On Wednesday, the precious metal gold prices trade sideways in a narrow trading range of 1,512 – 1500 in the wake of mixed economic events. Moreover, the uncertainties encompassing the United States and China trade war and dark Brexit headlines depressed investors’ sentiment. The gold futures for December delivery gained 0.5% to $1,511.83 at the start of the European session.

A report came from South China that China stepped back from the high-level trade talks between the United States and China. The report said the Chinese delegation might enter in Washington a day earlier than scheduled.

China also gave warning that they would hit back after the United States blacklisted a list of Chinese tech companies in the wake of China treatment with Muslim minorities, which ultimately threats increased incoming talks between the United States and China.

On the Brexit front, German Chancellor Angela Merkel told Boris Johnson, U.K.’s Prime Minister, that Northern Ireland has to continue being part of the customs union in any deal, which Johnson said has paved the way for a no-deal Brexit.

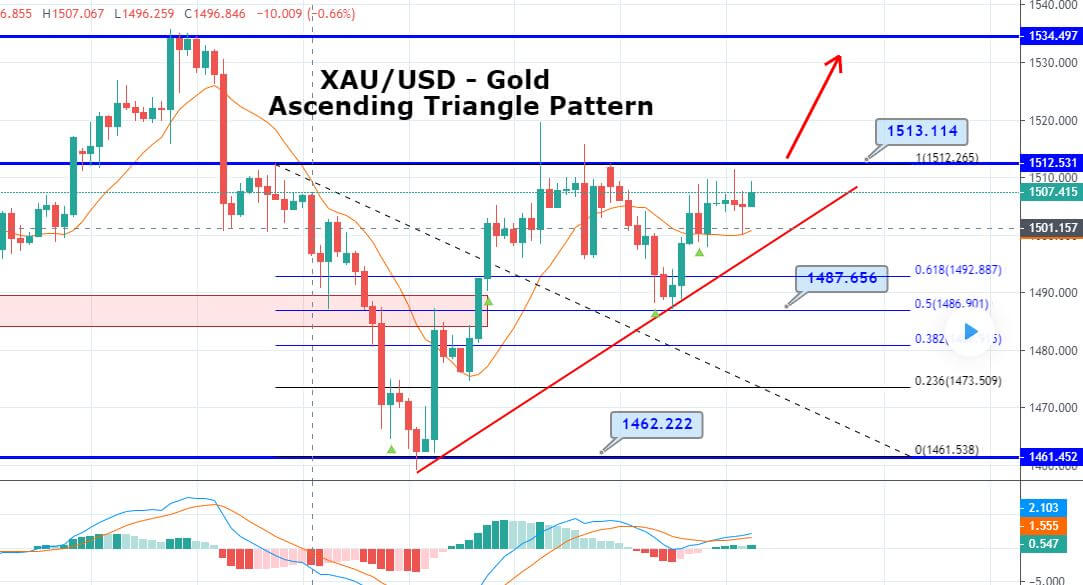

Gold – Technical Outlook

Technically, the XAU/USD has formed an ascending triangle pattern, which is keeping gold steady below 1,512 resistance level. The ascending triangle pattern is extending support at 1,500 level.

Typically, these ascending triangle patterns break out on the upper side and may extend bullish rally up to 1,534 in a medium run.

Daily Support and Resistance

S3 1459.04

S2 1480.2

S1 1492.88

Pivot Point 1501.36

R1 1514.04

R2 1522.52

R3 1543.68

Consider taking a buying position on the bullish breakout of 1,513 to target 1,525 and 1,530.

All the best!