Introduction

The chart pattern is the most common way to trade the markets. Patterns are when the price action resembles a common shape like Rectangle, Triangle, Cup and Handle, Head and shoulder etc. These are the visual pattern that provides an excellent risk to reward ratio trades. Here in this article, we will explain to you the cup and handle chart pattern formation. The Cup and Handle is one of the classical pattern used by the traders. The pattern occurs on all the trading timeframes, and it indicates the reversal and continuation signals. On higher timeframes pattern even take two to three months to print the complete formation. This pattern occurs at the end of the downtrend, where the market first is in a downtrend, and then we witnessed the price action challenged the most recent lower low. By printing this movement, we witnessed the ‘U’ type or ‘CUP’ shape on the chart.

Furthermore, when the prices challenged the most recent lower high, then you will witness the handle portion of the pattern. Make sure the handle formation should be smaller than the cup, and it should not drop to the lower half of the cup. Wait for the price action to complete the handle formation to trade the pattern. If the pattern forms in a downtrend then simply it is an indication of reversal and if you witness it in an uptrend, then it means it’s a sign to trade with the trend.

TRADING THE PATTERN ON THE HIGHER TIMEFRAME.

Cup and Handle pattern provides really good trades on the higher timeframe. This pattern holds the ability to reverse the trend entirely, so whenever you recognize this pattern on the higher timeframe, hold it for a couple of months to milk the trend completely. First of all, look for the downtrend and wait for the pattern to form fully. The handle portion of the pattern forms in the shape of the descending channel or a triangle, and even sometimes it goes sideways. Wait for the price action to break above the cup and handle portion to take the buy trades.

