Introduction

Ask any professional trader, what is your secret to making money from the market?

The answer will be they trade the chart patterns to make money consistently.

Chart patterns? Another common answer.

Most of the traders also use the chart patterns, but still, they failed to make money from the market, but these professionals are also making money by using the patterns. Professional and common trader both use the chart patterns to trade the markets but why one is more successful and other even losing the money. What do you think about what will be the reason?

The answer is simple, professionals use the chart pattern, but they use them differently. The common trader just looking for the formation and they take an entry, but this is only the half the picture. On the other hand, professionals never trust on the formation alone; instead, they focus on the psychology behind the candle to successful time the pattern even before the complete formation of the pattern. Before diving deep into the pattern, let me explain the Psychology behind the Hand and Shoulder.

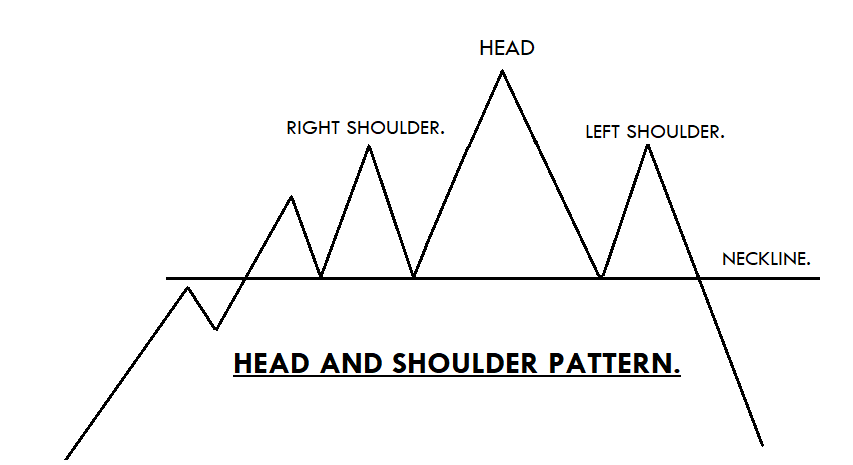

PSYCHOLOGY BEHIND THE HEAD AND SHOULDER PATTERN.

Head and shoulder is a reversal pattern. It appears at the top of the trend, and it indicates the uptrend is over and sooner the market is ready for the brand new downtrend.

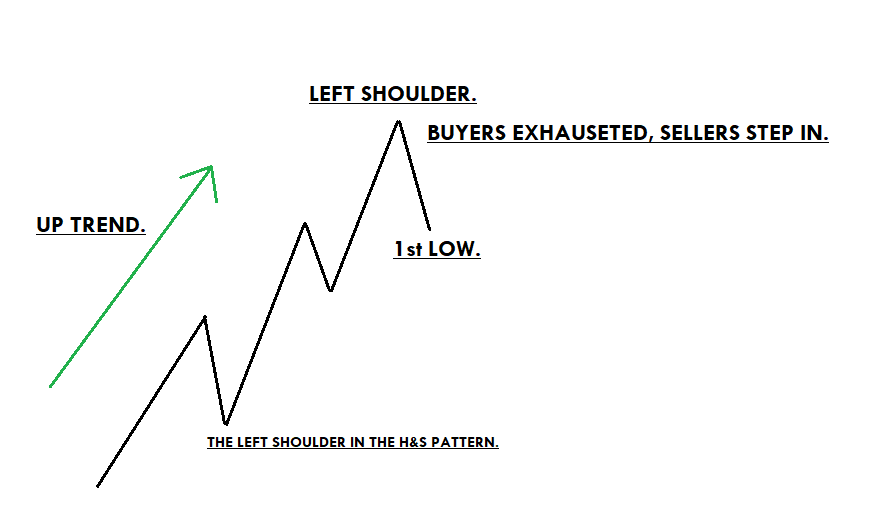

LEFT SHOULDER.

When the uptrend is completely visible to everyone, then it merely means there is an excessive amount of supply in the market, which leads to the pullback phase. If the pullback phase ends up near the most recent higher high, then it simply means buyers are no longer dominated, and sellers are stepping into the game. This is the first sign recognized by the professionals, and they started preparing to take sell trades sooner.

