Gold vs. Fiat currencies – What to do?

Gold markets have rallied quite a bit during the trading session on Friday. The rally was most likely caused by people that want to preserve their holdings since they find the situation around the world concerning. On top of that, central banks are running their printing presses at full tilt, bringing even more uncertainty to the market. Ultimately, everything suggests that we should see fiat currencies slowly get devalued.

The gold market, on the other hand, is the natural place to go looking to protect your holdings from value drops.

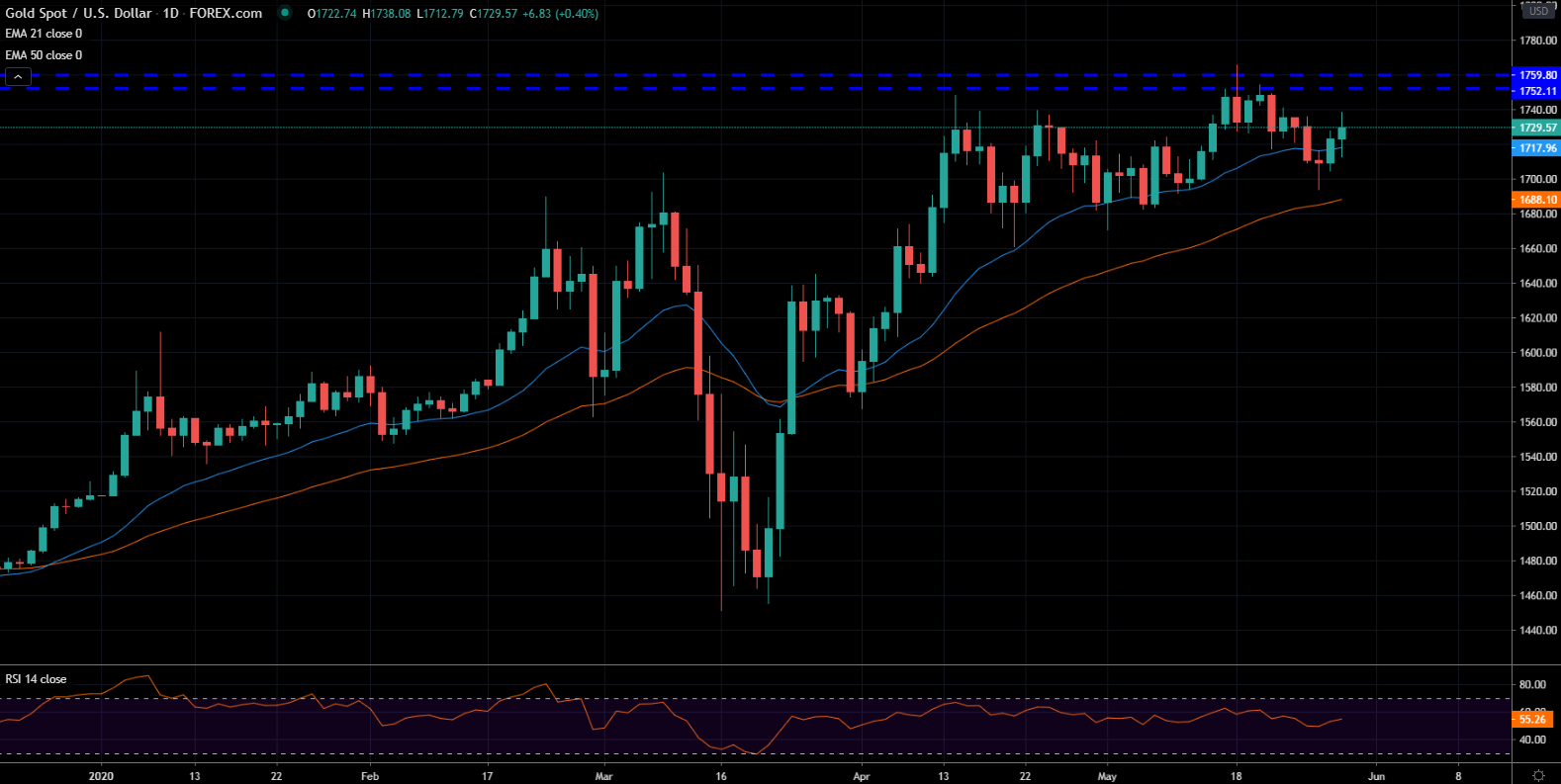

Looking at the chart, even though gold looks quite bullish, the resistance between the $1740 level and the $1760 level might pose a problem. If gold can break above this area, then the market is most likely going towards the $1800 level without many stops. Ultimately, the $1800 level itself is significant resistance, so breaking above it and establishing support would mean much for the future of gold. With all of the various concerns all around the world when it comes to global trade, the pandemic as well as constant fiat printing, it is hard to imagine a scenario where gold doesn’t rise over the long term against the US dollar.

The fiat currency market will have to seek equilibrium and find what the right price is for all the pairs as countries dealt with the global problems differently. This, in turn, affected their economies and currencies differently. Fundamental analysis should be at the forefront of FOREX analysis at the moment.