Thank you for visiting the Forex Academy FX Options market combined volume expiries section. Each day, where available, we will bring you notable maturities in FX Options of amounts of $100 million-plus, and where these large combined maturities at specified currency exchange rates often have a magnetic effect on price action, especially in the hours leading to their maturities, which happens daily at 10.00 AM Eastern time. This is because the big institutional players hedge their positions accordingly. Each option expiry should be considered ‘in-play’ with a good chance of a strike if labelled in red, still in play and a possible strike if labelled in orange and ‘out of play’ and an unlikely strike if labelled in blue, with regard to the likelihood of price action meeting the strike price at maturity.

……………………………………………………………………………………………………………………..

FX option expiries for May 26 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

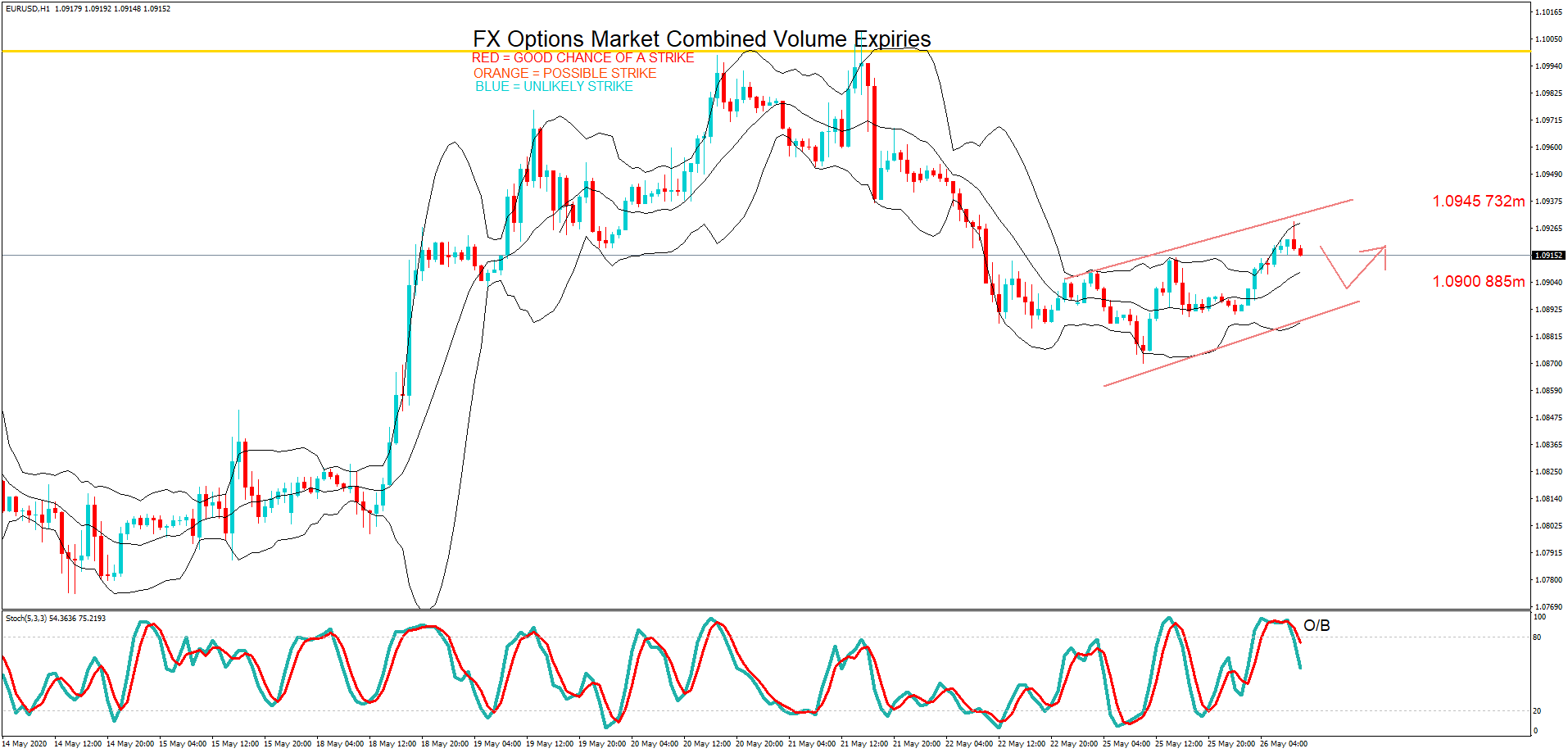

– EUR/USD: EUR amounts

- 1.0900 885m

- 1.0945 732m

The EURUSD pair is caught in an upward trend on our one-hour time frame. Currently pulling back from an overbought position we can expect that the pair will remain bullish during the European and US session. Therefore, both of our maturities remain in play. A slew of US data due out at 1:30 BST, which is before the cut, may have a significant impact on price action.

