The EUR/USD currency pair extended its early-day gains and rose further to 1.12607 level, mainly due to the broad-based U.S. dollar weakness possibly triggered by the encouraging news related to coronavirus vaccine initially provided support to the U.S. stock futures. On the other hand, the rising number of coronavirus cases weighed on the European equities, which undermined the shared currency and became one of the key factors that kept a lid on any additional gains in the pair.

However, the nervous mood in the European stock futures could be associated with the dovish comments made by the European Central Bank policymaker Francois Villeroy de Galhau on Sunday, which could further undermine the shared currency and push the currency pair lower. However, the politician was saying that the monetary policy needed to remain loose until the central bank’s inflation target of 2% was clearly in sight.

It is worth mentioning that the International Monetary Fund (IMF) Chief Economist Gita Gopinath said during the interview with Der Spiegel on Monday that the substantial part of the stimulus package must consist of grants rather than loans. As well as, she also said, “In case of more attribution to loans then it will not promote economic recovery”, this statement exerted some downside pressure on the shared currency.

On the positive side, the European Union is expected to welcome travelers from more than a dozen countries not overwhelmed by the coronavirus, unlike the United States, Russia, and dozens of other countries. As of now, the traders seemed failed to cheer this fresh optimism as the European Union was thinking to stop most travelers from the United States, Russia, and dozens of other countries which are considered as too risky because they have not controlled the coronavirus outbreak yet.

Apart from this, the reason for the risk-off market sentiment could be associated with the fresh report of coronavirus (COVID-19) outbreak, which suggested the pandemic has already crossed approximately half a million lives. Whereas Texas-registered consecutive seven days of above 5,000 cases by the weekend, whereas California’s State Health Department said claims rose by 4,810 to 211,243 total as of June 27. The figures from Los Angeles County rose by near-record of 2,542 to a total of 97,894 by Sunday.

Despite the intensifying fears of coronavirus second wave and geopolitical concerns, the broad-based U.S. dollar failed to maintain its early-day gains and dropped at least for now as the investor’s sentiment swings between hopes for global economic recovery and fears that a fresh wave of coronavirus cases could undermine the recovery. However, the losses in the U.S. dollar kept the currency pair higher. Whereas, the U.S. Dollar Index that tracks the greenback against a basket of other currencies fell 0.11% to 97.293 by 12:50 AM ET (5:50 AM GMT).

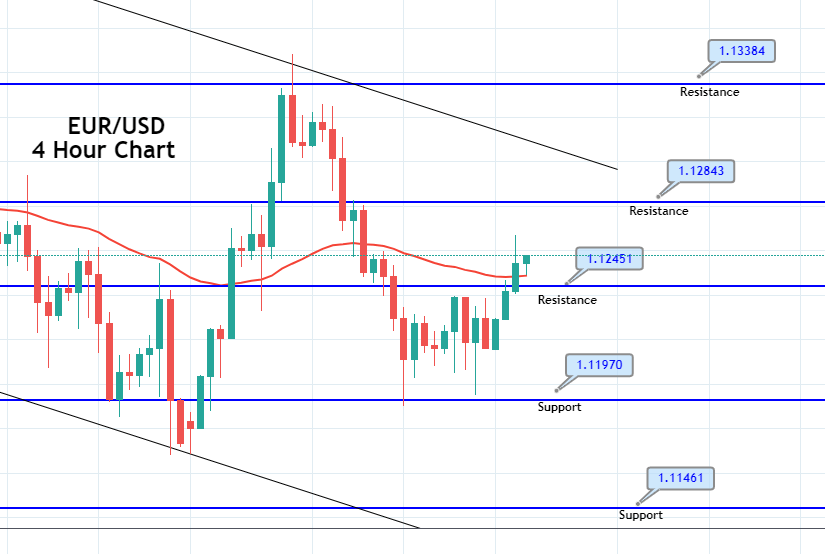

The EUR/USD is trading in a tight range of 1.1243 – 1.1193, limiting the price action for now. On the lower side, the EUR/USD pair can drop towards 1.1145 level upon the bearish breakout of 1.1193 level, while the bullish breakout of 1.1243 level will allow us to go long. Simultaneously, the RSI and MACD are still in a bearish zone, while the 50 EMA also suggests selling bias. Therefore, we should look for selling trades below 1.1250 levels.

Entry Price – Buy 1.12575

Stop Loss – 1.12175

Take Profit – 1.12975

Risk to Reward – 1

Profit & Loss Per Standard Lot = -$400/ +$400

Profit & Loss Per Micro Lot = -$400/ +$400