On Friday, gold prices reversed from a one-week high after a rumor hinted that China needs to reach an agreement with the U.S. to avoid further acceleration of an open-ended trade. The safe-haven-metal prices slipped due to positive headlines cames regarding the US-China trade war and Brexit.

The stock market traded bullish due to the positive trade news that the United States and China could reach on the positive outcome this week. As a result, the safe-haven gold prices came under pressure. The United States and China may announce a limited trade agreement during this week, avoiding a new increase in trade tension.

The White House stated that the trade talks going unexpectedly well. However, the future positive headlines regarding trade increased the chances of a currency deal this week.

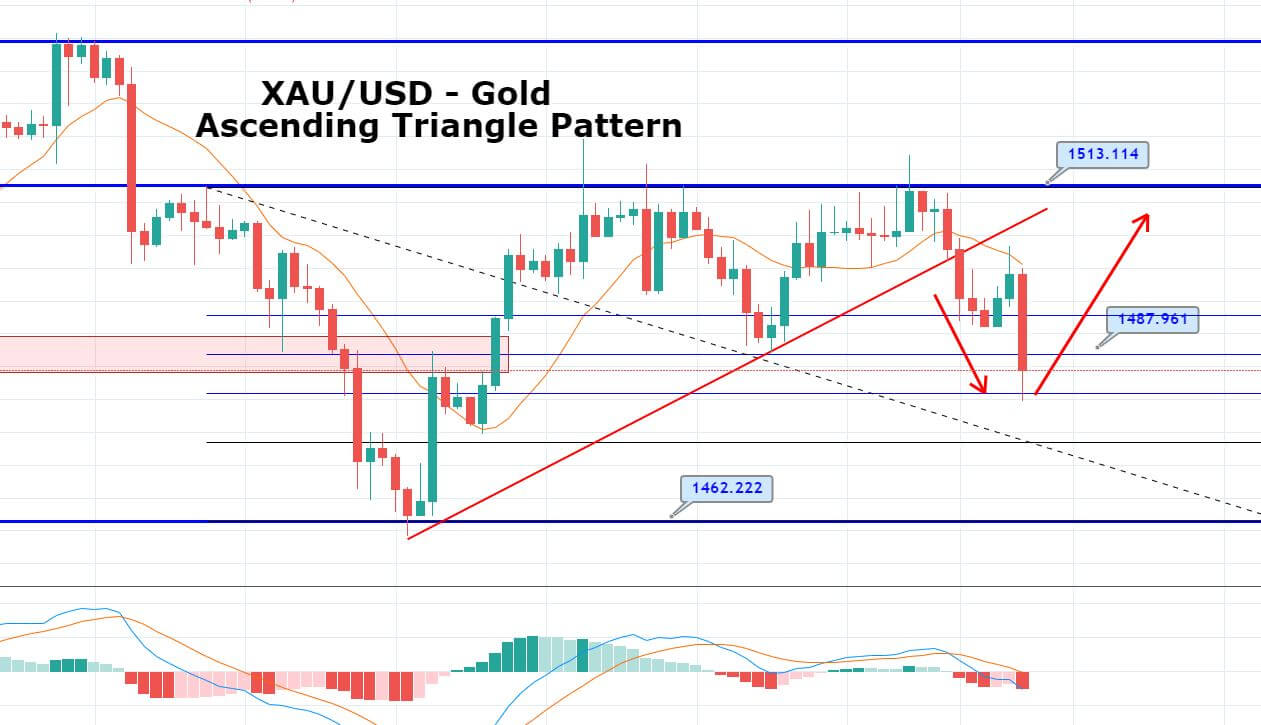

The market is now trading with Risk-off sentiment, shifting all the investment from gold to stock market. Technically, the precious metal gold has dropped from 1499 area to 1479 points amid faded safely have demand.

Earlier gold faced triple top resistance at 1,513 area, which pushed gold prices lower towards 1,479 that marks 61.8% Fibonacci retracement level.

Daily Support and Resistance

S3 1459.04

S2 1480.2

S1 1492.88

Pivot Point 1501.36

R1 1514.04

R2 1522.52

R3 1543.68

What’s Next?

Gold prices can stay bullish above 1,479 area, and closing of 4-hour candles bove this level could drive buying in gold.

The RSI and MACD have already entered the oversold zone, suggesting bulls are looming around the corner.

Gold may find an immediate resistance at 1,487, along with support around 1,479. Violation of 1,479 can lead to gold prices to 1,470 later in the U.S. session.

All the best!