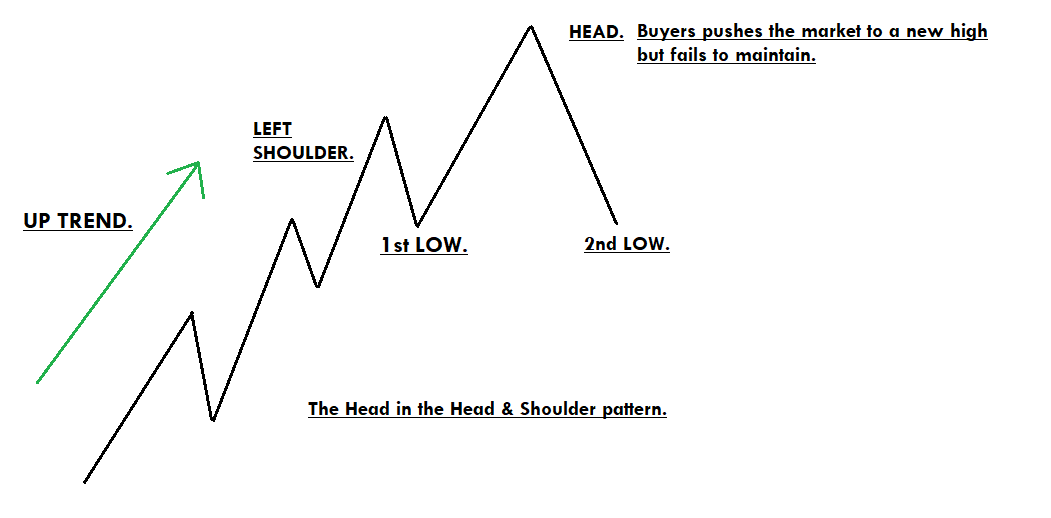

THE HEAD.

After the left shoulder is completed, buyers entered into the game again; they took the prices high again. The sellers, who short sell the market, buy back again, and both of the buyers and sellers printed the brand new higher high. When the prices print the head phase, it means the buyers are completed exhausted, and the sellers again gain the upper hand. This leads to the second low if the Head and Shoulder pattern.

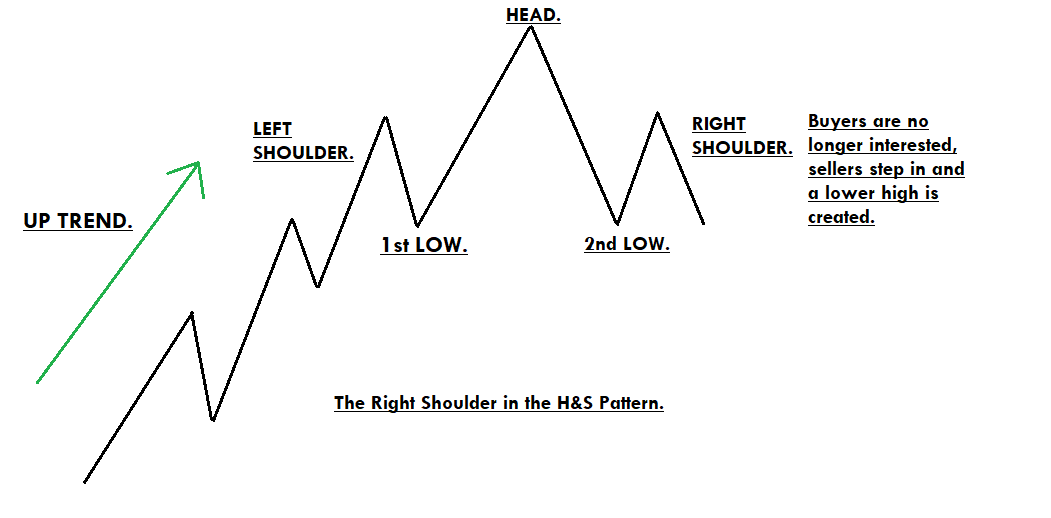

RIGHT SHOULDER.

At this stage of the market, professionals knew the buyers are exhausted and sooner we are going to witness the new downtrend. On the other hand, the common traders still believe that the market is in an uptrend because visually market is giving the illusion of buying trend. So some of the traders who are caught in the illusion retook the buy trade and expecting the brand new higher high because every time price action pulled back it prints the brand new higher high the professional traders looking to take the sell entry near the top of the head. In the end, price action prints the right shoulder, professionals are in profit, and newbie traders are at breakeven with the hopes of the market will go up from the support area. Price action tests the support level but the support failed to hold it, and we witness the brand new lower low. The professional traders enjoying the profits because they didn’t trust the visuals of the patterns, whereas the newbie traders end up in losing side just because of the visual representations makes them blind.

HOW TO TRADE THIS PATTERN.

