The safe-haven-metal prices remain depressed under the lowest level of more than a month around $1,680, mainly due to the risk-on market sentiment in the wake of better-than-expected U.S. employment report. The reason for the upbeat trading sentiment could also be attributed to the news about the merger of drug majors AstraZeneca and Gilead, which eventually exerted some downside pressure on the safe-haven assets.

At the press, the yellow metal prices are currently trading at 1,692.55 and has already violated the consolidated range of 1,677.67 and 1,689.86. However, the on-going US-China tussle and broad-based U.S. dollar weakness turned out to be the key factors that kept a lid on any additional losses in the gold prices, at least for now.

The Friday released U.S. employment data indicated that the negative impact of coronavirus on the economy could be short-lived or temporary, and this data also hinted that the economies could recover quickly, which recently boosted the market trading sentiment and kept the safe-haven asset under pressure. At the data front, the headlines U.S. Nonfarm Payrolls (NFP) increased 2.5 million against expectations of -8 million. Moreover, the Unemployment Rate also added to the optimism by 13.3%, against the 19.8% forecast.

As a result, the overall market mood turned positive and sent Wall Street higher after the job report was released. It’s worth mentioning that the U.S. 10-year Treasury yields added almost 7-basis points (bps) to 0.893% at the end of Friday’s closing.

Apart from the U.S., China released May month trade figures while reporting the biggest trade surplus despite the coronavirus crisis. The $62.93 billion of Trade Surplus, against $39 billion forecasts, probably boosted by the medical experts. Details suggest that the Exports have been down 3.3%, against -7.0% market agreement, whereas Imports declined slowly below -9.7% expected to -16.7%.

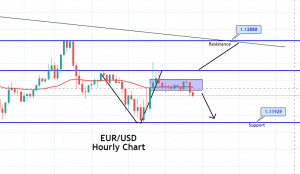

Technically gold has completed the ABCD pattern from 1,721 to 1,672 level. Closing of candles above 1,672 has driven bullish correction in gold, and it’s still soaring north to test the psychological trading level of 1,700 mark. The 50 EMA is likely to extend resistance around 1,698 level, and below this, the selling bias can be seen. But until this level is met, we can stay bullish in the XAU/USD trades.

Entry Price – Buy 1686.66

Stop Loss – 1680.66

Take Profit – 1696.66

Risk to Reward – 1.67

Profit & Loss Per Standard Lot = -$600/ +$1000

Profit & Loss Per Micro Lot = -$60/ +$100