Description

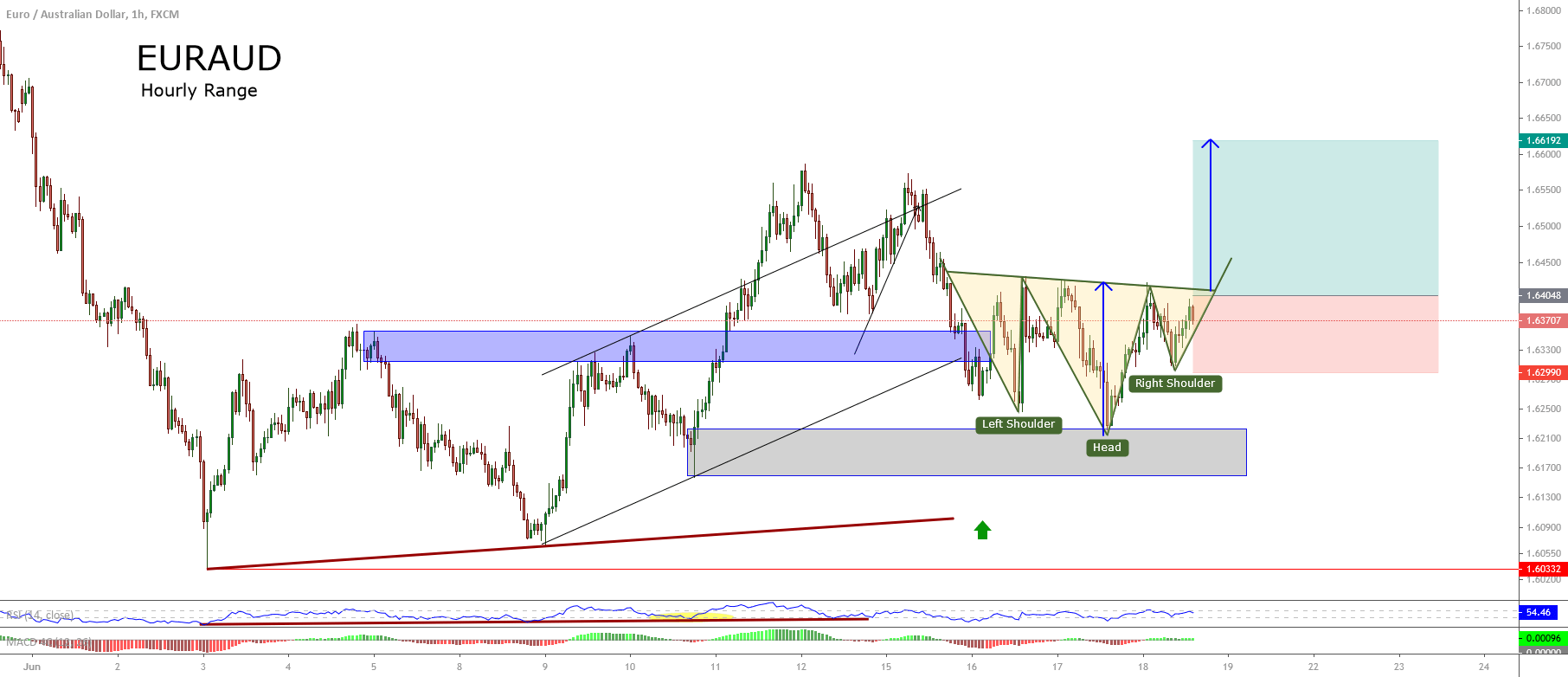

The EURAUD cross in its hourly timeframe illustrates an advance in a corrective structure that looks like a potential inverted H&S pattern.

The price action reveals sideways bias, bounded in the lower side by the June 03rd low at 1.6033, in where the cross found buyers at 1.6033. On the upper side, the price topped at 1.6586 on June 12th, from where the price started to develop a downward sequence.

From the EURAUD hourly chart, we observe that the corrective move retraced to the zone of 1.6221, which coincides with the previous swing of June 10th. This movement warns us about a potential institutional activity of buy-side incorporations.

On the other hand, the price action reveals the advance in a formation that looks like an inverted head & shoulder pattern, which suggests the likely scenario of an upward movement. This pattern will activate if the cross jumps over level 1.6401, which coincides with the neckline. The technical target of this chartist pattern locates at 1.6616. Our invalidation level is placed below the low of the right shoulder at 1.6299.

Chart

Trading Plan Summary

- Entry Level: 1.6401

- Protective Stop: 1.6296

- Profit Target: 1.6616

- Risk/Reward Ratio: 2.05

- Position Size: 0.01 lot per $1,000 in trading account.