The one way which is most common among the traders is to let the pattern to form completely then only they execute the trade. You can follow that way, but if you want to level up your game then explain the things deeply and take the trades even before the formation of the pattern. This way, you will get an excellent risk-reward ratio trades, and you will end up making handsome money. Below we shared the two different way to trade the Head and Shoulder pattern. The first one is to trade before the formation and the second way is to let the pattern to form fully to trade it.

FIRST EXAMPLE.

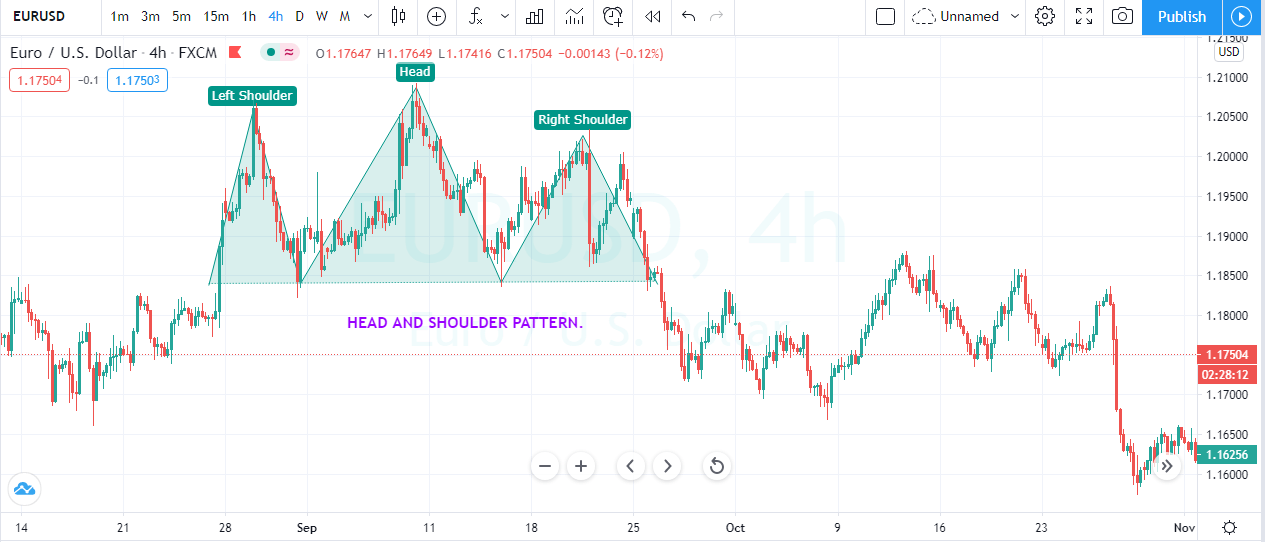

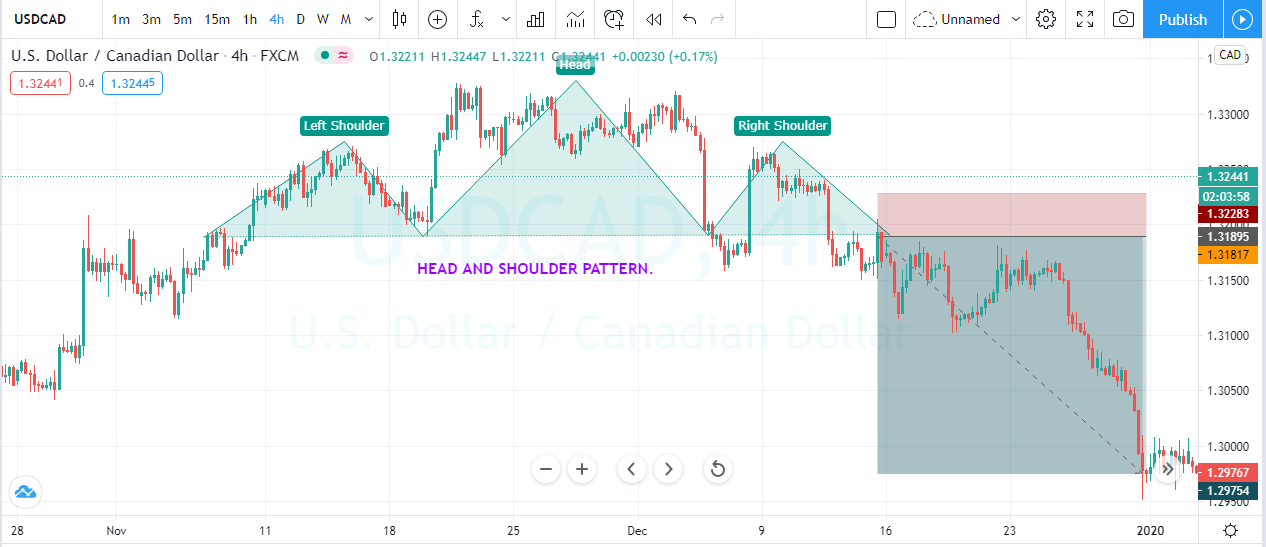

The image below represents the head and shoulder pattern.

