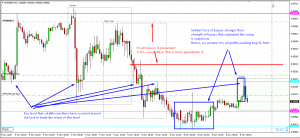

The EUR/GBP is trading at 0.9020 level, supported by the upward trendline at 0.9020. It seems like the pair is in the consolidation phase on the back of the NFP figure as investors’ focus has shifted to US-related pairs. Yet, the EU and UK fundamentals are influencing the movement in the EUR/GBP pair.

As per the latest statement, the Dutch Prime Minister (PM) Mark Rutte said that the discussions on the European Union (EU) recovery fund could take time, but a compromise is possible in the coming days. However, the hopeful outlook about the potential EU recovery fund deal is expected to support the shared currency as the Netherlands is among the ‘frugal four’ countries, who remain opposed to European Commission plans for the EUR750bn post-coronavirus recovery fund. This brings the bullish bias for the Euro currency.

On the other hand, the European labor market data also supported the Euro. The EU unemployment rate soared to 6.7% in May 2020 vs. 6.6% in April 2020, and these are the figures reported by Eurostat, the statistical office of the European Union. While the unemployment rate slipped to 7.4% vs. 7.6% during the previous month, better figures may help support the EUR/GBP pair.

Technically, the EUR/GBP is supported by a triple bottom support level of 0.9020, and the closing of candles above this level may drive buying until 0.9070 level.

Entry Price – Buy 0.90313

Stop Loss – 0.89913

Take Profit – 0.90713

Risk to Reward – 1

Profit & Loss Per Standard Lot = -$496/ +$496

Profit & Loss Per Micro Lot = -$49.6/ +$49.6