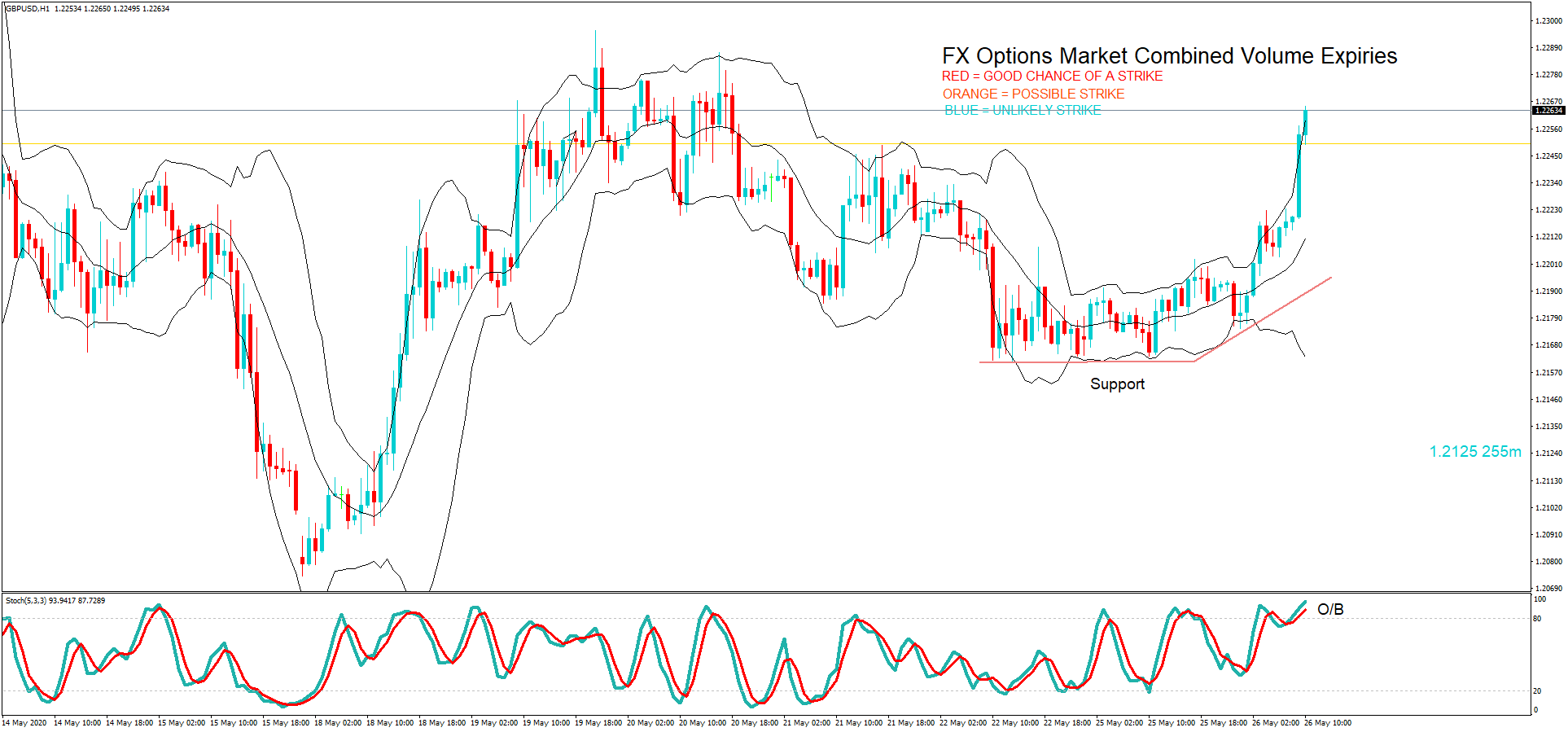

– GBP/USD: GBP amounts

- 1.2125 255m

The GBPUSD pair has caught a bid tone having failed to breach the support line. The pair is near an area of previous resistance and may see a pullback before the 10 AM New York cut. However, the maturity at 1.2125 is out of play.