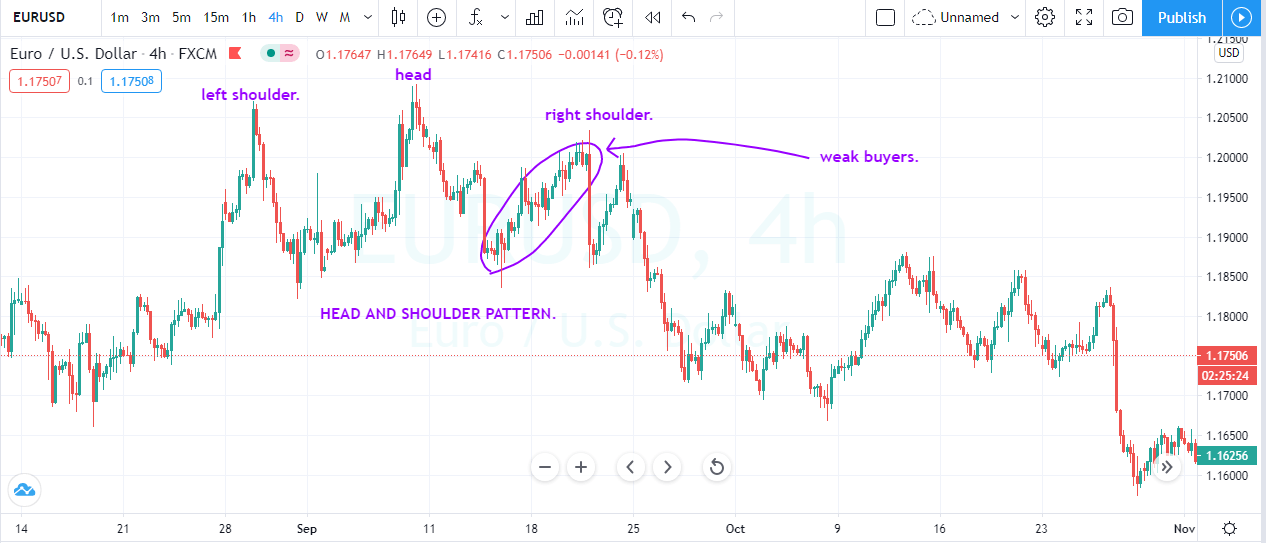

As you can see, the head and shoulder pattern in the image below. The buyers printed the head pattern quiet strongly and check the right shoulder {circled} leg. The right side buyers were super weak, which was a first clue of soon we can expect the right shoulder. Always compare the head’s left leg with the left leg of the right shoulder, and If the buyers were weak, then it’s a sign to take the trade.

