The AUD/USD pair was closed at 0.77661 after placing a high of 0.78171 and a low of 0.77661. After rising for two consecutive days, the AUD/USD pair dropped on Thursday amid the US dollar’s strength and rising safe-haven demand in the market.

The US Dollar Index (DXY) recovered from its 2-years lowest level and reached 89.85 and supported the greenback as the US treasury yield on a 10-year note also raised from 1% for the first time since March and supported the rising demand for the US dollar. The strength of the US dollar then added weight to AUD/USD pair on Thursday.

On the data front, at 05:30 GMT, the Building Approvals from November raised to 2.6% against the expected 1.9% and supported the Australian dollar that capped further losses in AUD/USD pair. The Trade Balance from Australia showed a surplus of 5.02B against the expected 6.45B and weighed n Australian dollars that ultimately added the AUD/USD pair’s losses. From the US side, at 17:30 GMT, the Challenger Job Cuts for the year in December increased to 134.5% compared to November’s 45.4%. At 18:30 GMT, the Unemployment Claims from last week fell to 787K against the projections of 798K and supported the US dollar that added further losses in AUD/USD pair. The Trade Balance from November showed a deficit of -68.1B against the projected -66.7B and weighed on the US dollar that capped further downside in AUD/USD pair. At 20:00 GMT, the ISM Services PMI rose in December to 57.2 against the projected 54.5 and supported the US dollar that added further losses in AUD/USD pair.

Meanwhile, the safe-haven demand rose after Donald Trump’s supporters stormed the US capitol in an attack. This was done after the US Congress certified Joe Biden’s victory in the presidential election. This attack resulted in four casualties and raised the safe-haven appeal that ultimately weighed on the risk perceived Australian dollar that added losses in AUD/USD pair.

Furthermore, the FOMC member and President of the Federal Reserve of Atlanta Raphael Bostic said that the US Federal Reserve might reduce its asset purchase program sooner than expected. These hawkish comments gave strength to the US dollar that added more AUD/USD pair losses on Thursday.

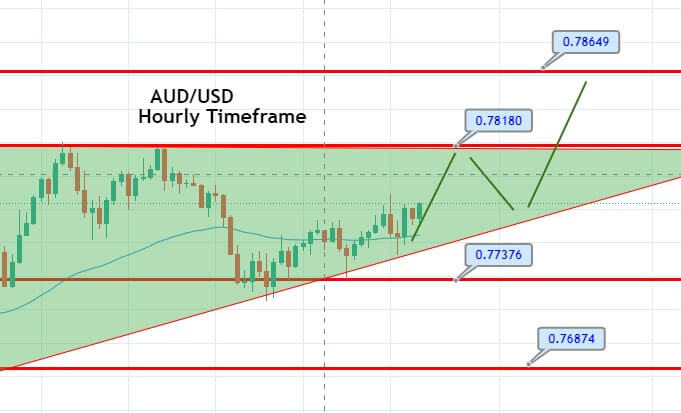

Daily Technical Levels

Support Resistance

0.7722 0.7816

0.7676 0.7864

0.7628 0.7910

Pivot Point: 0.7770

The AUD/USD pair trades with a bullish bias at the 0.7782 level, having formed an ascending triangle pattern on the hourly timeframe. On the higher side, the pair is likely to face resistance at a 0.7818 level, along with a support level of 0.7737. The AUD/USD pair may continue trading bullish as 50 periods EMA is extending support to Aussie around 0.7764 level. Good luck!