Gold, buy the dips

Welcome to this forex academy educational video. In this session, we will be looking at the uptrend in gold prices with regard to the possibility of a continuation in this bull trend.

Gold, buy the dips.

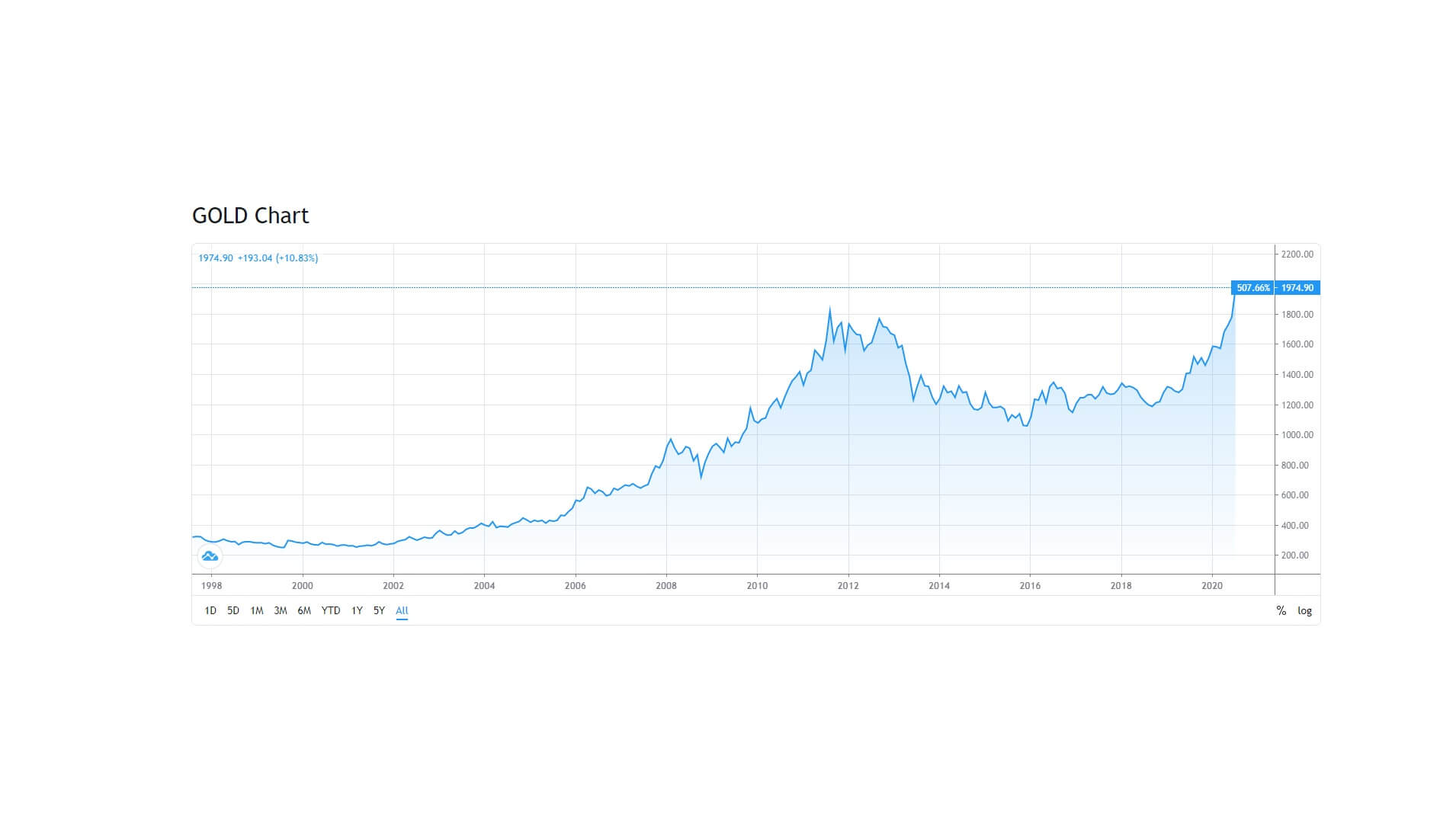

In this historical chart going back to 1998 where prices were just 200.00, we can see an almost exponential rise in the value of gold to its current levels.

Gold, which is the oldest currency on earth, is traded primarily by people looking to invest by taking ownership of the physical product however it is used in the markets four trading on speculation for hedging against swings peaks and troughs in the general financial markets which is pretty much what we are seeing today. The most recent rise in the value of go gold is attributed to the uncertainties in the global financial markets pertaining to the onset of the covid virus.

The recent rise in the value of gold should be attributed to a risk-off event in the financial markets where people are bailing out of certain riskier assets and moving into gold. This includes general speculators who are enjoying the recent bull trend to these historic highs.