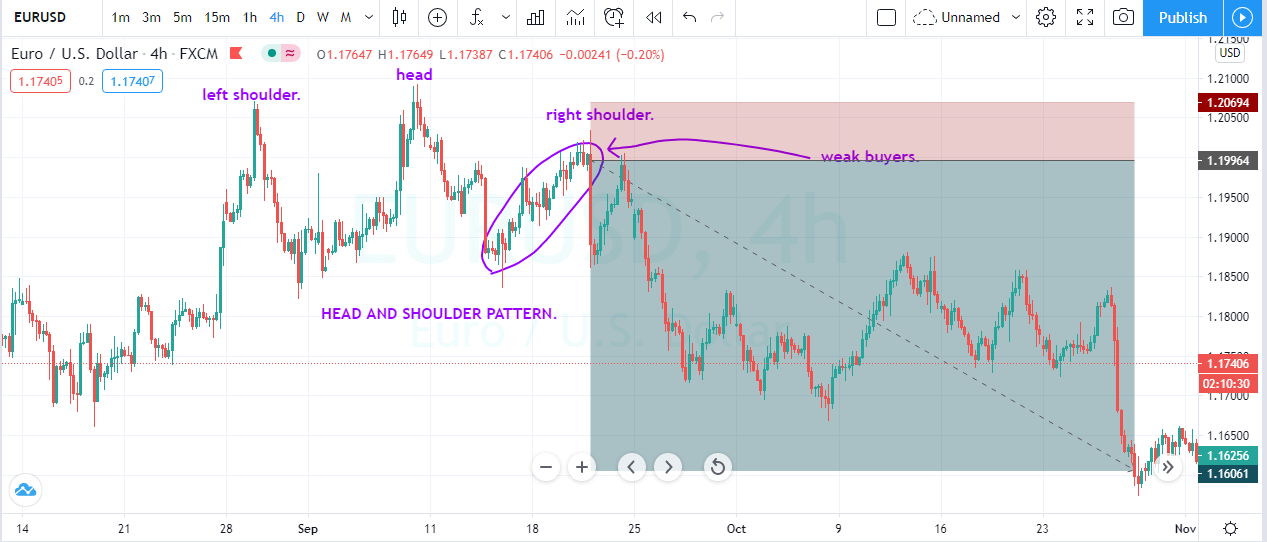

The image below is the entry, exit and stop loss in the EURUSD pair. Here we used the weak left shoulder buyers to take an entry. We used the second supply zone to activate the trade with the stops just above the entry and take profit below the trade.

SECOND EXAMPLE.

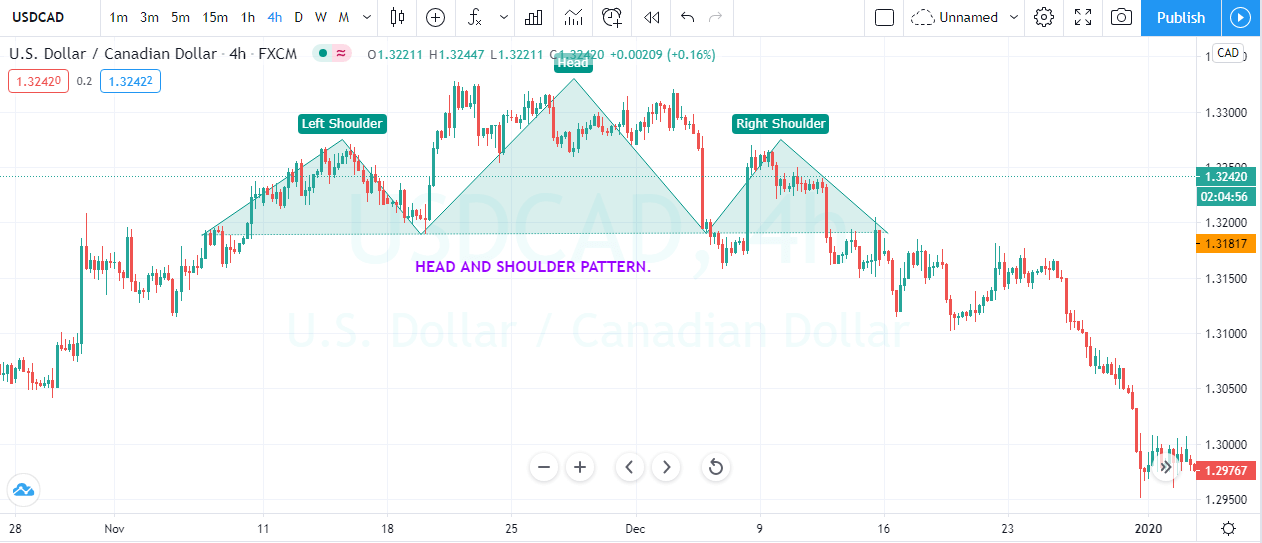

The image below represents the Head and Shoulder Pattern.

The image below represents the buying entry, stop loss and take profit in the USDCAD forex pair. When the market printed the complete pattern, we choose to take the selling trade. You can see that it was a straightforward textbook style pattern where everything was perfect. A complete pattern gave the ideal entry and take profit.

CONCLUSION.

Everything requires the mastery and mastery needs doing the same thing over and over again. The more you practice these patterns on demo and rehearsing them in your mind, the more comfortable you are going to recognize them on the price chart. If you are not a super professional in the game, then try not to use the first trading example in the live market because it requires a lot of focus and you need to believe on your intuition to make a trading decision. When you developed enough neurological networks in your brain, and you are able to spot the pattern within a second, then only trade them. Otherwise, stick to the second method and trade it for a couple of months, then only graduate to the higher levels. In the end, pattern trading is a super easy to make money from the market but don’t get up caught up only in the pattern design, instead, extract the pattern go deeper into it then only make any decision.