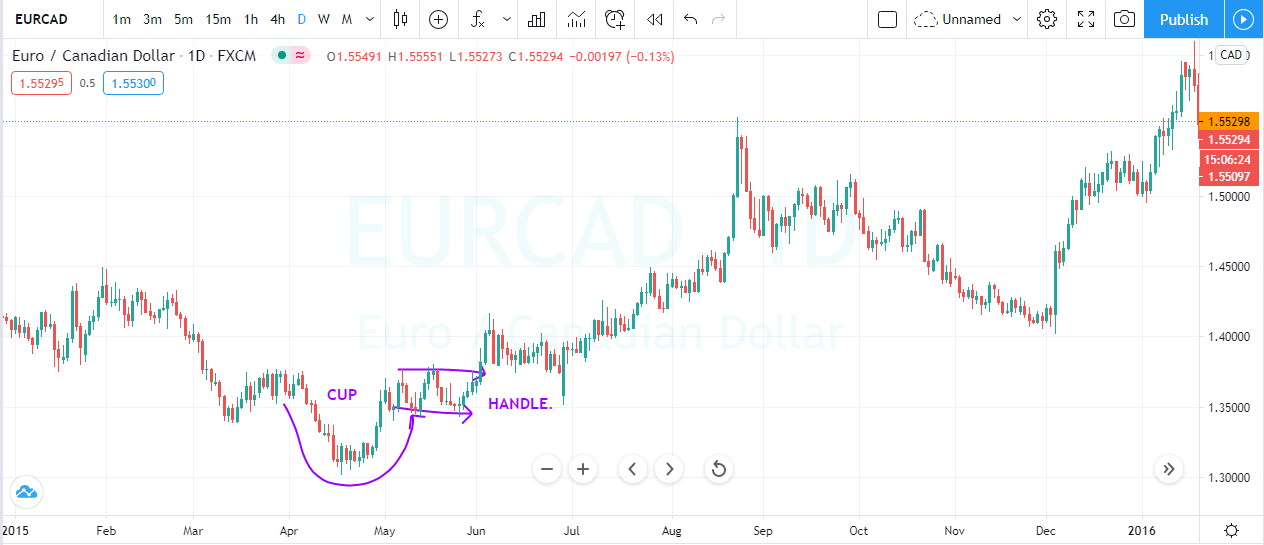

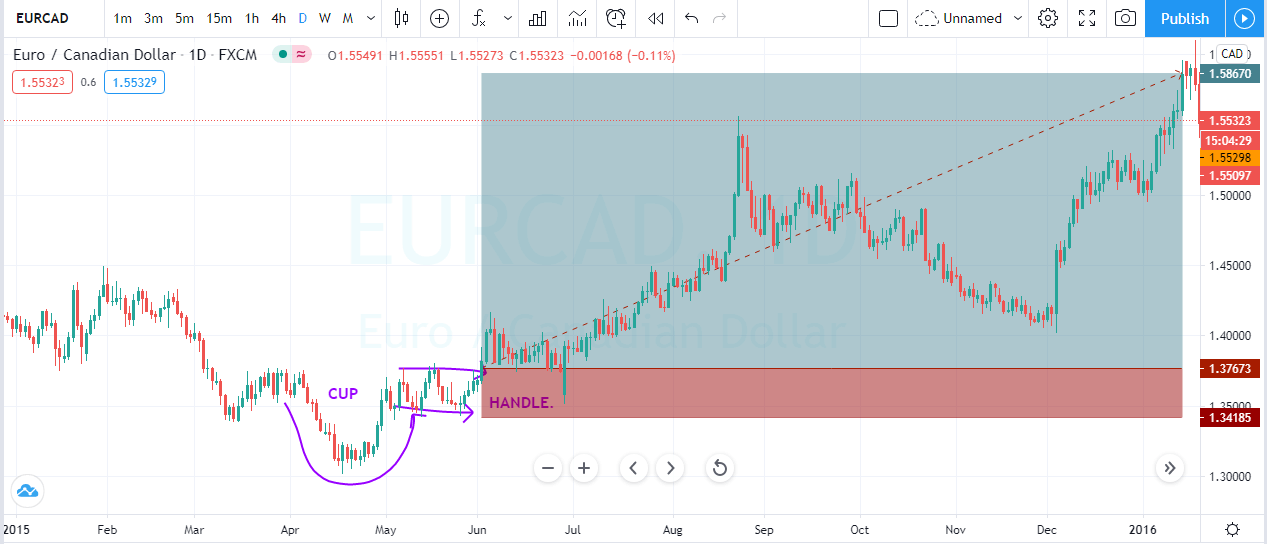

The image below represents the Cup and Handle Pattern on the EURCAD pattern.

The daily chart of the EURCAD indicates the buying trade in the currency as you can see that the currency was in a downtrend and the break of the handle portion above the cup was an indication to go long. On this daily chart our activation was around 1.3767, and with 150+ pips stop loss we choose to go for brand new higher high. Overall it was a really big trade which we hold for nearly six months end up making 2100+ pips.

TRADING THE PATTERN WITH THE TREND.

Cup and handle pattern also provide the intraday or lower timeframes trades. On the lower trades, find out the uptrend, wait for the price action to pull back enough. After the pullback, if the price action prints the cup and handle formation, then take long trade only after the breakout. The stop-loss order must be below the handle portion and go for the brand new higher high.

