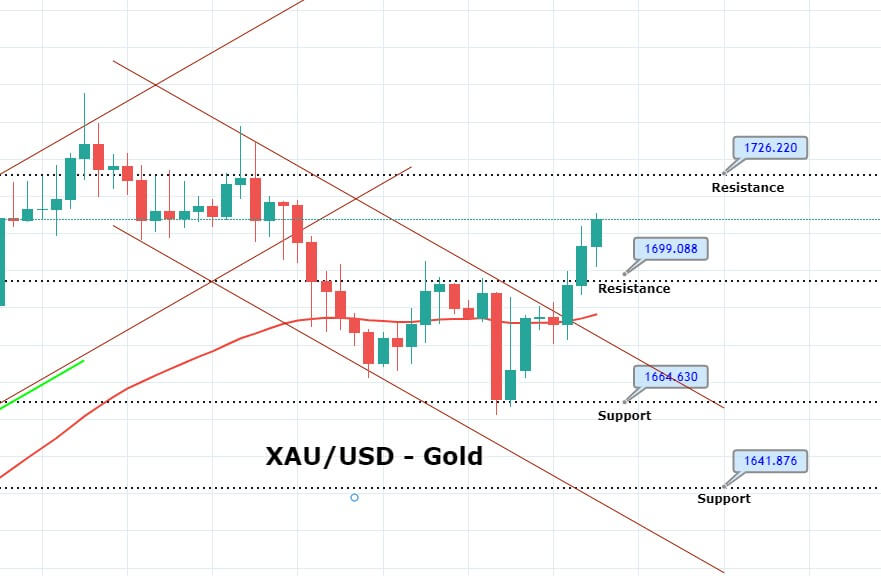

Gold – XAU/USD – Daily Technical Levels

Support Resistance

1,672.4 1,703.07

1,660.04 1,721.39

1,629.37 1,752.07

Pivot Point 1,690.72

Technically, gold is showing sharp bullish movement as its prices are going towards 1,726, while the support stays around 1,700 and 1,710 level. Gold is also forming three white soldiers pattern on the 4-hour chart, which is suggesting chances of a bullish trend continuation in the market. The 50 EMA is suggesting bullish trend continuation, so we should probably look for buying trades above 1,710 level to target 1,726 level. Good luck.