Forex trading has become increasingly popular in recent years, with many people looking to make a profit from the fluctuations of currency exchange rates. With the advent of mobile technology, it is now possible to trade forex on the go using your iPhone. In this article, we will look at how to do it on iPhone partial profit forex.

Firstly, it is important to understand what we mean by partial profit forex. This refers to a trading strategy where you close a portion of your position when a certain profit level is reached, while leaving the remaining portion open to potentially make further profits. This allows you to lock in some profit while also giving yourself the opportunity to make more if the market moves in your favor.

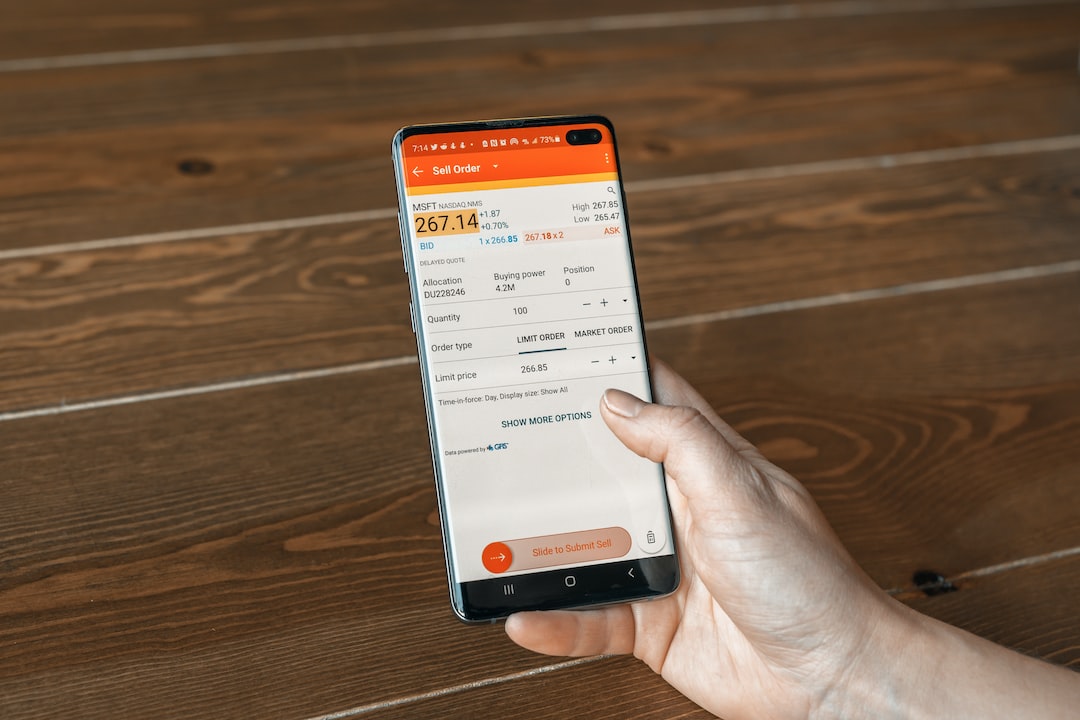

To start trading forex on your iPhone, you will need to download a trading app from the App Store. There are many different apps available, so it is important to do your research and choose one that is reputable and reliable. Some popular options include MetaTrader 4, Forex.com, and eToro.

Once you have downloaded and installed your chosen app, you will need to create an account and fund it with some capital. Most trading apps will allow you to start with a demo account, which is a great way to practice trading without risking any real money. However, if you do decide to trade with real money, it is important to only invest what you can afford to lose.

When it comes to trading forex on your iPhone, there are a few key things to keep in mind. Firstly, you will need to keep up to date with the latest market news and trends. This can be done by accessing the news section of your trading app, or by using a separate news app like Bloomberg or Reuters.

Secondly, it is important to have a solid trading strategy in place. This should include a clear entry and exit plan, as well as rules for managing your risk. One popular strategy for partial profit forex is to set a profit target for the first portion of your position, and then move your stop loss to break even for the remaining portion. This allows you to lock in some profit while also protecting yourself from potential losses.

Another key aspect of trading forex on your iPhone is monitoring your trades in real time. Most trading apps will provide you with real-time charts and price quotes, allowing you to keep a close eye on your positions at all times. You can also set up alerts to notify you when certain price levels are reached, which can be helpful for executing your trading strategy.

In conclusion, trading forex on your iPhone can be a convenient and potentially profitable way to invest your money. However, it is important to approach it with caution and to have a solid trading strategy in place. By keeping up to date with the latest market news, monitoring your positions in real time, and using a partial profit strategy, you can increase your chances of success in the forex market.