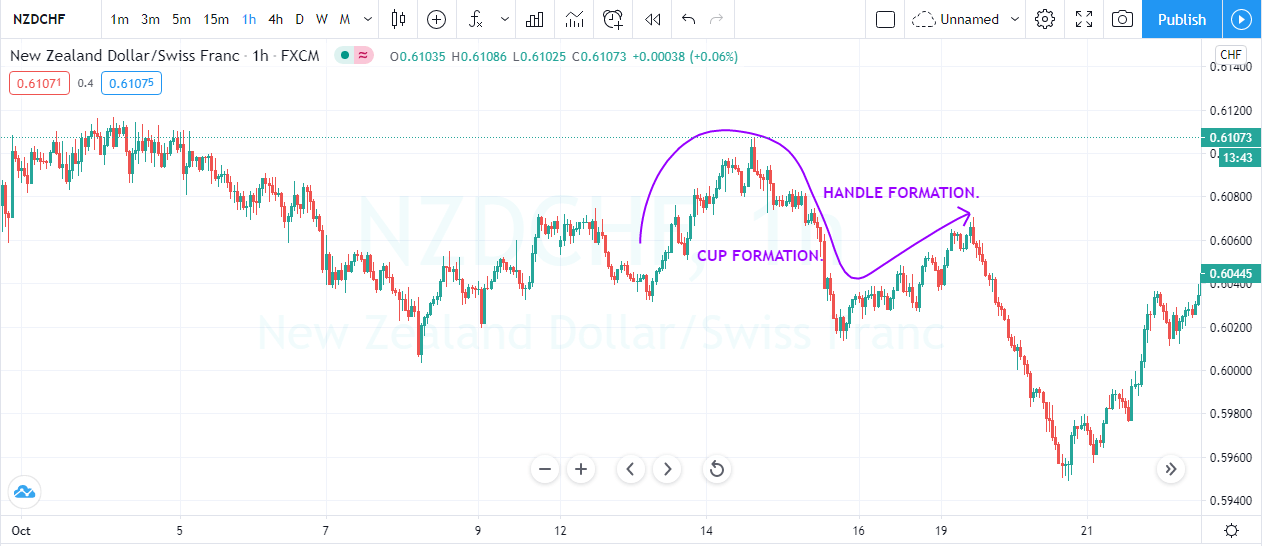

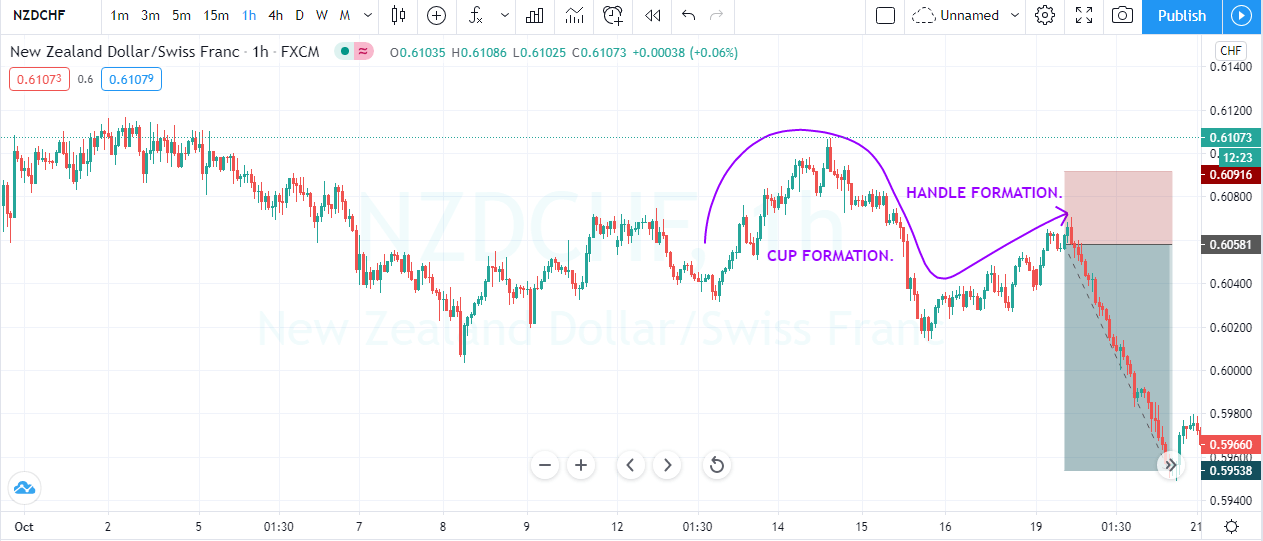

The image below represents the Cup and Handle formation in the NZDCHF forex pair.

The image below represents the selling entry in the NZDCHF forex pair. The currency was in a downtrend, and during the pullback phase prices goes higher and end up printing the cup and handle pattern. In the above trade, we choose to take the entry after the handle breakout, but here we decide to go before the breakout of the handle portion. This is because the cup formation was so strong, which confirms the pattern ahead of time. With the smaller stops, we activate the trade around 0.6058 with a take profit of 0.5953.

PAIRING THE PATTERN WITH THE STOCHASTIC OSCILLATOR.

In this strategy, we paired the Cup and Handle with the Stochastic Oscillator to trade the market. Most of the traders believe that they should trade the pattern alone to make some money. It is possible to trade the pattern alone, but if you pair it with any oscillator, you can easily time the market.

- On the lower timeframe, find an uptrend and wait for the prices to pullback.

- Look for the cup and handle formation.

- During the handle, phase check what the stochastic is saying if it is at the oversold area then go long and go for brand new higher high, and if the stochastic is at the overbought area, then it means buyers are exhausted now and expect the one leg down first. Wait for the stochastic to reach the oversold are to take an entry.

- By using the Stochastic, we are timing the market to the point, so using the more significant stops makes no sense at all. Put the stops just below the handle portion and ride for the brand new higher high.

