Gold prices were closed at $1744.21 after placing a high of $1747.91 and a low of $1725.74. Overall the movement of gold prices traded downward throughout the day. Gold prices posted gains after US Treasury Secretary; Steven Mnuchin warned that if coronavirus lockdown continued for months, then the US economy could face permanent damage. He added that job numbers would fell on a worse level before they get better. US administration’s officers said that the government could suffer losses from the risky loans it issued during the pandemic.

At this moment, the yellow-metal prices are currently trading at 1,748.71 and are consolidating above a strong support area of 1,739 level. Moreover, the broad-based US dollar modest weakness kept a lid on any additional losses in the gold and contributed to the pair’s bullish moves.

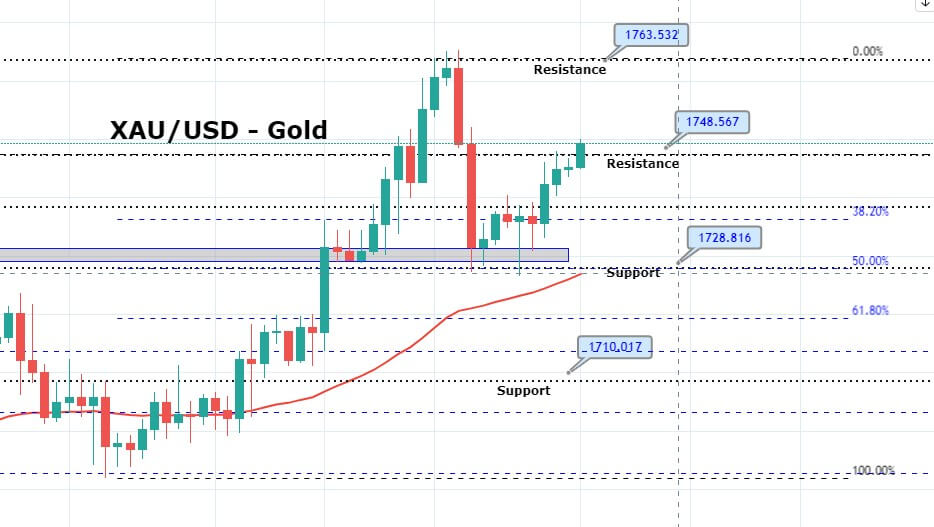

On the technical side, gold has completed 50% Fibonacci retracement at 1,727 level, and closings of candles above this level have the potential to lead gold prices higher towards 1,754 and 1,763. While the 50 EMA is also supporting bullish bias. At the same time, the MACD is forming smaller histograms on the selling side, signaling chances of bullish trend continuation on gold.

Entry Price – Buy 1748.34

Stop Loss – 1742.34

Take Profit – 1754.34

Risk to Reward – 1.00

Profit & Loss Per Standard Lot = -$600/ +$600

Profit & Loss Per Micro Lot = -$60/ +$60