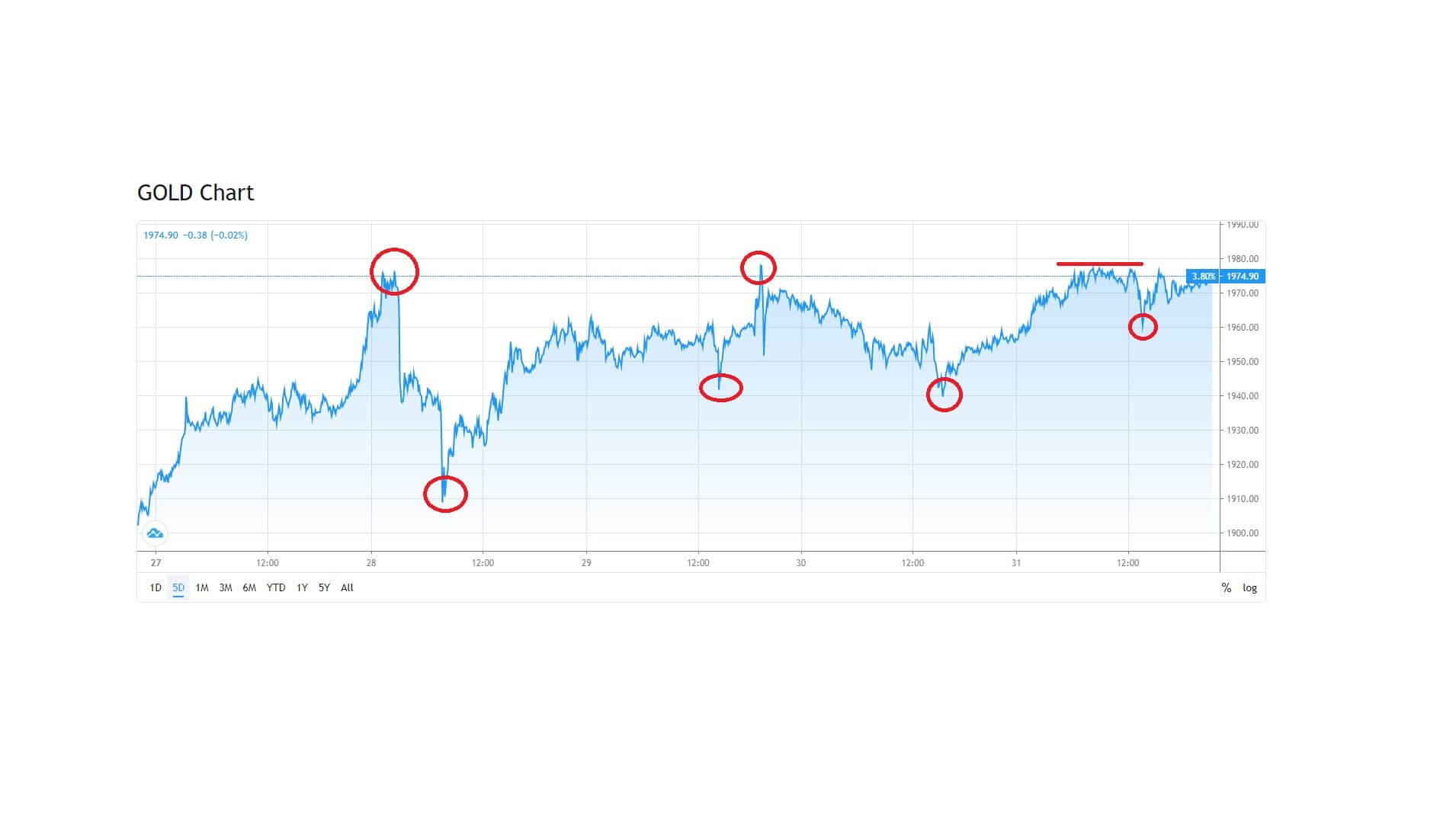

In this 5-day chart, we can see peaks, troughs, and spikes in prices, plus pullbacks and price flattening followed by a slight sell-off, and then continuations to the current highs. Price has generally been able to stay above 1900.00

Analysts at Goldman Sachs have increased their 12-month price outlook for gold to $2,300 a troy ounce. And while stock markets around the world are looking exposed to the continuation in the covid virus with potential falls on the horizon, and where yields are considered to be low in the bond market, it is no surprise that investors are looking for ways to offset their exposure to these assets and recently, for many, gold stands out. The bull trend speaks for itself.

Morning show institutions wrestle with the incredible amounts of stimulus being unleashed into the market by the federal reserve, and well they worry about the potential knock-on effect with regard to rising inflation; as a result, markets tend to reflect on previous similar situations such as the market crash in 2008 and other virus outbreaks in order to predict future price movement. While the big guns worry about the intricacies of the continuing financial crisis, shrewd investors will be following the money. With that in mind, gold is looking like a safe investment, in which case some major analysts are suggesting should continue looking for entries into this gold trend as it nudges up towards 2000.