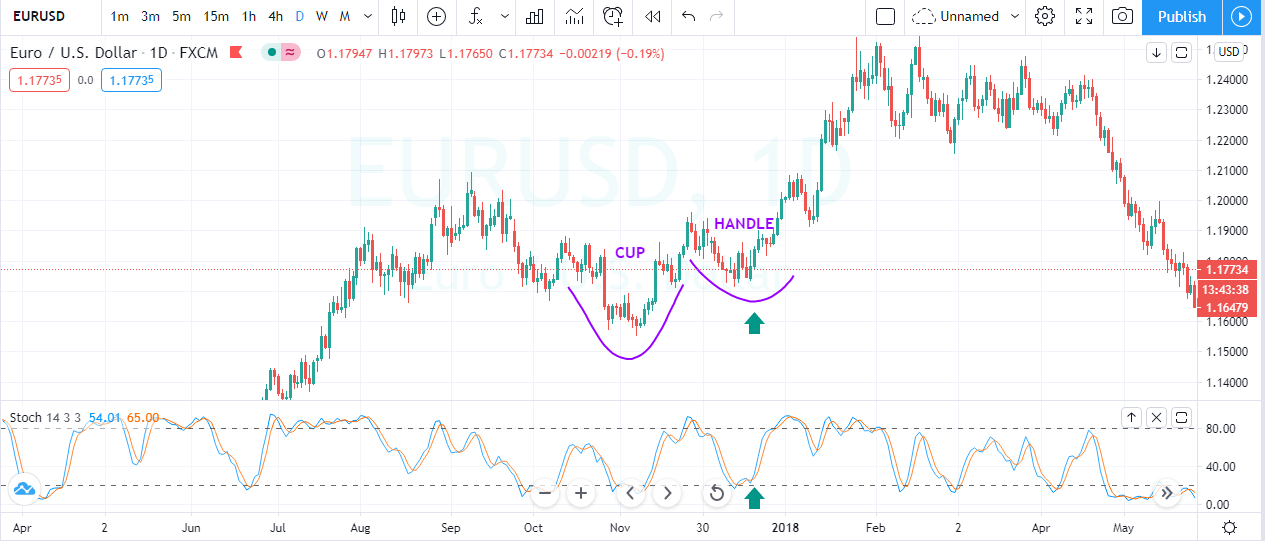

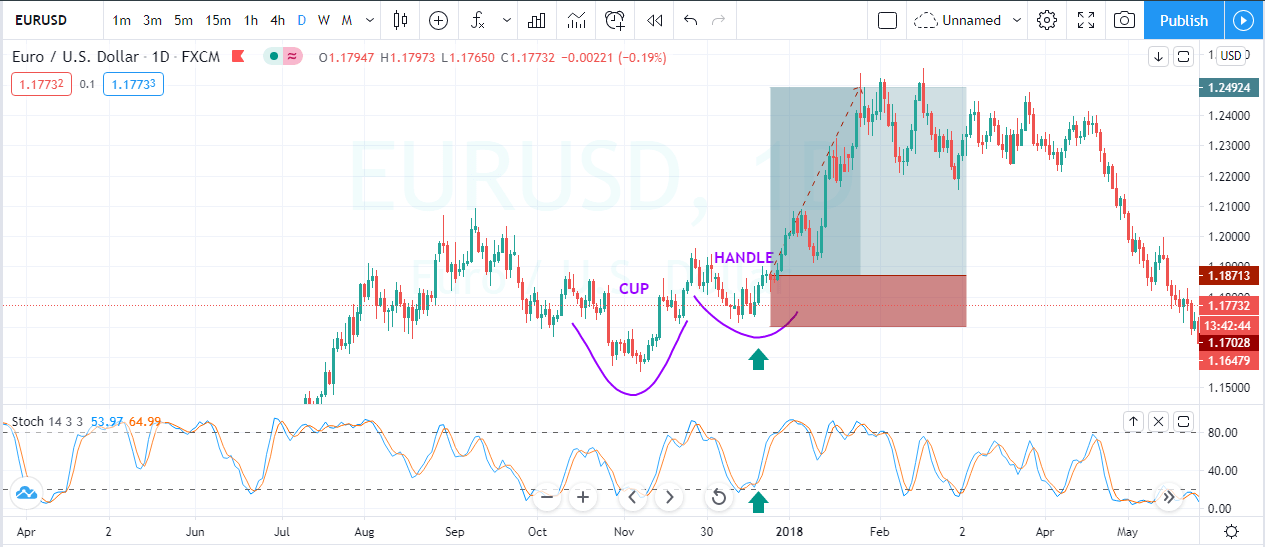

The image below indicates the cup and handle pattern in the EURUSD daily chart.

In the image below the pair was in an uptrend, and during the pullback phase, we witnessed the cup and handle formation. During the handle phase, when stochastic approached the oversold area, it means the sellers who are going down are exhausted, and sooner we are going to witness the uptrend. The stochastic oscillator is very useful to time the market when it helps to activate the trade even before the formation of the pattern. As a result, we can quickly get a better risk to reward ratios.

CONCLUSION.

The cup portion represents the price action found the bottom zone and the prices have very low chances to go down. The brake out of the handle portion means the sellers are no more in the market, and bulls are ready to lead the game. If the pattern came in an uptrend, it means it’s a continuation pattern, and now the market has very high chances to print the brand new higher high. To improve the timing of your trade, you can use the stochastic indicator, or if you are a professional, then there is no need to use any indicator. Cup and Handle is a reliable pattern which performs most of the time; most of the professionals market technicians use these patterns to cash out the money from the market.