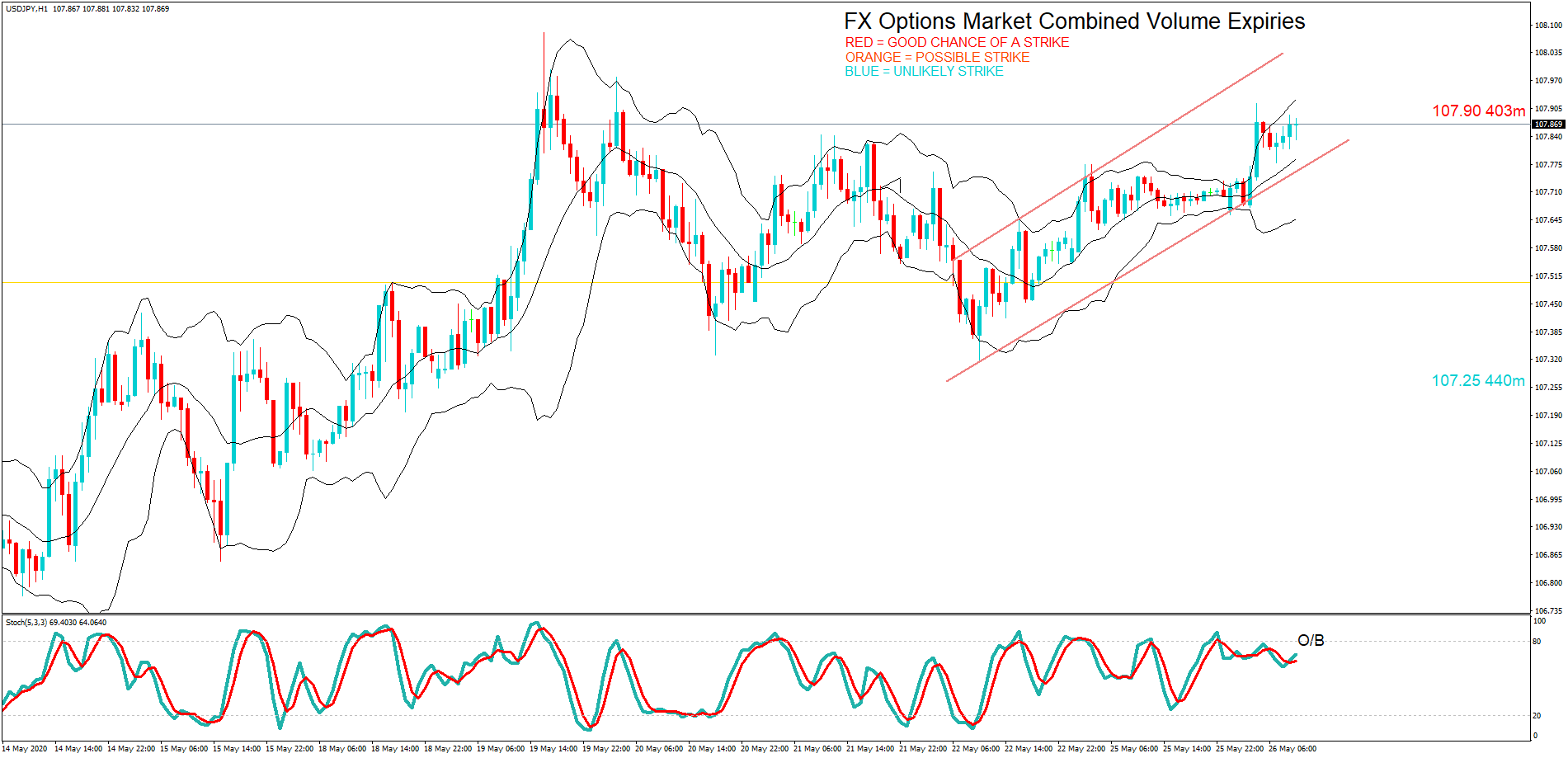

– USD/JPY: USD amounts

- 107.25 440m

- 107.90 403m

The USDJPY pair is continuing in its bull trend and the 107.90 Cut is very much in play. The pair is overbought on our one hour chart but seems to be holding up and aside from the US data due out as previously mentioned, the pair should remain bid.

………………………………………………………………………………………………………………

As you can see on the charts we have also plotted the expiration levels at the various exchange rate maturities and we have also labelled in red, orange and blue. Therefore, if you see option expiry exchange rates labelled in red these should be considered in-play, because we believe there is a greater chance of the expiry maturing at these levels based on technical analysis at the time of writing. There is still a lesser possibility of a strike if they are in orange and so these are ‘in-play’ too. However, if we have labelled them in blue, they should be considered ‘not in-play’ and therefore price action would be unlikely to reach these levels, which are often referred to as Strikes, at the time of the 10 AM New York cut.

Our technical analysis is based on exchange rates which may be several hours earlier in the day and may not reflect price action at the time of the maturities. Also, we have not factored in economic data releases or keynote speeches by policymakers, or potential market volatility leading up to the cut.

Although we have added some technical analysis we suggest you take the levels and plot them onto your own trading charts and incorporate the information into your own trading methodology in order to use the information to your advantage.

Remember the higher the amount, the larger the gravitational pull towards the exchange rate maturity at 10:00 AM Eastern time.

If you want to learn how forex option expiries affect price action in the spot FX market see our educational article by clicking here: https://bit.ly/2VR2Nji

DISCLAIMER: Please note that this information is for educational purposes. Also, the maturities will look more or less likely to become a strike at 10 AM NY time due to exchange rate fluctuations resulting in a different perspective with regard to technical analysis, and also due to upcoming economic data releases for the associated pairs.