On Friday, the precious metal gold trade sideways in the wake of mixed fundamentals. Despite this, gold is still on track to post its most vital monthly drop in 3 years, as traders solicited evidence on the U.S.-China trade progress after the United States withdrew anti-government protesters in Hong Kong.

Earlier, the U.S. Section of Hong Kong law got criticized by China and Hong Kong as well. But we noticed only a limited reaction due to the thanksgiving day holiday in the United States.

Furthermore, the criticism from the China State Council that Beijing will adequately resolve the trade disputes, and they will step up punishment for intellectual property infringement, seems to have played their role, keeping the safe-haven demand diminished.

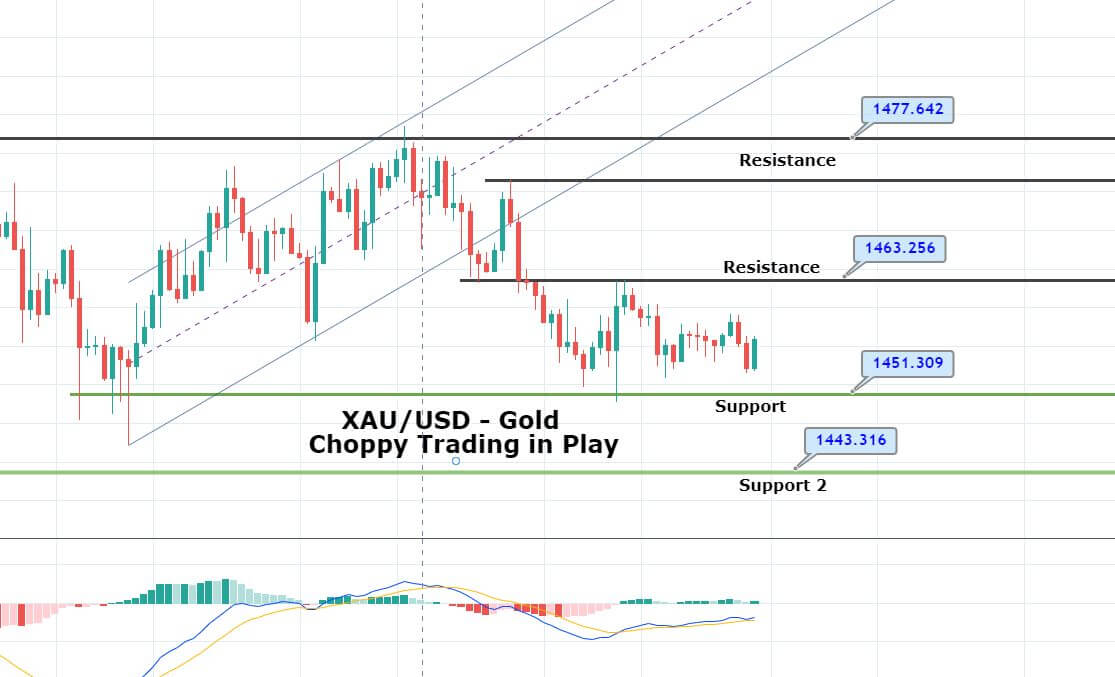

XAU/USD – Daily Technical Levels

Support Resistance

1454.29 1459.19

1451.77 1461.58

1446.86 1466.48

Pivot Point 1456.67

Gold continues to trade within a narrow trading range of 1,463 – 1,451 as investors await for a fundamental reason to determine further trends in the market. In the meantime, the XAU/USD is likely to continue trading in the same trading range.

On the downside, gold is presumed to find support at 1,452 area, and the violation of this could initiate further selling unto 1,442. The MACD is still holding in the buying zone, but the latest histograms are smaller than the previous one, signaling chances of a further bearish trend.

Good luck!